How Your Daily Commute Can Drive Up Your Auto Insurance Rates

When it comes to the cost of auto insurance, mileage matters. And that’s because insurers know that more miles driven per year equates to a greater risk of accidents and claims. But some drivers may be surprised to learn just how much (or, in some cases, how little) annual miles affects what you pay for auto insurance.

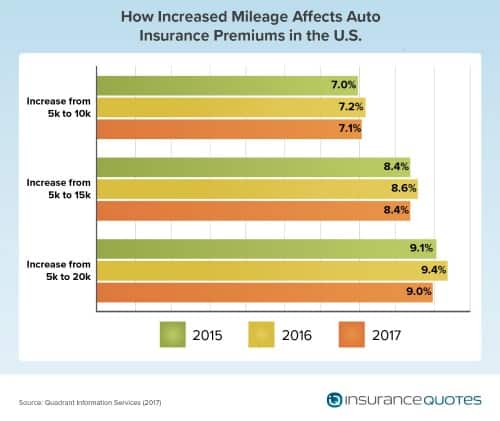

For the third year in a row, insuranceQuotes and Quadrant Information Services examined the average economic impact annual miles driven has on the cost of auto insurance.

In the end, the study found that drivers who increase their annual miles driven have the following rate increases: 5,000 to 20,000 miles — 9 percent; 5,000 to 15,000 miles — 8.4 percent; 5,000 to 10,000 miles — 7.1 percent.

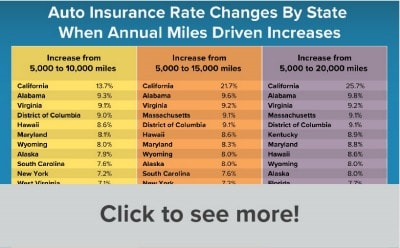

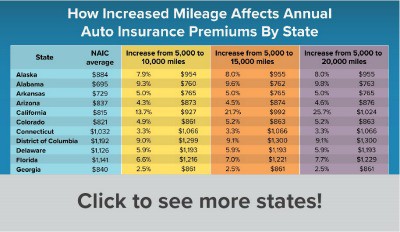

However, the financial impact of annual miles driven varies greatly depending on the state where you live.

For instance, California residents who increase their annual miles from 5,000 to 20,000 pay almost 26 percent more.

Conversely, North Carolina drivers whose mileage increases from 5,000 to 20,000 would see no increase. What’s more, several other states — like Rhode Island, Georgia, Texas, and Oregon — show negligible price increase when driving additional miles per year.

When looking at savings when decreasing the miles you drive — California drivers are the big winner with $209 annual savings from dropping from 20,000 to 5,000 annual miles driven.

Next up for savings was D.C. at $108 and Massachusetts at $95. Rounding out the top five states with the most savings are Florida and Maryland, both coming in at $88.

John Espenschied, a veteran auto insurance expert, says the study’s findings illustrate the time-tested correlation between the number of miles driven each year and the increased risk for auto accidents and insurance claims.

“Everything in the insurance industry is based statistics — the age of a driver, the type of vehicle he or she drives, the zip code where a vehicle is garaged, and miles driven per year. All are statistics used to determine risk,” he says. “More miles driven simply means a higher potential of being involved in an accident, which means you’re going to pay more for insurance.”

Impact of annual miles driven by state

According to a February 2017 study published by the Federal Highway Administration, Americans are driving more than ever before. All told, American consumer vehicles logged a record 3.22 trillion miles in 2016, up 2.8 percent from 3.1 trillion miles in 2015.

It’s the fifth straight year of increased mileage on public roads in the U.S., and it may be having some negative consequences.

For instance, the National Safety Council (NSC) reports that traffic fatalities jumped 6 percent in 2016, topping 40,000 for the first time since 2007. That’s a 14 percent increase in traffic deaths since 2014, the most significant two-year spike in more than 50 years.

What’s more, the NSC estimates that 4.6 million drivers were seriously injured in 2016, and the overall cost of motor-vehicle deaths, injuries, and property damage last year was $432 billion, a 12 percent increase from 2015.

On a more micro level, the U.S. Department of Transportation says the average American drives 13,476 miles per year, and the financial consequences of being above or below that average will vary depending on the state you call home.

According to the insuranceQuotes study, here are the top five states where drivers see the highest jump in premiums for increasing annual mileage from 5,000 to 20,000 miles:

- California — 25.7 percent

- Alabama — 9.8 percent

- Virginia — 9.2 percent

- Massachusetts — 9.1 percent

- Washington, D.C. — 9.1 percent

Conversely, here are the top five states where the cost increases for going from 5,000 to 20,000annual miles barely makes a difference:

- North Carolina — 0 percent

- Rhode Island — 1.1 percent

- Georgia — 2.5 percent

- Texas — 2.8 percent

- Oregon — 3.1 percent

The reasons for these state-by-state discrepancies can be attributed to differences in how each state regulates insurance, says Espenschied.

For instance, California voters passed Proposition 103 in 1988, which significantly limited the factors insurance companies can use when determining auto rates, including a ban on using credit scores. Since then, insurance companies in the Golden State must base insurance premiums on three primary factors (and in this order of importance):

- Driving safety record.

