By Michael Giusti

When it comes to insuring a vehicle in Florida, a few details could mean the difference of thousands of dollars coming from drivers’ pocketbooks. To examine what goes into auto insurance pricing in Florida, InsuranceQuotes.com worked with research firm Quadrant to dig into how much policy pricing varies across the state.

Together we shopped a typical policy with six of the largest auto insurers in the state. We shopped policies in the top 100 most populated cities, and checked rates for men and women who were married and single, and who had various levels of credit worthiness. Each scenario used the same policy criteria, defined as one driver with no accidents or moving violations with $100,000/$300,000/$100,000 limits and a $500 deductible for both comprehensive and collision.

The top line is that statewide, this typical policy cost an average annual premium of $7,617.

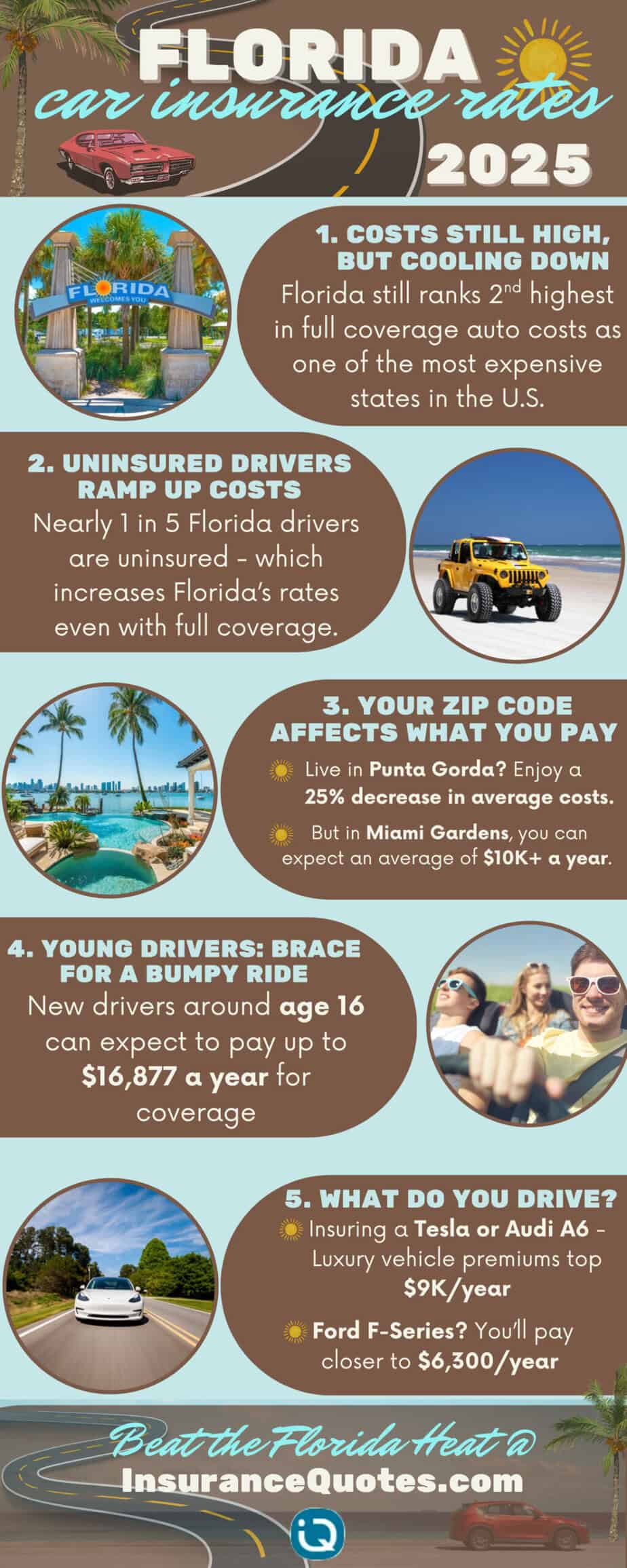

That is one of the highest average annual premiums in the nation for this policy. The reasons for that high cost vary — Florida has several challenging factors when it comes to the auto insurance industry. For example, the state is prone to hurricanes and flood-related comprehensive claims due to its weather patterns and geography. Florida is also struggling to bring down the number of uninsured drivers, making insurance more expensive for everyone else on the road.

While the average annual premium statewide is higher than most places in the country, there were areas of Florida, and specific drivers in Florida who paid substantially less – and some substantially more – than the statewide average.

This report aims to dig into the various factors that drive auto insurance pricing in the Sunshine State.

Metro Area by Metro Area Breakdown

Miami-area drivers led the way in premiums, paying the highest annual average premiums by far. On average, drivers in the Miami-Fort Lauderdale-West Palm Beach Metropolitan Statistical Area paid $9,707 for our model policy, or 27% more than the statewide average.

On the other end of the spectrum, drivers in Punta Gorda paid the least, averaging $5,736, or 25% less than the statewide average for our model policy.

