Many consumers confused by language in insurance policies

Have you ever sat down and really tried to understand your auto insurance policy? If so, there’s a good chance that it doesn’t make sense.

According to an online Harris Interactive poll commissioned by insuranceQuotes.com, 87 percent of drivers who currently have auto insurance said they had read at least part of their auto insurance policies. Thirty-six percent of surveyed drivers who had read their auto insurance policies found them to be somewhat or very difficult to understand.

Even though more than 30 states have enacted laws designed to simplify the language in insurance policies — including auto and home — many consumers are confused by how their policies are written, and have trouble determining what’s covered and what’s not.

“What makes it tough is the long lists of items that are covered or excluded,” says Linda Alschuler, a policyholder from Chicago.

Despite reading through her entire auto insurance policy, Alschuler hasn’t been able to determine whether she has coverage for rental cars. “I suspect we don’t, but it wasn’t listed in the optional coverage section either,” she says.

Robert Hunter, insurance director at the Consumer Federation of America, sympathizes with Alschuler. Hunter says that even policies “written in plain English are above the average person’s grade level. There are so many twists and turns in the language that you can read through the whole policy and not understand it.” (Story continued below map.)

State readability regulations

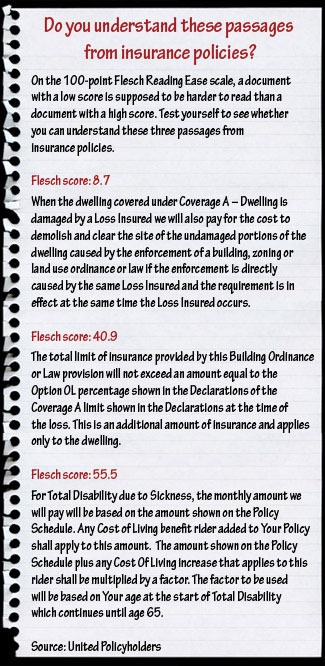

Beginning in the early 1980s, a number of states began to regulate the “readability” of insurance policies. In many of these states, the language used in auto, life, health and other insurance policies must pass the Flesch Reading Ease test, which analyzes the number of syllables in words to determine reading comprehension by grade level. Generally, the text should be “readable” for someone at an eighth- or ninth-grade reading level.

The Flesch Reading Ease test measures text on a 100-point scale. The higher the score, the easier it is to understand the document. For states that include Flesch in their readability laws, the required scores range from 40 to 50.

Connecticut’s “definition of readable language” means there must be a standard layout and font, and the policy must avoid “the use of unnecessarily long, complicated, or obscure words, sentences, paragraphs, or constructions.” If the entire policy is 10,000 words or fewer, the entire policy will be analyzed for readability; for longer texts, two 200-word samples per page will be measured. Although requirements differ slightly from state to state, the general terms are relatively common to all of the states that have readability standards.

The problem is, these regulations don’t tend to make the policies any easier to read for the average policyholder.

“The Flesch test is a good starting point, but the structure of the policy itself is difficult for the average consumer to understand,” says Jeffrey Thomas, a professor at the University of Missouri-Kansas City School of Law. “The relationships between coverage and exclusions are often convoluted. It’s not uncommon for people to assume that something is covered and then find out it’s not when they need to file a claim.”

What causes confusion?

For instance, many consumers don’t recognize the difference between comprehensive and collision coverage. “If you ask someone what comprehensive means, they think it’s everything, but it only covers certain damages to your car,” Hunter says.

Generally, comprehensive coverage applies only to damages when the policyholder is not driving the car, such as when a tree falls on it while it’s parked in your driveway. To make a claim for damages that happen in an auto accident, you’d need collision coverage as well.

John Couture, a State Farm Insurance agent in Gray, Maine, acknowledges that such distinctions often trip up his customers.

“I don’t think the terminology itself is that bad, but in an auto policy, you have the general provisions and then you go to the exclusions,” Couture says. “If you don’t read them through completely, you may not realize that something isn’t covered.”

For instance, if a policyholder is involved in an accident while driving someone else’s vehicle, he may think that he’ll be covered under his policy, but the coverage may not apply because of an exclusion buried in his policy.

To make sure his customers understand their policies, Couture goes over the details with them in person.

“When someone gets coverage, even if he says he knows what’s covered, we’ll almost always go through the general provisions,” Couture says. “Obviously, though, we can’t go through every single possibility.”

How can I get clarification?

If you’re not certain what your auto insurance policy includes, don’t wait until you’re in an accident and need to file a claim to find out the answer. Get in touch with your insurance agent or company right away. It’s their job to ensure that you understand your policy, and know what it does and does not cover.

