Making One Auto Insurance Claim Can ‘Drive’ Up Your Rate by as Much as 76%

You may know that filing an auto insurance claim will probably cause a spike in your annual premium — but you may be surprised to learn just how significant the increase can be.

For the second year in a row, insuranceQuotes.com and Quadrant Information Services examined the average economic impact of filing various claims on your auto insurance policy.

Using a hypothetical 45-year-old married female driver who’s employed, has an excellent credit score, has no lapse in coverage and has filed no prior auto insurance claims, the study looked at how much annual premiums can go up after filing one of three different types of claims:

Using a hypothetical 45-year-old married female driver who’s employed, has an excellent credit score, has no lapse in coverage and has filed no prior auto insurance claims, the study looked at how much annual premiums can go up after filing one of three different types of claims:

- Bodily injury.

- Property damage.

- Comprehensive.

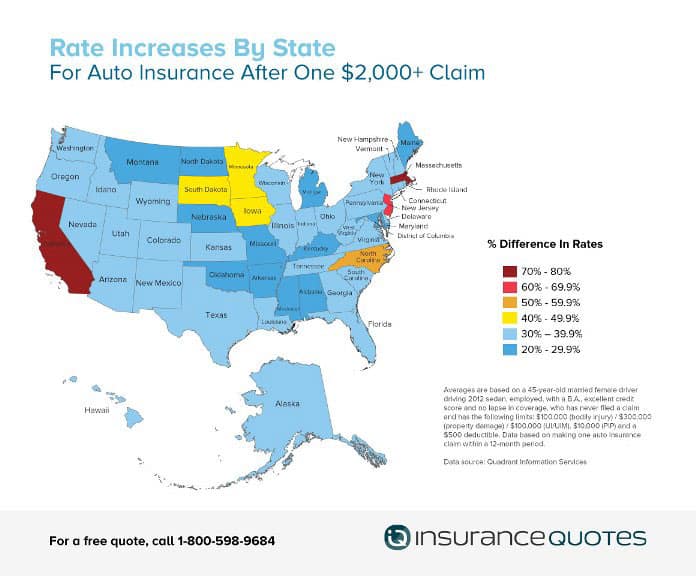

The study compared the average premium increases for all 50 states and Washington, D.C.

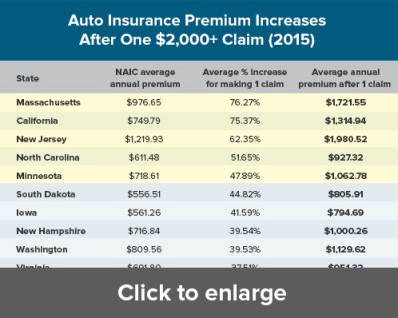

Auto insurance premium increases by state

The study found that drivers who make a single auto insurance claim of $2,000 or more will see an average premium increase of 41 percent (a 3 percent jump from last year’s findings).

Filing a second claim in one year is even more costly, with an average annual premium increase of 93 percent.

According to the National Association of Insurance Commissioners (NAIC), the average cost of an auto insurance premium in the U.S. is $815, which means an increase of 41 percent would result in about a $335 spike.

However, these increases typically only kick in for accidents where you’re at fault. If someone hits you, his or her insurance will cover the claim and typically, your rates won’t be affected.

According to Mike Barry, spokesman for the nonprofit Insurance Information Institute, insurers know that if you file a claim, you’re statistically more likely to file another claim in the future.

“It’s important to understand that increased premiums aren’t a penalty, but a shift in your risk moving forward,” Barry says.

Premium increases after a claim by state

According to the insuranceQuotes.com study, premium increases vary widely by state.

For instance, filing a single auto claim of $2,000 or more in Massachusetts will result in an average premium increase of 76 percent (up from 67 percent in last year’s study).

According to the NAIC, Massachusetts drivers paid an average annual premium of $976.65 in 2012. That means a single auto insurance claim in that state could result in paying an additional $745 per year for auto insurance.

Meanwhile, other states were far below the national average.

For instance, Maryland drivers who file a single auto insurance claim of $2,000 or more will only see a 22 percent spike in annual premiums (a 2 percent increase from last year’s study).

According to NAIC figures, that’s an annual increase of about $213.

According to Doug Heller, an independent consumer advocate with the Consumer Federation of America, there’s one overarching reason why certain states show more significant premium increases than others — regulation.

