Flooding, Dog Bites, Stolen Car Items — How Insurance Misconceptions Can Cost You

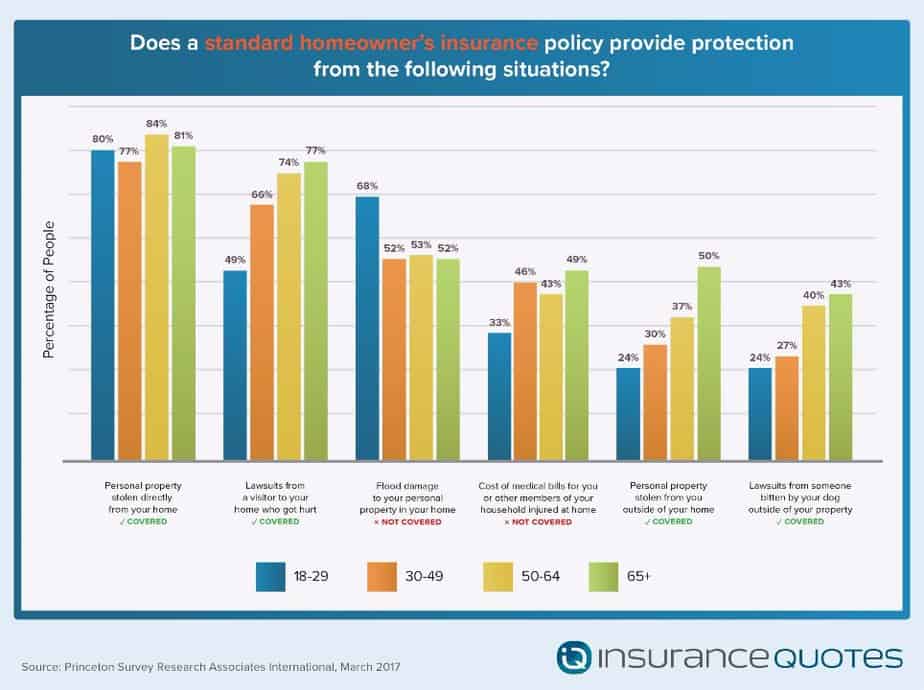

In the event of rising water, more than half of homeowners would be in for an unpleasant surprise because they believe their standard homeowner’s insurance policy will cover flood damage.

In a March 2017 survey commissioned by insuranceQuotes, 56 percent of respondents mistakenly believed that a standard homeowner’s policy covers flood damage. For millennials ages 18 to 36, the percentage rose to 67 percent.

Considering a few inches of water in a 1,000 square-foot home can cost more than $10,000 in repairs that’s a costly misconception.

RELATED: How Trump Could Use Flood Insurance to Pay for His Border Wall

“And floods can happen at any time in any place,” says Stephanie Moffett, spokeswoman for the Federal Emergency Management Association. “It’s the No. 1 costliest disaster in the United States.”

What’s worse for many misinformed consumers is the fact that federal disaster assistance usually will not pay for flood damage unless the property is in an area declared a major disaster by the president.

Even then, according to FEMA officials, most forms of assistance are loans that must be repaid with interest.

So how do you protect your home from flooding?

The good news is that flood coverage is available via a separate policy from the National Flood Insurance Program, a federal entity created by Congress in 1968 to help provide a way for owners to financially protect themselves.

The program is also charged with improving floodplain management and developing maps of potential hazard zones.

“Know your risk when you’re looking to buy or rent, and talk to your agent to find out more about flood insurance,” Moffett says.

But you can’t wait until a flood warning on the news to buy a policy, she says: There is a 30-day waiting period before the coverage takes effect.

“So the sooner, the better,” she says.

According to FEMA data, the average flood policy in 2016 cost $700, and the average total paid claim was about $31,000.

The NFIP also encourages those living outside high-risk flood areas to ask their agents if they are eligible for the Preferred Risk Policy, an affordable flood insurance program that offers protection starting as low as $127 in the year 2016.

Dog bites covered in your homeowner’s policy

Consumers may overestimate their coverage when it comes to flooding, but they underestimate coverage when it comes to dog bites, according to the insuranceQuotes study.

Regarding potential lawsuits filed by someone bitten by a policyholder’s dog outside their property, 54 percent of respondents and 67 percent of millennials didn’t know they would be protected with a standard homeowner’s policy.

