Cannabis Business & Insurance in 2023

By Michael Giusti

The cannabis and marijuana industry seems to be in a bit of middling period right now — legalization at the state level is nothing new and has been under way for years now, but federal recognition seems to be as frustratingly unattainable as ever.

That state of flux means that when it comes to marijuana and insurance, there are a lot of areas of unsettled policy and few best practices, but there are still insurance policies to be had for businesses who ply their trade in pot.

In this 2023 State of Cannabis & Insurance report, we will look at many of the ways marijuana affects the insurance policies that touch it.

In this report we will tend to use the more precise term marijuana, because while marijuana is a cannabis product, so is hemp. And hemp is regulated by many different laws than marijuana, and states often treat the two very differently.

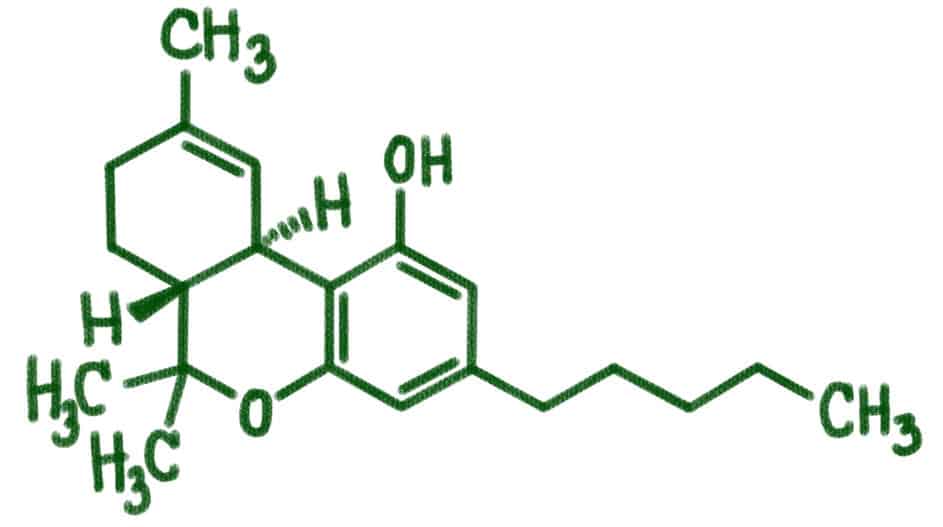

Further blurring the line are the novel cannabinoids being derived from hemp, such as delta 10, and being sold in many states where marijuana is otherwise illegal.

Changing Landscape of the Cannabis Industry

Talking to insurance industry professionals, it becomes clear that when it comes to marijuana policy at the state level, things are changing fast. Currently, 21 states and the District of Columbia allow legal recreational use of marijuana, with Rhode Island, Maryland and Missouri passing legislation to legalize the plant as recently as 2022.

Regarding medical marijuana usage, that count jumps to 37 states and the District that have made it legal for medical use, with Mississippi joining them in 2022.

One outlier this year was Oklahoma, where voters failed to pass a ballot measure legalizing adult-use marijuana in March 2023.

Within the states that have legalized marijuana, one of the primary driving trends right now is that states are struggling to find the appropriate balance of how many dispensary licenses to offer. In some states, such as Oregon and California, too many licenses have led to too much competition and that has driven prices to the point that many of the dispensaries are being forced out of business.

Since marijuana is federally illegal, that means that the dispensaries don’t have access to the federal bankruptcy system, so instead many are turning to mergers and acquisitions, and buyouts to help stem their losses.

From an insurance standpoint, without federal legalization, and in turn federal regulation, the regulation is being driven at the state level, which has led to a patchwork of what is allowed, with some states being much more restrictive than others. The result is often that multistate policies end up with several pages of exceptions and carveouts.

“It is all evolving so fast,” said Eric Morrison, senior vice president and cannabis lead for Aura Risk Management and Insurance Services. “It seems like regulations and laws change daily.”

Available Insurance Coverage

Most business insurance policies for marijuana businesses are being offered on the surplus, or non-admitted market, which means that the policies are not overseen by the state insurance commissioners in the same way that more traditional insurance policies are.

