What Changes to Expect in Medicare for 2019

By Brian O’Connell

With open enrollment beckoning, it’s time for a deep dive into Medicare for the new year, as cornerstone issues like financial viability, regulations and coverage changes confront older Americans heading into 2019.

“It’s a good time for current beneficiaries to review their policies and for new applicants to make important choices,” says Carol Levine, director of the Families and Health Care Project at the United Hospital Fund in New York and author of the new book “AARP’s Navigating Your Later Years for Dummies.”

This year’s open enrollment period is Oct. 15 to Dec. 7 for 2019 coverage, and Medicare consumers need to have all their ducks in a row before making any health care decisions, including shopping for Medicare supplement insurance.

“Whatever path you may take toward a secure and healthy future, Medicare sets the framework,” Levine notes. “Seniors need to know that whatever Medicare covers (and it covers a lot), you don’t have to pay for. Additionally, you’ll want to know whatever Medicare doesn’t cover (that’s a lot, too), where you’ll have to find other sources of payment.”

Here’s what to focus on when enrolling in Medicare

To set the table for seniors heading into a new year and a new Medicare experience, here are key areas of focus for health care consumers in 2019:

Spending up, but long-term risks remain. There’s good news and bad news on the Medicare financing front. According to the Kaiser Family Foundation, Medicare spending was 15 percent of total federal spending in 2017, and is projected to rise to 18 percent by 2028.

Meanwhile, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, three years earlier than the 2017 projection.

Some of the proposed program changes to address Medicare spending challenges include:

- Restructuring Medicare benefits and cost sharing

- Further increasing Medicare premiums for beneficiaries with relatively high incomes

- Raising the Medicare eligibility age

- Shifting Medicare from a defined benefit structure to a “premium support” system.

KFF stated those changes “could increase the financial burden on future generations while leaving unaddressed long-term financial challenges, raising the question of whether raising the Medicare payroll tax or increasing other existing taxes should be considered.”

Higher earners to pay more. To shore up Medicare savings, the U.S. government is introducing a new income tier for 2019 that will force more affluent Medicare recipients to bear a larger financial burden. Beginning next year, Medicare consumers with incomes of $500,000 or more and couples earning $750,000 will have to pay 85 percent of the total cost of their Medicare parts B and D benefits. That’s up from 80 percent in 2018.

The new tier represents a double hit, of sorts, to wealthier Americans. Back on Jan. 1, 2018, a new statute called for Medicare beneficiaries who earned $133,501 to $160,000 (or $267,001 to $320,000 for couples) to pay 65 percent of the cost of their parts B and D benefits. That’s up from up 50 percent in 2017. Medicare consumers who earn up to $85,000 ($170,000 for couples) will continue to pay 25 percent of their benefit costs.

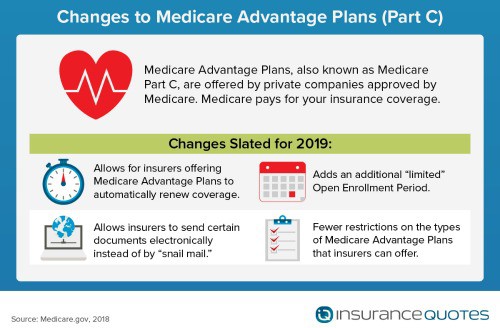

New wrinkles on open enrollment. While the official open enrollment period starts on Oct. 15, 2018 and runs through Dec. 7, 2018, the Centers for Medicare & Medicaid Services (CMS), which administers Medicare, offers beneficiaries two new adjustments for 2019.

- Explanation of coverage (EOC) must be delivered by Oct. 15. “Before the new changes from CMS for the 2019 plan year, the due date was Sept 30,” says Katie Hulan, a specialist at Indellient, a consulting firm that works with health care providers on Medicare plans.”

- A new open enrollment period “do over.” Starting Jan. 1, 2019, the CMS will allow Medicare A members to elect another health plan between January 1 and March 31. “That’s in case if they discover things aren’t as they were promised when they enrolled,” states Hulan.

As part of the Medicare enrollment process, plan providers must submit website marketing content for review, including contracted third-party websites, says Hulan. “Plans do not need to submit web pages with or containing CMS-required content for review,” she notes. “This means almost every website needs to be reviewed now.” Also, website content that has not been reviewed/approved cannot be viewable to the public. “This is a significant change as sponsors were previously permitted to post websites that were pending review,” she says.

During the annual enrollment period, Medicare consumers can make the following changes to their plan coverage, the CMS notes:

- Users can switch from Original Medicare to Medicare Advantage, or vice versa.