- Average miles driven per year.

- Years of driving experience.

“There are not as many discounts available in California, nor is credit a factor, so miles driven is an allowable way to provide some rate reduction when lower annual miles are driven,” Espenschied says. “In California everything has to be fair for everyone, which means there are no discounts for prior length of time with current insurance company, no pay-in-full discount, and no good credit discount.”

RELATED: Raise Your Deductible and Save How Much?

In other states, however, Espenschied says drivers are rewarded for factors like long-term continuous insurance coverage with the same company and higher bodily injury limits.

For outliers on the other end of the spectrum — like North Carolina and Rhode Island — it’s more challenging to find a reason why miles driven has so little impact on the cost of insurance.

According to Eli Lehrer, insurance regulations expert and president of the R Street Institute, North Carolina has a unique way of setting insurance rates. There, insurers propose new rates to the North Carolina Rate Bureau, which then sets a statewide base rate for all companies insuring in the state.

What’s more, the state’s insurance commissioner sets a cap on how much insurers can raise rates based on annual miles driven.

What’s more, the small difference in certain states could have something to do with the way individual insurers set their base rates for auto insurance, says Todd Berg, an attorney who specializes in insurance law in Michigan (where drivers only see about a 3.5 percent hike in premiums when upping their driving from 5,000 to either 10,000, 15,000 or 20,000 annually.)

“If I’m being slightly cynical about it I would say that auto insurers price policies assuming people are going to drive a lot and thus have an increased risk of accidents and claims,” Berg says.

“And then if someone says they drive a lot less than others, okay, give them a four percent discount. If you’re setting your prices for a considerable profit margin to begin with, it’s no big deal to throw a bone to a few low mileage drivers.”

Keep your insurer in the loop

Regardless of the financial impact, it’s critical to be honest and forthright about how many miles you drive each year for several reasons, says Mike Barry, vice president of media relations for the nonprofit Insurance Information Institute.

For starters, lying about how many miles you drive each year in an effort to save some money could wind up in a canceled policy should your insurer find out. That means if you suddenly change jobs and now have to drive considerably more each year, let your insurer know.

“Policyholders should share with their auto insurer any changes in their driving habits,” Barry says. “A retiree is going to be on the road less whereas someone who is now driving to a new job is driving more miles. An auto insurer can only cancel a policy for either non-payment of premium or a material misrepresentation of their circumstances when initially applying for auto insurance.”

In some states, insurers are becoming vigilant about verifying your annual miles driven.

In some states, insurers are becoming vigilant about verifying your annual miles driven.

For instance, drivers in California who claim they log fewer than 12,000 miles annually must verify their odometer readings each year with their insurer.

“Once a year they mail a mileage verification card to be completed and mailed back,” Espenschied says. “If the card is not mailed back the insurer will automatically increase the mileage every year until proof is provided otherwise.”

Looking ahead, industry experts think more and more insurers will turn to pay-as-you-drive (or usage-based) insurance programs. Right now these are all voluntary and drivers can earn discounts based on factors such as how well, how far, and how often they drive.

These programs—which are being rolled out by almost every major U.S. auto insurer—require insurers to use telematics devices, smartphone apps, or even existing technology built into the car (like OnStar) to record data regarding driver behavior and then transmit that to insurers to help set discounts, which typically range between 5 and 30 percent off the annual premium.

For instance, Liberty Mutual offers a program called RightTrack, which uses a small wireless device that plugs into the diagnostic port located under the dashboard of a car to capture how, when, and how much someone drives.

Simply singing up for the program shaves 5 percent off your annual premium.

Then, the device records how many miles you drive each day, how often you drive between midnight and 4 a.m. and how often you slam on your brakes. After driving with RightTrack for 90 days, Liberty Mutual uses the collected data to determine your discount. The better your driving behaviors (i.e. fewer miles driven at night, no hard braking) the better the premium discount, which can be as much as 30 percent.

CHECK OUT: Why Insuring Teen Drivers Has Gotten Cheaper

To be sure, usage-based insurance options will become increasingly ubiquitous in years to come. The only question is whether or not drivers will embrace the trend.

“In our experience with drivers from across the country, the acceptance of products such as RightTrack really depends on the individual,” says Espenschied. “We see about 40 percent of drivers accepting these products right now.”

Espenschied says that even when presented with immediate savings of 5 percent and the potential to save as much as 30 percent, drivers are “very wary of ‘big brother.’”

“Even when it is explained that the only things that are monitored are hard breaking, fast acceleration, and time of day driving habits we get a lot of push back,” says Espenschied. “Even people who are looking for the best rates balked at the idea of being monitored, in any capacity. Nonetheless, I think the future will be miles or use-based insurance. It only makes sense.”

Methodology

insuranceQuotes commissioned Quadrant Information Services to measure the impacts of mileage on car insurance premiums using data from the largest carriers (representing 60-70 percent of market share) in each U.S. state and the District of Columbia. Averages are based on a 45-year-old married female driving a 2015 vehicle, employed, with a B.A., excellent credit, no lapse in coverage, with the following coverage limits: $100,000 bodily injury, $300,000 property damage, $100,000 UI/UIM, $10,000 PIP and $500 deductibles for comprehensive and collision.