Are Florida Auto Insurance Rates High? Savings Depend on Your City and County

It’s no secret to Florida drivers that auto insurance in the Sunshine State is expensive, but a new study finds that insurance premiums for Floridians can vary significantly depending on the city or county they call home. If you need help finding affordable insurance rates in Florida, iQ can help you compare multiple insurance quotes.

A recent Quadrant Information Services study, commissioned by insuranceQuotes, examined the average cost of auto insurance premiums in 409 Florida cities. Using a hypothetical 40-year-old female driver with a clean driving record and no prior claims, the study also examined the average cost of auto insurance in all 67 counties statewide, and some of the results were quite significant.

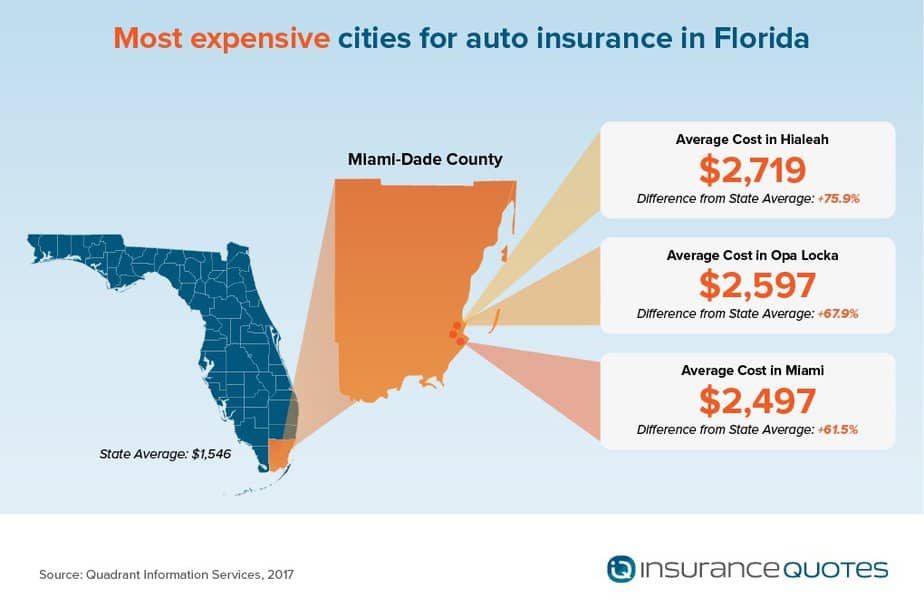

For instance, the average annual cost of an auto policy in the city of Hialeah (the sixth largest city in the state) is $2,719, which is 76 percent higher than the state average of $1,546.

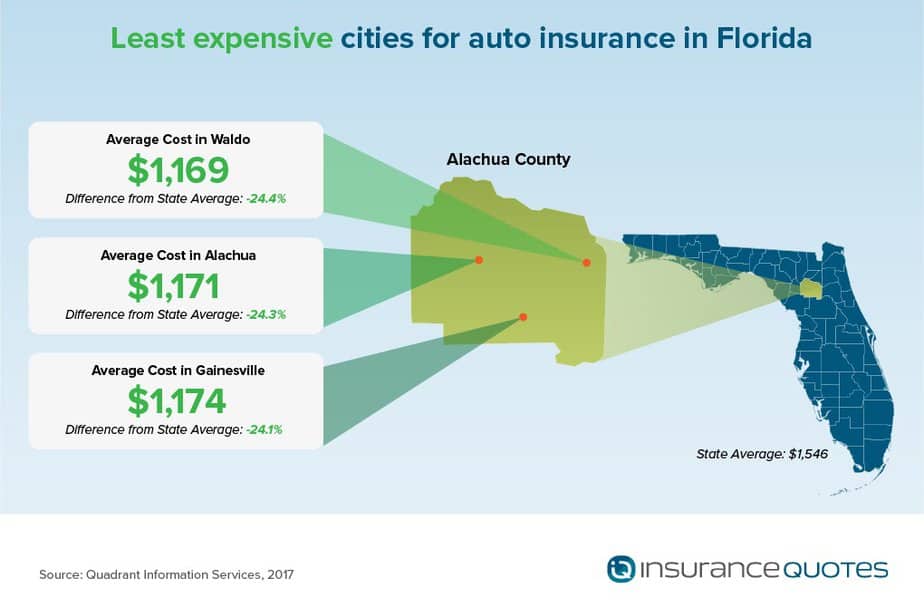

Meanwhile, drivers in Waldo are paying — on average — 24 percent less than the statewide average for car insurance.