- Users can switch from one Medicare Advantage plan to another, or from one Medicare Part D prescription drug plan to another.

- Users who fail to enroll in a Medicare Part D plan when first eligible, can sign up during the general open enrollment. A late enrollment penalty may apply.

More flexibility for Medicare Advantage. One major option Medicare consumers have going into 2019 is between Original Medicare and Medicare Advantage (sometimes called Medicare Part C).

“The 2018 Chronic Care Act passed by Congress as part of the Bipartisan Budget Act of 2018 gives Medicare Advantage plans more flexibility in covering non-medical products and services, such as bathroom grab bars and wheelchair ramps,” says Levine. “These private insurance plans can also expand telehealth services so that people who live in rural areas or have mobility problems can communicate more easily with a doctor’s office.”

Do these add-ons make Medicare Advantage a better deal than Original Medicare?

Levine advises taking a long-term view.

“That depends on whether the plan you choose would offer these features, and whether you would find them valuable,” she says. “Medicare Advantage plans already have more add-ons than Original Medicare, but don’t have as extensive networks of providers and health care settings.”

Anyone making this choice should look at the whole range of benefits, not just the most appealing ones, Levine advises.

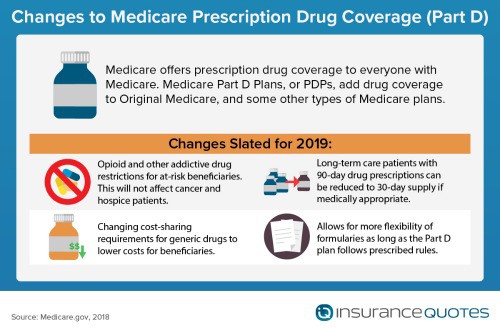

Adjustments on “Donut Hole.” The Part D payment donut hole will be eliminated in 2019 (instead of 2020). “In 2018, the coverage gap with no insurance (i.e., the donut hole) begins once a beneficiary reaches his/her Part D plan’s initial coverage limit ($3,750) and ends when he/she spends a total of $5,000 out of pocket,” says Hector De La Torre, executive director of the Transamerica Center for Health Studies, a non-profit division of Transamerica Institute. “The new coinsurance rates (for beneficiaries to pay) will be set at 25% of brand-name and 37% of generic drugs.”

New changes to supplemental insurance. CMS is reinterpreting the ‘uniformity requirements’ for Part C benefits offered to beneficiaries. ‘They’re allowing Medicare Advantage plans the ability to reduce cost sharing for supplemental benefits, as well as offering different deductibles based on beneficiaries’ ability to meet specific medical criteria (known as the Targeted form of supplemental benefits,” says Torre.

“Medicare Advantage plans must specify which supplemental benefits are covered in the Evidence of Coverage, as well as any limitations.” In 2020, those with a chronic illness will have a “wider array of supplemental benefits” instead of the current requirement that these benefits be “primarily health-related”, Torre adds.

Elimination of the ACA individual mandate no threat to Medicare. The individual mandate repeal should not impact Medicare as “it is universal for those over 65 and incorporates incentives/penalties to sign up for coverage around their 65th birthday,” says Torre.

Watch out for card fraud. Since the summer Medicare has been issuing new identification cards, which are designed to reduce fraud by replacing the beneficiary’s Social Security Number with a random number that has both letters and numbers. “The change has instead produced new scammers,” says Levine. “These fraudsters may call a beneficiary and claim that Medicare charges for the new card. Not true, it is free. The cards are being issued in waves across the country, so not everyone will get the new card at the same time.”

Outlook on Medicare going forward

The bottom line? Health care experts say the changes coming to Medicare in 2019 have less impact on consumers than one might think.

“Although the Centers for Medicare & Medicaid Services report states the changes are intended to help serving beneficiaries and relieve some of the burdens on health care providers, the bottom line is that the changes will actually save Medicare about $295 million each and every year beginning in 2019,” says Sonny O’Steen, an expert in Medicare supplement plans.

“As for the changes that have been approved and published, they affect health care providers much more than beneficiaries and appear to be intended to reduce the cost of Medicare to the government,” O’Steen adds.

There are some concerns about Medicare costs and budgeting going forward, in addition to the increasing number of beneficiaries as more baby boomers turn 65 years-old, therefore increasing the covered population.

“However, Medicare has been a tremendous success in covering seniors over time (over 98 percent) and there is sufficient bipartisan support to make any adjustments/improvements over time,” says Torre.