CHECK OUT: How Insurance Ignorance Is Putting a Generation At-Risk

“Homeowner’s policies cover dog bites wherever your dog might be,” says Loretta Worters, a national spokesperson for the Washington, D.C.-based nonprofit Insurance Information Institute.

Many owners of friendly, four-legged pets may discount the need for such knowledge, but it happens more often than people might think.

“Even normally docile dogs may bite when they are frightened, or when defending their puppies, owners or food,” Worters says.

Do breeds matter to insurance companies?

“It depends on the insurer, the state you are in and the claims history of that insurance company,” she says. “Some companies may charge a higher rate (based on breed), exclude your dog from liability coverage or exclude the dog from the policy. Some companies don’t use breed at all. Their contention is, ‘It’s the bite, not the breed.’”

Another surprise might be how much that dog bite will cost.

Dog bites and other canine-related injuries are more common than you may think. They account for more than one-third of all homeowner’s insurance liability claim dollars paid out in 2016, costing more than $600 million, according to the Insurance Information Institute and State Farm.

An analysis of homeowners insurance data by the III found that the number of dog bite claims nationwide increased to 18,122 in 2016 compared to 15,352 in 2015 — an 18 percent increase. The average cost per claim for the year, however, decreased by more than 10 percent. The average cost paid out for dog bite claims across the nation was $33,230 in 2016, compared with $37,214 in 2015 and $32,072 in 2014.

Officials say the decrease in the 2016 average cost per claim may be a result of a decrease in severity of injuries.

However, the average cost per claim nationally has risen more than 70 percent from 2003 to 2016, due to increased medical costs, plus the size of settlements, judgments and jury awards to plaintiffs. Those all are trending upward.

Renter’s insurance covers more than many think

If you think you don’t need homeowner’s or renter’s insurance, then you’re putting the valuables in your car at risk. Surprised? You have plenty of company for that misconception.

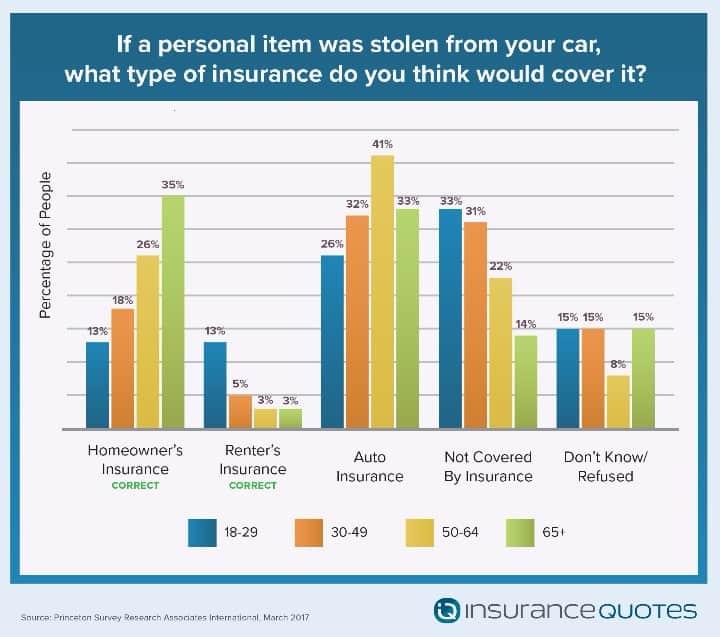

While 81 percent of respondents knew that valuables stolen from their homes were covered under a standard homeowner’s policy, only 28 percent knew renter’s insurance would cover valuables stolen from their cars.

For millennials, those ages 18-36, the percentage was even lower — 25 percent.

Not everyone who rents gets renter’s insurance, however.

According to the survey, 58 percent of millennials and 39 percent of respondents overall who rent held renter’s polices.

“Take a moment to think how much it would cost to replace your stuff in the event of a theft, vandalism or fire in your home,” says John Zinno, president of GEICO Insurance Agency. “Renter’s insurance goes well beyond what’s covered in a basic landlord’s insurance policy and protects you from financial risks that are associated with taking on named perils.”

According to Insurance Information Institute, renter’s insurance is important because it protects renters with multiple coverage options for personal property including furniture, televisions, clothing, jewelry and computers, liability, loss of use, legal defense and medical payments.

It’s also a great value for the investment considering the average renter’s policy costs about $250 a year.