That doesn’t mean there aren’t efforts afoot to find some standardization. One effort is being driven by the National Association of Insurance Commissioners Cannabis Working Group.

Still, each policy typically varies greatly, so industry professionals agree that the devil is in the details.

“Brokers get into trouble when they try to sell policies but they don’t know what the laws are in that state. Without the proper experience, they can’t advise their clients properly,” said Eric Rahn, chair of the National Cannabis Industry Association Risk Management and Insurance Committee, and owner of S2S Insurance Specialists.

Rahn said that the danger comes if an inexperienced broker tries to sell a marijuana policy, but they are not in tune with the market, because there is a range of policies available with everything from A+ paper to D+, and each has a variety of pitfalls businesses can fall victim to.

“What the business needs is someone who has an active cannabis book to help guide them through the process,” Rahn said.

Some policies have restrictive clauses in them that could trip up business owners when it comes time to make a claim, and others could have exclusions that could lead owners to think they were covered for something that they were never covered for, which is where the guidance of an experienced broker is so important.

That said, just about every type of coverage is available when it comes to marijuana businesses. Available business lines include:

- Auto

- Cargo

- Commercial General Liability

- Commercial property/business interruption/crime

- Crop

- Cyber

- Directors and Officers

- Employment Practices (EPLI)

- On Premises Consumption

- Products Liability

- Professional/Errors and Omissions

- Recall Coverage

- Workers Compensation

That said, there isn’t enough capacity in the market to offer policies to every marijuana business if they all stepped up to buy a policy today. With the industry topping $28 billion USD, the available policies just can’t cover that much.

Adding to that are products relying on novel cannabinoids, such as delta-10 THC, which are derived and sometimes synthesized from hemp. These newly emerging products are complicating the industry, but for now are still largely relegated to the illicit and gray markets in most states. For the most part, insurers have been steering clear of these products altogether.

Specific lines

Regardless of which business is taking out a marijuana insurance policy, the three big cost drivers right now seem to be theft, fire, and smoke, with product liability hanging over the top as a big question mark.

For cultivators, the actual growers, the most unique policies they tend to take out would be crop insurance. These are the policies that protect the actual plants while they are still in the ground.

Those policies are available, but Morrison warns that cultivators should read their crop insurance policy closely to ensure they are buying what they think they are buying. Some policies may say they have $4 million in crop coverage, for example, but later in the policy they may have a table that sub-limits losses, so the actual coverage ends up a small fraction of that.

Cultivators also tend to purchase premises insurance to protect their equipment and physical investment, and they need to invest in policies to protect their crop while in transit.

But according to Rahn, perhaps one of the most overlooked policies cultivators need to consider is product liability.

“If I were to advise a client between crop insurance and product liability, I’d tend toward product liability. Crop tends to be too expensive, but when it comes to product liability, it’s important to remember, you are the first person in the supply cycle,” Rahn said. “If something goes wrong, it is going to go back to you.”

Still, traditional losses have been the driver for cultivators to date, such as falling high-wattage light stacks that start fires, or even wildfires that spread smoke that destroys crops even if they don’t burn.

When it comes to retail stores, the risks for dispensaries tend to track with other high-value retail stores, such as jewelry stores. Business owner’s policies, premises coverage, and commercial property coverage all are the primary policies here.

Crime coverage takes the special emphasis when it comes to dispensaries, with high-profile robberies grabbing headlines.

That means that most insurers insist that dispensaries follow a slew of best practices ranging from keeping a small amount of actual inventory on the store floor, with the rest locked in a vault in the back room, to monitoring the entire premises with closed circuit video, and even controlling access to the shop through so-called mouse trap doors, which have a chamber that allows you in, but then you must be buzzed into the next level — meaning a robber could be trapped behind bulletproof glass as they try to escape.

Even still, at the end of the day, dispensaries are still just retail shops, meaning fire coverage, and even sewage backup coverage tends to account for as many claims as robberies in sheer numbers.

