Big Factors That Affect Car Insurance Rates – Do Men Really Pay More?

It probably comes as no surprise that car insurance premiums vary between certain demographics. For instance, it’s well understood a 20-year-old male driver will most likely pay more for insurance than a man 20 years his senior. What may be shocking, however, is just how significant these premium swings can be — and age isn’t the only factor.

A recent study, commissioned by insuranceQuotes.com, found car insurance premiums, on average, can vary by more than 50 percent based on age, gender and marital status. The study looked at the economic impact of these three demographic designations across the country — and the results may be startling to some drivers.

How age affects car insurance rates

Here’s the bottom line: Young drivers pay more for car insurance than any other demographic — and with good reason. According to the U.S. Centers for Disease Control and Prevention, crash rates per mile driven for 16- to 19-year-olds are three times higher than those of older drivers. That’s why it’s important to get multiple car insurance quotes when shopping for teenage driver coverage.

According to Mike Barry, spokesman for the nonprofit Insurance Information Institute, younger drivers also file more car insurance claims than those with more experience behind the wheel, which is what accounts for the significant differences in premium price tags.

For example, according to the study, a 25-year-old single male will pay an average of 49 percent less for car insurance than a 20-year-old single male driver.

“This comes as no surprise to anyone in the insurance industry,” says Barry. “Certain demographics, like young, single men, are going to pay more for auto insurance because history shows that they are more likely to file a claim and that they’re more expensive to insure. It’s not until they get some experience under their belts — and have a clean driving record — that rates start to drop.”

Men aren’t the only ones whose premiums are affected by age. According to the study, a 25-year-old single female driver will pay an average of 39 percent less for auto insurance than a 20-year-old single female driver.

According to Barry, a lot of drivers assume they’re paying their lowest rate by their 30th birthday. This is not the case. The study shows that while the premium drop-off begins to stabilize around 30 years of age, rates continue to decrease for all age groups until they turn 60. After that, rates tick back up, but only slightly.

For instance, a 60-year-old single male driver is paying, on average, 60 percent less for auto insurance than his 20-year-old counterpart. For women, the difference is an average of 50 percent less.

“This is also not surprising,” says Eli Lehrer, president of the nonprofit research group The R Street Institute. “Like most other things, long experience makes people better drivers. Older people are also more likely to have lived in the same place longer and know the local roads better.”

How gender affects car insurance rates

The notion that women are safer drivers than men is not just anecdotal. According to Barry, decades of insurance data show that women are, on average, less likely than men to file a claim. And this means men pay more.

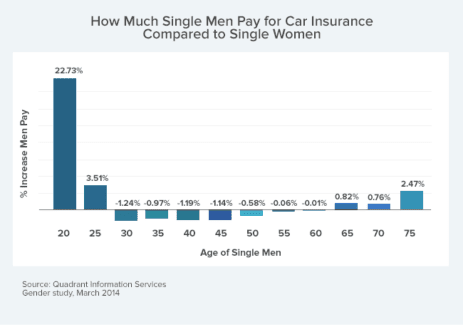

According to the study, a single 20-year-old male driver will pay 23 percent more than his female counterpart. The good news for men is this difference begins to drastically level off as male drivers get older.

For instance, a single 25-year-old male driver will only pay an average of 4 percent more for auto insurance than his female counterpart. What’s more, between the ages of 30 and 60, men actually pay slightly less for auto insurance than women.

“Across the board you see young men paying more for insurance, which makes sense,” says Barry. “Statistically, young men are riskier drivers, which means they are, on average, more expensive to insure.”

According to the Hawaii Department of Commerce and Consumer Affairs’ Insurance Division, Hawaii is the only state that doesn’t allow car insurers to use age, gender, or length of driving experience when setting rates.

How marriage affects car insurance rates

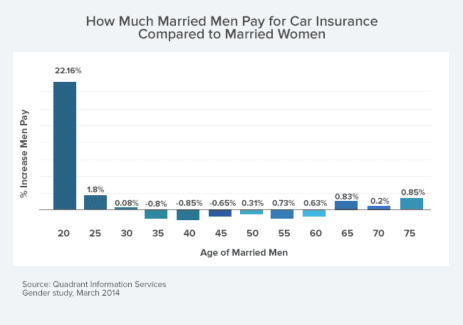

According to the study, there can be a significant difference between what a married person and a single person of the same age will pay for their auto insurance rates. On average, a single, 20-year-old male will pay 24 percent more for auto insurance than his married counterpart. And for a single, 20-year-old female the difference is 28 percent.

“The way marital status plays a role in setting premiums can be a contentious issue, but it’s based on the assumption that individuals — particularly young individuals — get more serious about being better drivers when they’re married,” says Bob Hunter, former Texas Insurance Commissioner and current director of insurance at the Washington, D.C.-based Consumer Federation of America, a consumer advocacy organization. “It’s questionable, but insurers maintain that claims data backs it up.”

Premium differences between married and unmarried drivers drop off significantly as they get older. For instance, a single, 25-year-old male driver will only pay 9 percent more for auto insurance than a 25-year-old married male. For 25-year-old women, the difference is 7 percent.

How to reduce your car insurance rates

Whether you’re male, female, married or single, here are some tips for reducing the cost of auto insurance:

1. Being a good student. Most insurers offer a discount for drivers who maintain at least a B average in high school and college.

2. Enrolling in a pay-as-you-drive program. Many major insurers, including Allstate, State Farm and Liberty Mutual, offer discounts based on how well and how far you drive. It’s a voluntary incentive that can save drivers as much as 25 percent.

3. Dropping collision and comprehensive. Nearly every state requires drivers to have a minimum amount of auto liability insurance, which pays for damage he or she may cause to another vehicle. However, comprehensive and collision are optional. Reducing or eliminating those coverages could save hundreds every year.

4. Never filing small claims. Auto insurance is not meant for everyday repairs. If you file multiple claims over the course of three or five years, your insurance company may not only raise your premium but could cancel your policy.

5. Shop and compare rates. The cost of car insurance is always changing. So comparing rates from several different carriers at least once a year can really pay off.

Study methodology: insuranceQuotes.com and Quadrant Information Services calculated the impacts of gender, age and marital status on car insurance premiums. The study assessed data from all garageable ZIP codes in every U.S. state and the District of Columbia and 60% to 70% of the carrier market share in each. Assumptions included: driver is employed, drives a 2012 sedan, has a bachelor’s degree, a clean driving record, an excellent credit score and no lapse in coverage with the following limits: $100,000 (bodily injury per person) / $300,000 (bodily injury per accident) / $100,000 (property damage per accident), $10,000 (personal injury protection or medical payments) and a $500 deductible for comprehensive and collision.

Data source: Quadrant Information Services

Click here to view the press release for this study.