Metro areas average annual premiums:

| Metro Areas | Avg Annual Premium |

| 1. Miami-Fort Lauderdale-West Palm Beach | $9,707.87 |

| 2. Tampa-St. Petersburg-Clearwater | $8,559.76 |

| 3. Lakeland-Winterhaven | $7,164.93 |

| 4. Orlando-Kissimmee-Sanford | $7,115.14 |

| 5. Port St. Lucie | $6,920.32 |

| 6. Jacksonville | $6,738.12 |

| 7. Ocala | $6,589.57 |

| 8 North Port–Bradenton–Sarasota | $6,549.89 |

| 9. Deltona–Daytona Beach–Ormond Beach | $6,549.29 |

| 10. Cape Coral-Fort Myers | $6,530.21 |

| 11. Pensacola-Ferry Pass-Brent | $6,429.40 |

| 12. Palm Bay-Melbourne-Titusville | $6,422.95 |

| 13. Tallahassee | $6,319.61 |

| 14. Sebastian-Vero Beach-West Vero Corridor | $6,318.47 |

| 15. North Port–Bradenton–Sarasota | $6,263.21 |

| 16. Sebring | $6,259.31 |

| 17. Gainesville-Lake City | $6,188.99 |

| 18. Naples-Marco Island | $6,062.99 |

| 19. Wildwood-The Villages | $6,029.11 |

| 20. Crestview–Fort Walton Beach–Destin | $5,983.18 |

| 21. Panama City-Panama City Beach | $5,945.29 |

| 22. Punta Gorda | $5,736.31 |

In many ways, the findings of which drivers pay more in particular cities followed certain nationwide trends. The Miami area has the highest population density, which translates into more drivers on the road at any particular time, as well as tightly packed urban driving, which can mean more accidents. Nationwide, dense urban areas tend to pay more because there are more opportunities to get into an accident when there are more vehicles packed into a tight spot.

On the other end of the spectrum, metro areas that were spread thinly along miles of beach had much less population density, and correspondingly lower annual average premiums. Punta Gorda, to the west of the Everglades, came in with the lowest average annual premiums, followed by Panama City and Fort Walton Beach, which are less dense communities along the Florida Panhandle.

Jacksonville was perhaps the city that most bucked this trend. With 1.7 million people in the Jacksonville Metro Area, it still had lower-than-average pricing.

Individual City Rankings

Of Florida’s top 100 most populated cities, below are the cities with the most expensive premiums:

| Individual City | Avg Annual Premium |

| 1. Miami Gardens | $10,503.60 |

| 2. Lake Worth | $10,458.72 |

| 3. Opa-locka | $10,402.78 |

| 4. Hialeah | $10,379.91 |

| 5. Town ‘n’ Country | $10,314.32 |

| 6. West Palm Beach | $10,273.51 |

| 7. Boynton Beach | $10,133.54 |

| 8. Lauderdale Lakes | $10,130.36 |

| 9. Delray Beach | $10,040.20 |

| 10. Miami | $9,989.55 |

Further, below are the cities, of the top 100 most populated, with the least expensive premiums:

| Individual City | Avg Annual Premium |

| 1. Punta Gorda | $5,733.99 |

| 2. Port Charlotte | $5,738.64 |

| 3. Venice | $5,845.94 |

| 4. North Port | $5,862.69 |

| 5. Bonita Springs | $5,868.42 |

| 6. Fort Walton Beach | $5,930.24 |

| 7. Panama City | $5,945.29 |

| 8. Gainesville | $5,957.71 |

| 9. The Villages | $6,029.11 |

| 10. Crestview | $6,036.13 |

Statewide Trends

Industry watchers point the biggest finger at uninsured drivers as the single factor driving up policy pricing statewide.

According to the Florida Policy Project, they estimate that 20% of drivers in Florida are shirking the law and driving uninsured.

Uninsured motorists are a problem because if someone is hit by a driver without insurance, the victim’s policy would have to step in and pay for any damage, and more to the point, any medical bills that resulted from the accident. Because the insured drivers’ policies have to do double duty, the insurers price in the extra risk as a higher annual premium.

The Florida Policy Project also estimates that another 25% or more of drivers are just buying the state minimum coverage of $10,000 in personal injury and $10,000 in property damage. While that is better than nothing, almost every vehicle on the road is worth more than $10,000, and the typical medical bill following an accident is more than $15,000 according to the National Highways Traffic Safety Administration. That means that even though the driver is technically insured, an accident with an underinsured driver would also likely leave the victim’s insurance on the hook for the difference, presuming they carried underinsured motorist coverage.

To try to remedy some of this imbalance, the Florida House introduced a bill in 2024 to eliminate no-fault personal injury coverage and raise uninsured and underinsured motorist minimums statewide. This bill would have allowed victims of accidents to sue the at-fault driver who hit them for non-economic damages, and the victim’s insurer wouldn’t necessarily be on the hook for medical bills following an accident.

Lawmakers argued that doing this would shift the risk burden in a way that would help lower rates. On the other hand, opponents argued the higher limits and shifting the liability would just lead to more lawsuits and higher rates in the long term.

Regardless, that law died in committee, meaning the status quo will be the law of the land for the immediate future.

Demographic Differences

When it comes to who pays what, demographics are one of the biggest factors.