Product manufacturers and consumer brands — the companies that make the flower product and edibles — have the unique issue of having to buy policies to protect themselves against product liability and product recall. That’s all in addition to the business owner policies and premises policies the other businesses need.

The need for recall protections became apparent a few years ago during the so-called “vape gate” when bootleg THC vaporizer cartages were using additives that were getting users sick, but state regulators began questioning legitimate manufacturers about their ability to issue and fund recalls if something similar were to happen to their products.

Recalls have happened with flower product recently, especially when labs have shown that the buds didn’t end up having the THC content the manufacturer rated them to have, leaving the manufacturer liable for the financial damages.

As more edible products continue to hit the market, product liability and recall coverage will continue to emerge as must-purchase lines.

These question marks have driven up the cost of product liability coverage in the past couple years.

Coverage for executives through directors and officers’ coverage has been a unique problem in the marijuana space — it’s just hard to get right now. Part of that is because marijuana continues to be an emerging industry, so the insurers just don’t have the data yet to properly price the policies and know where the risks are going to emerge. So, while D&O policies exist, they are hard to come by and expensive.

When it comes to insurance for non-plant touching companies that are involved with cannabis businesses, such as accounting firms and law firms, those companies seem to be having more luck landing policies.

“We call those our ‘belt-and-suspenders’ partners, and they are going strong,” Rahn said.

Risk mitigation

Because there isn’t enough capacity to insure every business in the marijuana space, companies shopping for policies tend to do better when they can set themselves apart from their competitors — specifically when it comes to having good risk-management practices.

Whether that is showing good written protocols for clearing the safe and shutting the dispensary every night, or managing fire risk at the grow operation, the more a company can show an underwriter that they have a written risk management plan, and that they are sticking to best practices, the more likely they will be to get a policy in the first place, and the lower their rates will tend to be.

That same logic extends to professional certifications and credentials.

There are industry groups and trade associations that are establishing credentialling programs, and insurers have said that the more a company can say that they have a qualified and certified workforce, the more likely they will be looked favorably on by the underwriter.

Ownership involvement also goes a long way. If the owners or managers are absentee, that can lead to opportunities for accidents and problems in the operations, whereas a hands-on management and ownership team with the higher ups getting their hands dirty can show that the company presents a better risk.

“They can have a great product and a great operation but if the owner is not minding the operation or not involved, things can go south real quick,” Morrison said. “I know when I have experienced management involved in a daily basis – those are risks I typically will give better pricing for.”

Personal lines

Business lines aren’t the only place where marijuana intersects with insurance. Many personal lines of insurance also carry implications when it comes to marijuana.

With health insurance, the biggest question is whether a policy will cover medical marijuana. And at least for now, the answer is a resounding “no.” At least for as long as marijuana is federally illegal there is no mandate under the Affordable Care Act for a health insurance policy to cover it. No state yet mandates it be covered, either, although a proposed New York bill could allow it to be covered.

The industry’s stand so far is that there just aren’t enough high-quality studies showing that marijuana is a valid treatment for an illness that should be covered by health insurance.

One thing the Affordable Care Act does weigh in on regarding marijuana is premiums. While medical marijuana won’t be covered, using marijuana also won’t negatively affect the premium someone pays. That is because only a few things are allowed to factor into the premium someone pays, and while tobacco smoking is one of them, marijuana smoking is not.

With homeowner’s insurance, there are a few areas policyholders should look at. One is whether damage to their home that may be caused by growing marijuana might be covered. Another is whether theft of a plant might be covered. And another would be if damaged plants might be covered. Finally, there is the question of what effect selling homegrown marijuana might have.

When it comes to the question of damage, many of the common kinds of damage that marijuana grow operations can cause do tend to be excluded by homeowner’s policies — such as mildew. Others, such as fires caused by overloaded electrical circuits might be covered.

Theft is a question that has been brought up in courts, with some states coming down on the side of the insurance company, saying that since the plants are federally illegal, the company is not obligated to pay for their reimbursement, while other states have said that since they are legal in that state, the policy must reimburse them.