Heller says that Massachusetts and California have “the most prohibitive insurance regulations in the country” when it comes to using socioeconomic factors such as credit scores and occupations to set a driver’s auto insurance premiums.

For instance, California voters passed Proposition 103 in 1988, which significantly limited the factors insurance companies could use when determining auto rates, including a ban on using credit scores.

Since then, Heller says insurance companies in the Golden State must base insurance premiums on three primary factors:

- Driving safety record.

- Average miles driven per year.

- Years of driving experience.

Likewise, Massachusetts auto insurers are prohibited from using nondriving-related factors such as gender, marital status, age, occupation, income or education in setting annual premiums.

“Essentially, I would expect to see pretty dramatic rate increases in states like California and Massachusetts for people who cause accidents because rates in these states are very closely aligned with driving safety,” Heller says.

Meanwhile, states like Maryland can use a whole host of nondriving-related factors when setting premiums, including your gender, age, marital status, occupation and a driver’s credit score.

And while it might seem like bad news for California and Massachusetts drivers who file an insurance claim, Heller says this is a benefit to the larger population of drivers who have never filed a single claim—mainly because it encourages safer driving.

“At it’s best, insurance pricing is supposed to incentivize safety, and premiums should be adjusted to reflect that,” Heller says.

Bodily injury claims are the most expensive

Not every type of claim is going to impact your premium the same way, and bodily injury (liability) claims are by far the most expensive.

According to Barry, bodily injury claims are filed whenever a driver causes injuries to individuals as the result of an accident.

Washington, D.C., and every state except New Hampshire requires drivers to obtain a minimum amount of liability coverage for these circumstances because they’re often very costly — the average bodily injury claim cost $15,443 in 2013 versus the average property damage claim, which was $3,231.

Barry says the higher costs of bodily injury claims are because typically, doctors and hospitals generate bigger bills than auto body repair shops.

According to the insuranceQuotes.com study, filing one bodily injury claim of $2,000 or more will result in a national average premium increase of 45 percent (or about $370) per year.

However, there are several states that buck the national average.

The following five states showed the greatest average premium increase as a result of filing one bodily injury claim of $2,000 or more:

1. California — 86 percent.

2. Massachusetts — 83 percent.

3. New Jersey — 69 percent.

4. North Carolina — 58 percent.

5. Minnesota — 52 percent.

Meanwhile, the following five states, on average, showed the smallest percentage premium increase:

1. Maryland — 22 percent.

2. Michigan — 25 percent.

3. Montana — 27 percent.

4. Oklahoma — 27 percent.

5. Mississippi — 28 percent.

“Anytime you involve bodily injury, it’s more likely to involve expensive medical costs and possibly litigation — which is also expensive,” says Nancy Kincaid, spokeswoman for the California Department of Insurance.

Premium increases for comprehensive claims

Of the three different claims featured in the insuranceQuotes.com study, comprehensive claims resulted in the least significant premium increases.

A comprehensive claim pays for damage that results from something other than a collision, such as fire or theft.

According to Barry, the average cost of a comprehensive claim in 2013 was $1,621 — but the smaller cost of paying for a comprehensive claim isn’t the primary reason why it barely affects premiums.

“Comprehensive claims barely move the needle because they’re the result of something beyond the driver’s control,” Heller says. “So it really doesn’t tell an insurer anything about the future likelihood of filing another claim.”

The numbers support this. According to the insuranceQuotes.com study, the national average premium increase after filing one comprehensive claim of $2,000 or more is about 2 percent (or about $18)

However, a few states did come in above average: South Dakota saw the greatest average premium increase, 11 percent, for filing a comprehensive claim of $2,000 or more.

Meanwhile, 16 states showed a premium increase of less than 1 percent, and eight of those showed no increase at all.

How long do increases stay on your premium?

Here’s the good news: Premium increases don’t stick around forever.

According to Barry, drivers can expect rates to remain high for between three to five years, depending on the severity of the claim. After that, they will begin to lower to pre-claim levels (provided you don’t file another claim during that time).

“If you don’t like that, shop around,” Barry says. “Different insurers treat prior claims differently, so you could end up with a better deal elsewhere.”

Methodology

Averages are based on a 45-year-old married female driver driving 2012 sedan, employed, with a B.A., excellent credit score and no lapse in coverage, who has never filed a claim and has the following limits: $100,000 (bodily injury) / $300,000 (property damage) / $100,000 (UI/UIM), $10,000 (PIP) and a $500 deductible. Data based on making one auto insurance claim within a 12-month period.