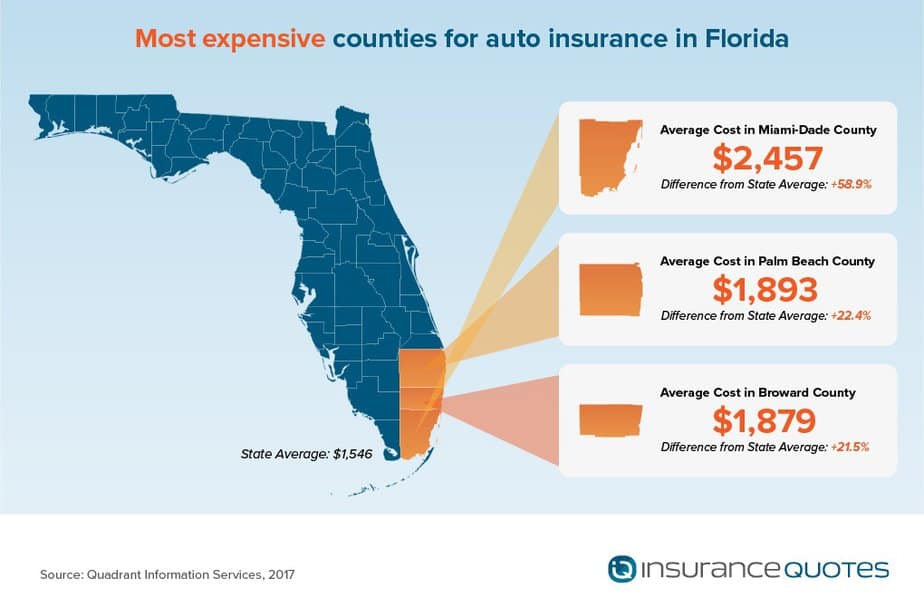

Furthermore, the price of insurance can swing substantially from county to county. Consider, for instance, that drivers in Miami-Dade County pay, on average, $2,456 for car insurance — 59 percent more than the statewide average. Meanwhile, drivers in Alachua County pay 24 percent less.

Florida insurance experts and analysts say these differences may be alarming to the average driver, but hasten to add that they logically reflect the realities of insurance pricing and the regional variables that play a role.

Why do Florida auto insurance rates vary so much?

“I don’t think this data is all that surprising,” says Lynne McChristian, Florida representative and catastrophe response director for the nonprofit Insurance Information Institute (III). “Where you live matters when it comes to the cost of auto insurance. Those who live in highly populated, traffic-dense areas of the state are going to pay more than those who live in the more rural, less populated cities and counties.

“When you consider it closely it all makes sense.”

The average annual cost of car insurance in Florida is $1,546. But when it comes to examining the average cost of car insurance on a smaller scale, it’s apparent that not all cities are created equal.

According to the insuranceQuotes study, the following five cities, on average, have the most expensive annual auto insurance rates in Florida:

- Hialeah — $2,719; 76 percent above average

- Opa Locka — $2,597; 68 percent above average

- Miami — $2,497; 62 percent above average

- Miami Gardens — $2,480; 60 percent above average

- Homestead — $2,314; 50 percent above average

Meanwhile, the following five cities, on average, have the least expensive auto insurance rates in the state:

- Waldo — $1,169; 24 percent below average

- Alachua — $1,171; 24 percent below average

- Gainesville — $1,174; 24 percent below average

- Earlton — $1,175; 24 percent below average

- Newberry — $1,177; 24 percent below average

This breakdown of auto insurance costs doesn’t surprise Sha’Ron James, Florida’s state Insurance Consumer Advocate.

“This pretty much reflects what I would have expected,” says James, who serves as an independent voice for state residents in matters pertaining to public policy and regulation of the insurance market. “High premiums are unfortunately an everyday reality for Floridians, and the two main factors that determine rates are geography and population density. And what you see are drivers in more densely populated areas pay more for auto insurance because their risk is higher.”

Indeed, all five of the state’s most expensive cities are located within Miami-Dade County, the most densely populated county in the state.

Meanwhile, the bottom of the list comprises cities in the much less populated Alachua County, including a municipality such as Waldo, which is home to just 939 residents.

“In densely populated areas you’ve got all those cars and people and a high rate of speed, which is a combination that’s going to drive up insurance costs,” McChristian says.

Florida’s Office of Insurance Regulation declined to be interviewed for this story but did comment in the form a written statement from communications director Amy Bogner, supporting the notion that geography plays a necessary role in pricing insurance.

“Auto insurance costs are driven in large part by historic losses in a particular geographic area, which are used in a rate filing to predict the rate needed to cover anticipated claims and expenses for the coming year,” writes Bogner. “Companies use rating territories, but a county in a study like this could reflect higher premiums due to average loss costs in that area across insurance companies. … We have not conducted an in-depth review of the detail of the methodology used in this study, but it is not surprising that loss costs, risk, and rates vary in different parts of the state.”