Damaged plants tend to be directly addressed through language written into many homeowner’s policies, which specify that trees, plants, and shrubs are covered from perils, so in theory marijuana plants could get some coverage. But that coverage is typically limited to a small percentage of the overall value of the policy – about 5% – and further limited to a much smaller amount per plant – about $500 or less.

But policyholders should be extra wary of selling any marijuana they might grow from home, because that could trigger commercial-use exclusions. Most homeowner’s policies specifically exclude coverage for money-making ventures run from the home, so if that grow operation turns into a business, homeowners should talk to their agent about commercial coverage.

When it comes to auto insurance, the primary concern with marijuana is driving while intoxicated. DUI statutes don’t typically discriminate about which intoxicant the person has ingested, so if a person gets a DUI because of marijuana, they are going to pay just as much of a premium increase as they would if they got a DUI with alcohol.

The main problem with marijuana and driving is that police don’t have an effective way to field test someone’s level of marijuana intoxication the way they can with an alcohol breath test. That is because while THC can be detected in a person’s blood for potentially weeks after it has been used, the intoxication would have worn off within hours.

How life insurers handle marijuana really differs by carriers. Some life insurers don’t even take marijuana use into consideration. On the other hand, some can disqualify a potential policyholder altogether for marijuana use.

Many fall somewhere in between, with heavy users expecting to pay more than moderate users, who will pay more than non-users.

The method of use can also come into play, because from many insurers’ perspectives, smoke is smoke. So, if an insurer sees that a prospective policyholder smokes or vapes, they may pay more than someone who typically uses tinctures or edibles.

The most important thing to remember regarding life insurance and marijuana is to not lie on the application. That is because lying on an insurance application is a crime in all 50 states. Plus, if someone lied and said they were not a marijuana user and then ended up dying, that could be grounds for the company to not pay out on the policy if the person died during the policy’s contestability period.

The money problem

Few places impact the marijuana industry more directly when it comes to being federally illegal than how the industry approaches money.

Because it is federally illegal, large banks and credit card processors refuse to do business with any business that primarily engages in a marijuana-focused business.

That has meant that since its inception, the industry has relied largely on cash, making it particularly vulnerable to robbery, and making many large-scale transactions difficult.

Through the years the industry has found some workarounds, including by working with some smaller, regional banks that don’t do business across state lines, minimizing the risk to federal oversight, and relying on debit transactions and so-called “cashless ATM” transactions.

When it comes to paying for insurance, the lack of banking has meant that policies were either completely prepaid — which can be a huge cashflow burden for the largest players, who would have to come up with hundreds of thousands of dollars up front — or the policies were financed through costly premium financing plans with especially high interest rates.

For their part, Congress has proposed a legislative fix called the Secure and Fair Enforcement Banking Act, or SAFE Banking Act. The act has gone through several rounds with the Democratic-controlled House passing it repeatedly, only for it to die in the Senate.

Now that party control of both chambers has shuffled, industry watchers are hopeful that the SAFE Act can instead take the reverse route toward passage and make it through the Senate first, with the now-Republican-controlled House potentially passing it.

But for now, that route will have to wait a little longer, because the bill’s latest speedbump is the recent banking collapses. Following the banking turmoil, the Senate Banking Committee has at least temporarily shelved hearings on the act so they can handle the immediate crisis at hand.

“It’s been like trying to continue to push the rock up the hill, but I do think there is a chance for passage this time, especially given how many red states have voted for recreational use at this point,” Rahn said.

Conclusion /looking ahead

While access to capital is still a struggle for the marijuana industry, and while finding the balance for how many dispensary licenses is the right one is an ongoing challenge, the good news is there are still insurance policies to be had at every level of the value chain.

That said, not every policy is created equal, and experts reinforce that reading those policies and asking questions is crucial, as is buying policies from insurers and brokers who specifically specialize in the marijuana industry and can lend their expertise to ensure the business is getting precisely what they are expecting.

But, as the industry grows, and as legalization expands, many industry players are hopeful that standardization across states and best practices within the industry will begin to take hold, leading to policies that are a bit more homogenous, which could potentially encourage more players into the market, expanding the pie for everyone. Michael Giusti, MBA, is senior writer and analyst for InsuranceQuotes.com