How Does a Traffic Ticket Affect My Insurance Rates?

If you get nabbed for speeding, rolling through a stop sign or failing to buckle up, you might worry your insurance costs will skyrocket.

But most drivers don’t pay higher premiums after a ticket, a new survey shows.

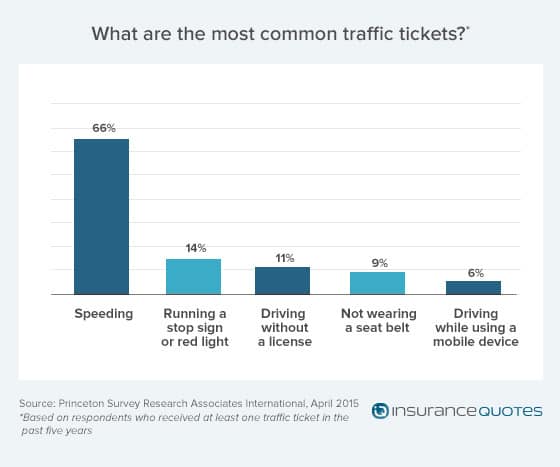

The survey, conducted on behalf of insuranceQuotes.com in April 2015 by Princeton Survey Research Associates International, found that about 1 in 5 Americans got a traffic ticket for a moving violation in the past five years. Common reasons for getting a ticket included:

- Speeding.

- Running a stop sign or red light.

- Driving without a license.

- Not wearing a seat belt.

- Driving while using a telecommunications device.

Less common violations included: careless or reckless driving (5 percent), passing another vehicle improperly (4 percent), failure to stop for a pedestrian (3 percent) and driving under the influence (2 percent).

Speeding is on the rise, 4 percent higher than in a previous survey two years ago. Of drivers who got tickets, more women than men (69 versus 64 percent) reported getting cited for speeding.

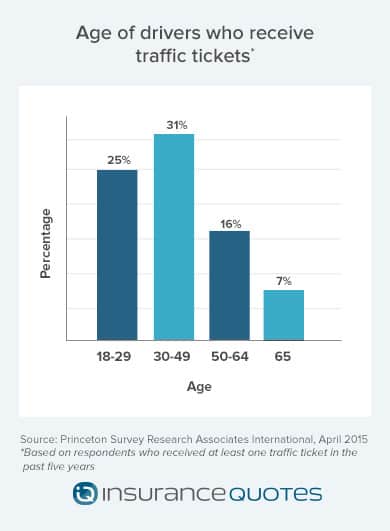

Surprisingly, it wasn’t young adults but 50- to 64-year-olds (70 percent of those who have received at least one ticket) who were most likely to get caught driving too fast.

Most drivers who got a ticket — 78 percent — reported they’re not paying more for auto insurance as a result. Only 19 percent said the violation caused a spike in premiums.

However, a common violation like speeding five or 10 miles over the limit can cause a modest increase in premiums for a middle-aged driver and a huge hike for a young driver, says Jon Zimmerman, a Washington traffic attorney.

That’s because speeding is a cause of accidents, and younger drivers get into more accidents, so an insurance company might raise a younger driver’s premiums more to compensate for the higher risk, he says.

“The same violation can have a very different effect on two different drivers’ premiums,” Zimmerman says.

You Might Not Pay More for Insurance After a Ticket

There’s good news for drivers, though. It’s become increasingly common for policyholders not to see a premium increase after a ticket, says Brian Rauber, a Missouri insurance agent with Brian Rauber Insurance Agency. Here are five reasons your insurance rates might NOT go up

Depending on your insurance provider’s policy your costs for car insurance could go up around 20% to 30% after a speeding ticket. The final increase will depend on the speed you were driving over the speed limit. Other traffic tickets that will increase your insurance could be DUI’s, distracted driving, or an illegal passing violation.

On average a traffic ticket will affect insurance costs for 36 months (3 years) there are also other factors that may come into play such as your overall driving record and if your insurance policy offers accident forgiveness or something of the sort.

Fighting a traffic ticket could be worth the effort should it get expunged from your driving records; however, it can often take a lot of your time to successfully fight it. If your insurance premiums increase dramatically due to your ticket the return on investment may be well worth the fight and spending time to get it removed.

You Got Stopped for a Minor Violation

The seriousness of different moving violations varies by state, Zimmerman says. Some states stipulate that certain offenses don’t go on your driving record or, if they do, can’t be seen by insurance companies.

For example, speeding or any other infraction caught by an automated traffic camera does not go on a driver’s record in Washington, he says.

