Are Red Cars More Expensive to Insure?

Have you heard the one about red car insurance costing more than insurance for other color cars? It’s an urban myth that you’ve probably heard at your office, in your neighborhood or at your school.

But does this long-standing legend have legs to stand on? Or is it a bunch of nonsense?

Turns out, it’s a little bit of both.

The idea that a car’s color can affect your insurance rates isn’t always accurate. A red car will not be more expensive to insure, despite this being a common belief amongst consumers. For the most part a red car will not be more expensive to insure than any other color you choose.

Though car color usually will not have an impact on your car insurance rates, white, black, blue, and red cars are usually more expensive to purchase across the board as they are very popular colors. Popular car colors may be more expensive as the demand for them is higher.

The Truth About Red Cars and Insurance

If you’re wondering “Are red cars more expensive to insure?” We have the answer. Red cars do cost more to buy, but not necessarily to insure.

LeaseTrader.com recently analyzed the effect of color on only the price of cars. Their study found the color red had the highest average monthly listing price for almost all makes and models.

Black was a close second, followed by blue. “The color silver is very inexpensive compared to most of the other colors,” Sternal says.

Red is relatively popular, too.

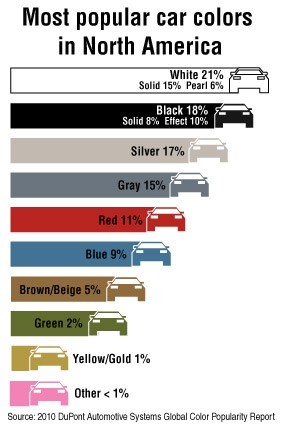

The 2010 DuPont Automotive Systems Global Color Popularity Report says silver and black are locked in a tight race for the title of “world’s most popular car color.” Black’s popularity in key automotive markets outside North America is substantial.

Closer to home, white held the top color spot in North America for the fourth year in a row, with black, silver, gray, and red rounding out the top five according to DuPont.

Amy Wax, president of the International Association of Color Consultants of North America and owner of Your Color Source Studios Inc. in Montclair, N.J., says red continues to be a popular car color because it stands out.

“It’s dynamic and exciting, and represents high energy. It makes people feel young and good about themselves,” Wax says.

The love affair that drivers have with red keeps sticker prices from coming down.

“In some instances, a car dealer may not negotiate as much on a red car as they might on another color — especially a new color or one that’s not selling very well,” says Iman Jalali, owner of National Auto Credit, a car dealership in Chicago.

The Wrong Info May Have You Seeing Red

However, the popularity of red doesn’t translate into higher auto insurance rates.

“It’s a myth that red cars cost more to insure,” says Jerry Becerra, president of Barbary Insurance Brokerage in San Francisco, who writes car insurance policies with numerous insurance companies, including Safeco, Travelers, and Progressive. “None of the insurance companies I work with ever ask for the color of the vehicle when rating coverage.”

However, while the color of the vehicle does not directly affect auto insurance rates, Becerra says it may have an indirect effect.

Do red cars get pulled over more? Statistics show that red cars get stopped for traffic violations more than other vehicles. With more tickets on their driving records, drivers of red cars are more likely to pay higher rates for red car insurance coverage. It’s best to compare multiple insurance quotes.

A 1990 survey by the St. Petersburg Times found color does matter. White cars, which accounted for 25 percent of the cars on the road, were issued 19 percent of speeding tickets. By contrast, red cars made up 14 percent of those on the road but represented 16 percent of speeding tickets.

Statistics also show color plays a role in crash rates, yet red isn’t the most dangerous color on the road.

Researchers at Monash University in Melbourne, Australia, pored over crash data for 17 car colors and found that black cars drive away with the dubious honor of being the color most likely to get into an accident. The researcher say black cars have a 12 percent higher risk of being involved in a crash during daylight hours than a white vehicle. Following black are gray, silver, blue and red.

Although color really doesn’t affect your car insurance rates at the end of the day Becerra says these factors do:

- Years of driving experience. If you’ve been driving for fewer than three years, you’re going to pay more for policy coverage.

- Driving record. A history of traffic tickets or wrecks will send your auto insurance uphill.

- Vehicle use. The number of miles you drive, including how far you commute to work, plays a part in your rates.

- Age of driver. Older drivers are considered riskier, so they pay more. Teenage drivers fit into that category as well.

- Credit score. Auto insurance companies believe a motorist with a low score is more likely to skip premium payments, drive recklessly, get a ticket or crash a car than someone with a score of at least 650. Keeping up with your premiums and staying away from trouble behind the wheel could prevent you from seeing red.

To get more information on insurance options, contact us for a free car insurance quote today!