“What I recommend is that if you feel worried about something in your policy, write a letter to your agent to say, ‘Here’s how I interpret this. I want you to put it in writing if I’m right or not,’” Hunter says.

Also, state insurance regulators provide free assistance to consumers who don’t understand their policies. Kerry Hall, a spokeswoman for the North Carolina Department of Insurance, says her agency runs a consumer hotline available to anyone in the state where they can get “free, unbiased information.” The Texas Department of Insurance provides a toll-free consumer help line as well. In addition, the department’s website supplies information to help consumers understand their insurance policies, spokesman Jerry Hagins says.

Neither state tracks insurance complaints tied to policy readability, but both Hall and Hagins believe the number received is small. State insurance regulators do address such complaints with insurance companies.

What if I have a problem with my policy?

If you find yourself in a situation where you’ve read your policy fully and later discover you don’t have the coverage that you thought you did, you might be able to take your insurance company to court. Case in point: In 2004, a man named Terrell Ford sued a California company called Palmden for damages after being beaten outside a Palmden restaurant. When Palmden’s insurance company denied coverage under an exclusion, a California appeals court ruled that the contract language was unclear and forced the insurance company to pay the claim.

“A lot of language in policies is vague and difficult,” Hunter says. “If the language is very ambiguous, the policyholder has a legal advantage. If you have a real, legitimate interpretation, you should win that suit.”

Legal fees can be expensive, however, so you may first want to consider negotiating directly with your insurance company over the claim.

“You can use the prospect of switching insurance companies as a bargaining chip,” Thomas says. “Sometimes the agent can encourage the adjuster to make more generous compensation, but that usually applies in terms of value for a covered claim, rather than whether a claim will be covered at all.”

Reform may be on the way

Fortunately, experts and regulators have taken note of the complexity of insurance policies, and they’re working to create additional protections for insurance consumers.

Daniel Schwarcz, a professor at the University of Minnesota Law School, recently issued a report assessing the clarity of language in homeowner’s insurance policies and found that “only a seasoned expert” can understand the specific details of each policy. The language used is “an indication that insurers are writing policies so they can deny claims whenever they want,” he wrote.

Partly in response to Schwarcz’s findings, the National Association of Insurance Commissioners has created a group dedicated to making all insurance policies easier to understand. Although the group’s recommendations haven’t gone into effect yet, insurance companies may be following new consumer-friendly policy regulations within the next few years.

How much do you need to know?

Insurance policy readability may be a non-issue for most policyholders, however. Few people actually read their policies unless they need to make a claim. “Every time I teach an insurance law class, only 3 or 5 percent of my students have read their insurance policies,” Thomas says.

Generally, though, most experts agree it’s not necessary to memorize all of the nitty-gritty details of your policy, as long as you’ve gotten clarification on the general provisions and understand the amount of coverage you have.

“What’s important is getting the right coverage,” says Eli Lehrer, a spokesman for the Heartland Institute, a nonprofit research and education group.

“The policies are sold based on a standard of good faith, represented by what your agent has told you about the policy. Making sure that you have the right coverage and having an agent that you trust is a lot more important than knowing every little detail about your policy. Reading your insurance policy may not be the best way to spend your time unless you want to put yourself to sleep.”

Poll methodology

The Harris Interactive survey was conducted online within the United States on behalf of insuranceQuotes.com from Feb. 24-28, 2011, among 2,366 adults age 18 and older, 2,107 of whom are current drivers and 2,079 of whom currently have auto insurance. This online survey is not based on a probability sample and, therefore, no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact [email protected].

State-by-state insurance policy readability requirements

Most states now have regulations that impose a “plain language” requirement on insurance policies or on legal documents in general. These requirements can include a score for reading comprehension: The higher the number, the more understandable the text is. A score of 50 to 59 means the material is fairly difficult to read, while a score of 30 to 49 means it’s difficult. Eighteen states don’t have any readability requirements.

No plain language law: Alabama, Alaska, California, Colorado, Idaho, Illinois, Iowa, Kansas, Louisiana, Michigan, Mississippi, Missouri, New Hampshire, Rhode Island, Utah, Vermont, Washington, Wyoming

General plain language law: Arizona, Connecticut, Delaware, District of Columbia, Georgia, Indiana, Kentucky, Maryland, New York, Oregon, Pennsylvania, South Carolina, Virginia, West Virginia, Wisconsin

Minimum Flesch test score of 40: Arkansas, Hawaii, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee, Texas

Minimum Flesch test score of 45: FloridaMinimum Flesch test score of 50: Maine, Massachusetts, Minnesota, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina

Information current as of April 2011; research by