Geography, driving patterns factor into auto insurance rates

Stepping back further and looking at the cost of auto insurance by county, a similarly varied landscape emerges. According to the study, the following five counties, on average, have the most expensive annual auto insurance rates in Florida:

- Miami-Dade — $2,457; 59 percent above average

- Palm Beach — $1,893; 22 percent above average

- Broward — $1,879; 22 percent above average

- Hillsborough — $1,827; 18 percent above average

- Pasco — $1,641; 6 percent above average

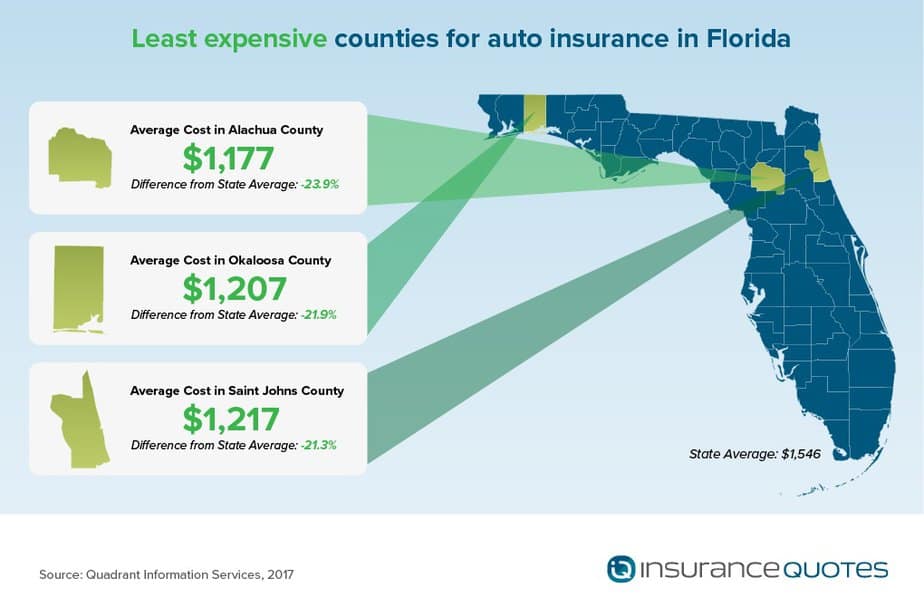

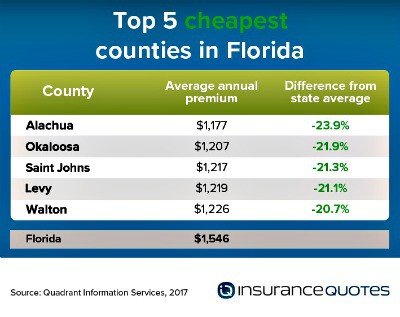

Meanwhile, the following five counties, on average, have the least expensive auto insurance rates in the state:

- Alachua — $1,177; 24 percent below average

- Okaloosa — $1,207; 22 percent below average

- Saint Johns — $1,217; 21 percent below average

- Levy — $1,219; 21 percent below average

- Walton — $1,226; 21 percent below average

Again, geography and driving patterns seem to play a critical role in the distribution. Counties with the least expensive insurance rates tend to be in the state’s most rural, sparsely populated regions, while those counties with the highest rates tend to be the most densely populated in the state.

For instance, Miami-Dade County is the largest in the state, with a population of 2.6 million people (followed by Broward, Palm Beach and Hillsborough counties, respectively). Meanwhile, the entire population of Levy County is just 40,553, followed by Walton County which is home to 62,943 residents.

More people means more cars, more traffic congestion, and a greater risk for accidents, says McChristian — and the data supports this.

For instance, according to the Florida Department of Highway Safety and Motor Vehicles, Miami-Dade County experienced 63,451 motor vehicle crashes in 2015. That same year, Levy County only experienced 523 total crashes.

“When you consider that Miami-Dade County is so highly populated, with a lot of four-lane interstate highways running through it and drivers traveling at high speeds, you are naturally going to have more accidents than in other parts of the state,” McChristian says. “And that increased likelihood of crashes is one of the reasons those drivers pay more for insurance.”

McChristian also points out that Florida’s most populous cities and counties lack extensive public transportation options seen in other East Coast metropolises.

“We don’t have a subway system or a lot of well-used and well-planned public transportation infrastructure, which means there are more cars on the road,” McChristian says. “In order to get around in Florida you more or less have to do it in a car.”

As for whether or not consumers should be concerned about the disparity of premium costs throughout the state, James says no.

“Ninety-nine percent of what drivers pay for auto insurance is based on the statistical work of actuaries, and there’s no way to avoid the correlation between population density and the increased likelihood of accidents, theft, and even fraud,” James says. “That being said, consumers can only become more informed by regularly shopping around to see if they can find a better rate than the one they’re currently paying.”

The bottom line, says McChristian, is that geography will continue to play an important role in determining what Floridians pay for auto insurance.

“Insurance — whether it’s auto or home — represents the risk of where you live, and it’s factual that the risks are different in different parts of the state,” McChristian says. “Florida is not just one homogenous entity.”