And some insurers won’t increase your rates for a minor infraction like rolling through a stop sign, says J. Robert Hunter, director of insurance for the Consumer Federation of America.

However, “If you speed through a stop sign, that’s a different story,” he says.

You Have a Good Driving Record

If you’ve been with the same insurer for many years and have no previous tickets or accidents, your rates might not go up, says Pablo Fabian, a California attorney who focuses on traffic infractions.

“The insurance company treats it as an anomaly because you have a stellar record,” he says.

For example, a married 45-year-old driver might pay $30 extra per month, or $360 a year. But a single driver under 25 could pay $100 extra per month, or up to $1,200 in a year, he says.

For example, a married 45-year-old driver might pay $30 extra per month, or $360 a year. But a single driver under 25 could pay $100 extra per month, or up to $1,200 in a year, he says.

Your Policy Includes Accident Forgiveness

More insurers offer incident forgiveness, which waives surcharges for an accident or ticket, Rauber says.

For example, Allied Insurance offers minor violation forgiveness, so each driver on the policy can get a free pass once every three years for an infraction such as running a red light or driving too fast in a school zone.

Your Insurer Didn’t Check Your Driving History

It’s becoming more common for insurers not to check the driving records of their current policyholders, Rauber says. That’s partly because states are charging more for access to driving records, he says.

Each state charges a different amount for obtaining a motor vehicle record, from about $2 in California to $10 in Pennsylvania to $27.50 in Oklahoma, according to Drivers History, a company that provides court traffic violation data to insurance companies.

The cost of obtaining motor vehicle records tripled over a decade, from an average of $3 in 2003 to $9 in 2012, according to Drivers History.

You Got Out of the Ticket

Depending on where you live, and whether you had previous tickets, you might be able to keep a violation off your driving record by attending traffic school or fighting the ticket, Fabian says.

However, a major moving violation, such as a DUI or reckless driving, could cause your rates to go through the roof — or even cause your insurer to drop you, Hunter says.

Getting multiple moving violations within a couple of years also can cause a spike in premiums, Hunter adds.

The survey showed that, of the drivers who got a ticket in the last five years, most (63 percent) got only one ticket. But 18 percent got two and 11 percent got four or more, and most of those multiple repeat offenders (20 percent) fell into the 18- to 29-year-old age group, the survey shows.

How to Steer Clear of Tickets and Insurance Increases

Here are five ways to avoid getting a traffic ticket — or, if you do, getting hit with a higher insurance bill.

Keep Your Car in Good Working Order

Check your vehicle before you hit the road, Zimmerman says. An officer might ignore a single transgression, such as driving a few miles over the speed limit, but would almost certainly stop a speeding car with a broken headlight or burnt-out taillight, he says.

Don’t Go Over the Speed Limit

Know the speed limits on highways, county roads and city streets — and keep your eyes peeled for changes in limits, Zimmerman says.

Cooperate But Don’t Talk Too Much If You Get Pulled Over

If you see flashing lights and hear a siren behind you, pull over to a safe spot and hand the officer your driver’s license, proof of insurance and registration, Zimmerman says. Be polite and don’t argue with the officer.

Give noncommittal answers, and don’t volunteer information or admit you did anything wrong, legal site Nolo.com recommends. For example, if the officer asks if you know why he pulled you over, simply say “No.”

Call a Traffic Attorney If You Need One

Instead of paying your ticket immediately, get a free consultation with an attorney who specializes in traffic violations, Fabian says.

An attorney can review your case and tell you whether you might be able to fight the ticket and keep the violation off your record so your insurer doesn’t find out about it.

“It’s definitely worth a call,” he says.

Shop for a New Car Insurance Policy

If you shop for new insurance, your tickets will show up during the underwriting process, so you might not want to shop around just to get a great deal. It’s always smart to compare multiple free car insurance quotes to get the best prices.

However, different insurers treat violations differently, so it’s worth shopping if your insurer hiked your premiums, Hunter says.

Methodology

The PSRAI April 2015 Omnibus Week 1 obtained telephone interviews with a nationally representative sample of 1,000 adults living in the continental United States. Telephone interviews were conducted by landline (500) and cell phone (500, including 300 without a landline phone). The survey was conducted by Princeton Survey Research Associates International (PSRAI). Interviews were done in English and Spanish by Princeton Data Source from April 1 to 4, 2015. Statistical results are weighted to correct known demographic discrepancies. The margin of sampling error for the complete set of weighted data is ± 3.6 percentage points.