Predictably, the youngest drivers pay the most in premiums. Statewide, 16-year-old drivers pay an average premium of $16,877 – more than twice the statewide average annual premium. But after just one year, their average premium falls by more than $2,700 to $14,125. By age 18, the average premium is $12,746 – still substantially more than the statewide average, but not nearly as high as a newly minted driver.

Middle-aged drivers pay the least, with a 54-year-old driver paying $5,067. But people see their rates climb in their later years, with the average premium coming back up to $6,383 by age 80.

There is a gender gap in average premiums as well, especially in the youngest age groups. As a whole, women drivers paid less than men across nearly all age groups. Statewide, women paid on average 6% less than male drivers.

16-year-old girls pay 12% less than their male counterparts. That holds true until the early 20s when that spread starts to close. By Age 34 men and women both pay essentially the same rates.

Some individual insurers treated the genders more differently than others, though. Statewide, the average female Standard Fire Insurance Co. driver paid 12% less than their male policyholders – twice the statewide difference. On the other hand, Direct General Insurance Co., Geico General Insurance Co. and Security National Insurance Co. treated men and women largely the same, with female drivers only saving on average 2% to 3% over their male counterparts.

For men, marriage status also comes with an insurance break. Married 18-year-olds pay 14% less than their single counterparts. Married male drivers keep paying less for several years, though the spread narrows though their 20s. By the time men reach their 30s, single and married men are paying essentially the same average premium.

News isn’t all bad for younger drivers, though. Some insurers treat younger drivers more favorably. For instance, 18-year-old drivers with Standard Fire Insurance Co. pay 31% less than the statewide average for their age group.

That said, 18-year-olds with Allstate pay 22% more than the statewide average for their age group. Security National Insurance Co. is particularly punishing for the youngest drivers, with a 16-year-old policy holder paying on average 43% more than their counterparts in the state.

Other Factors

Drivers with good credit tended to pay less for their insurance, though that wasn’t true for all insurers. On average, drivers with good credit scores paid 17% less than fair credit scores and 79% less than drivers with poor credit histories.

The nexus between credit and insurance premiums is a bit controversial, but the theory is that if someone is responsible in their financial lives, they can be more likely to be responsible behind the wheel.

But not all insurers buy into the credit-as-risk theory.

Geico didn’t appear to take credit score into consideration, with average premiums staying the same between good, fair, and poor credit histories.

On the other end of the spectrum, Standard Fire Insurance Co. charged the lowest credit scores 89% more than the drivers with the best credit history, and Allstate charged the lowest credit scores 78% more than the highest credit scores.

Drivers also paid different rates depending on what vehicle they drove.

Audi A6 drivers paid the highest average premium at $9,108, followed closely behind by Tesla Model 3 drivers who paid an average premium of $9,091. Meanwhile Ford F-series truck drivers paid the least on average, coming in at an average premium of $6,300, with Honda CR-Vs coming in at $6,653.

Rates differ by vehicle for several reasons. One is that some vehicles tend to sustain more damage in wrecks than others – which is one of the criticisms of electric vehicles, such as the Tesla. Although, the Chevy Bolt, which is also an electric vehicle, was right in the middle of the pack in terms of insurance costs.

Another factor is how much it costs to repair a vehicle. Vehicles tend to cost less to insure if there is more access to aftermarket repair parts and to more mechanics who know how to make the repairs.

And in general, more expensive vehicles cost more to insure because if they are totaled, replacing them costs more.

| Vehicle | Avg Annual Premium | |

| Audi A6 | $9,108.57 | |

| Tesla Model 3 | $9,091.29 | |

| Lexus ES | $8,619.01 | |

| Cadillac Escalade | $8,461.94 | |

| Nissan Altima | $8,239.61 | |

| Toyota Camry | $7,546.84 | |

| Honda Accord | $7,470.43 | |

| Acura MDX | $7,423.58 | |

| BMW X3 | $7,399.96 | |

| Chevy Bolt | $7,255.62 | |

| Toyota Corolla | $7,177.44 | |

| Dodge Ram | $7,164.34 | |

| Nissan Titan | $7,068.48 | |

| Chevy Silverado | $6,720.02 | |

| Honda CR-V | $6,653.96 | |

| Ford F- Series Truck | $6,300.59 | |

The Big Picture

Florida lawmakers do point to some victories when it comes to insurance pricing.

Advocates say that years of past reforms are just now beginning to pay off. Changes, such as eliminating the assignment of benefits provision, were done to help reduce lawsuits and lower premiums over the long term. And so far this year, a handful of insurers, including Geico, Progressive, and State Farm have publicly announced rate decreases for 2025.

Still, auto insurance pricing in Florida is anything but one-size-fits-all. While the statewide average premium sits among the highest in the nation, individual drivers can find themselves paying thousands more — or less — depending on where they live, how old they are, their marital status, credit score, gender, and even what car they drive.

From the dense streets of Miami to the quiet roads of Punta Gorda, risk factors vary dramatically, and insurers price accordingly. Understanding these factors is essential for Florida drivers looking to make informed decisions and potentially lower their premiums.

Michael Giusti, MBA, is an analyst for InsuranceQuotes.com