Filing an Auto Insurance Claim? Expect a Big Spike in Your Premium

It probably comes as no surprise to most drivers that filing an auto insurance claim will likely result in a premium spike. However, the extent of those increases — and their steady year-over-year incline — may seem staggering.

For the fourth year in a row, insuranceQuotes and Quadrant Information Services examined the average economic impact of filing various claims on your auto insurance policy.

Using a hypothetical 45-year-old married female driver who is employed, has an excellent credit score, has no lapse in coverage and has filed no prior auto insurance claims, the study looked at how much annual premiums can go up, on average, after filing one of three different types of claims:

- Bodily injury.

- Property damage.

- Comprehensive

The study also looked at the impact of the claim’s dollar amount ($2,000 or more) and compared the average premium increases for all 50 states and Washington, D.C.

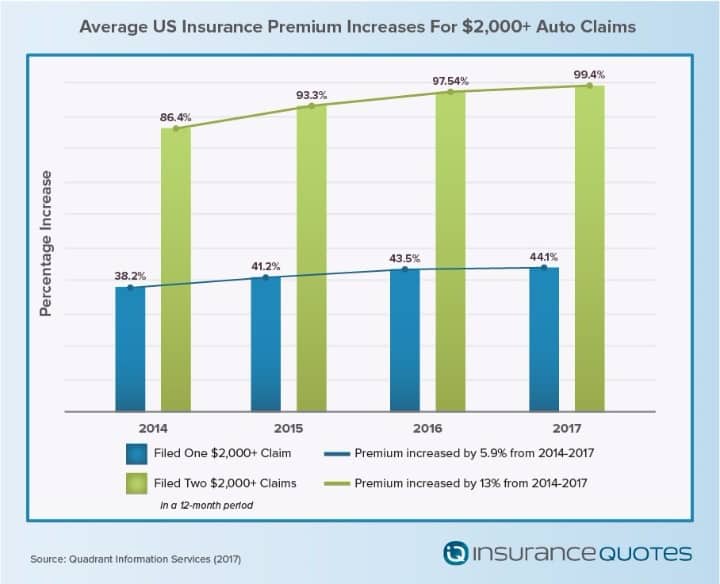

The study’s findings indicate that average premium increases after filing a single claim can be significant, and that these increases have, on average, gone up steadily over the past four years, suggesting that the expense of filing an auto insurance claim will continue to rise.

Average auto insurance premium increase

The study found that drivers who make a single auto insurance claim of $2,000 or more will see their premiums increase, on average, by 44.1 percent (a 6 percent jump from just three years ago).

Filing a second claim in one year is even more costly, with an average annual premium increase of 99.4 percent (a 13 percent jump from 2014).

According to the National Association of Insurance Commissioners (NAIC), the average cost of an auto insurance premium in the U.S. is $841, which means an increase of 44.1 percent would result in a $371 spike.

According to experts and analysts the reasons for this steady increase are nuanced and varied.

“I don’t know for sure, but I have some theories,” says Eli Lehrer, president of the nonprofit R Street Institute. “Medical inflation has been lower, but it may be that increasing numbers of people with insurance and in government programs are reducing hospital profits, which means insurers are making up the difference with higher auto insurance premiums.”

Lehrer adds that with so much safety equipment and driver assistance components in modern cars, it’s harder to actually get into an accident and much harder to sustain an injury from one unless it’s severe.

CHECK OUT: How Much Does It Cost to Insure a Teen Driver?

“It may be that the average accident resulting in a claim is getting more serious, even as accident rates decline,” says Lehrer.

There may also be economic influences to consider as well, says Mike Barry, vice president of media relations for the nonprofit Insurance Information Institute.

Barry says the deep recession between 2007 and 2009 resulted in fewer people driving to work and taking long vacation road trips. Once the economy began to improve — and gas prices started to dip — more cars were on the road, which led to a spike in the frequency and severity of accident claims.

“At the same time the cost of paying bodily injury claims has also increased and auto insurers have needed to allocate more resources for expensive replacement parts in vehicles,” says Barry. “It’s not just more cars on the road but newer cars on the road, and insurers have had to adjust their books to compensate for that.”

Rate jump tied to claim type

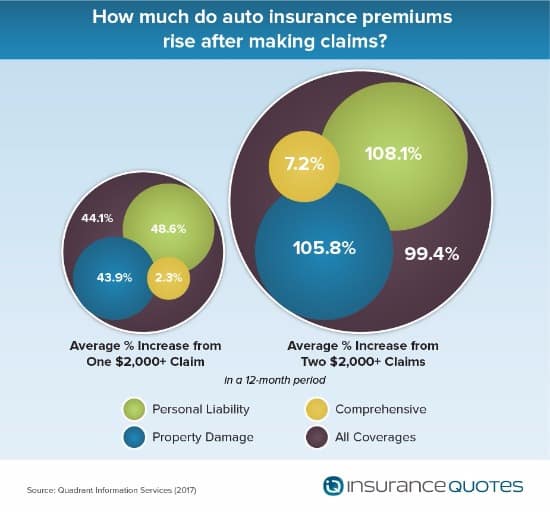

It’s important to note that premium increases vary by the claim type and typically only kick in for accidents where you are at fault. If someone hits you, his or her insurance will cover the claim and typically your rates won’t be affected.

For instance, a single bodily injury claim — which is filed whenever you cause injuries to individuals as the result of an accident — will result in an average premium increase of 48.6 percent.

Meanwhile, a single comprehensive claim — which pays for damage that results from something other than a collision, such as fire or theft— results in an average premium increase of less than 2 percent.

Barry says insurers know that if you file a claim after an accident for which you were at fault, you are statistically more likely to file another claim in the future.

“Basically, the driver who is filing a claim for an incident they caused is seen as somebody who is likely to file another claim soon thereafter. And that assumption is then priced into their new rate,” says Barry. “This means you’re now riskier and more expensive to insure.”

Increases in premiums vary by state

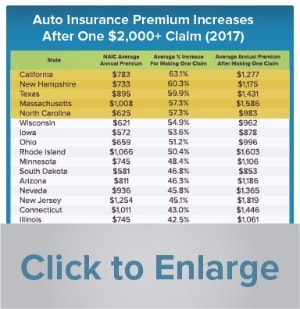

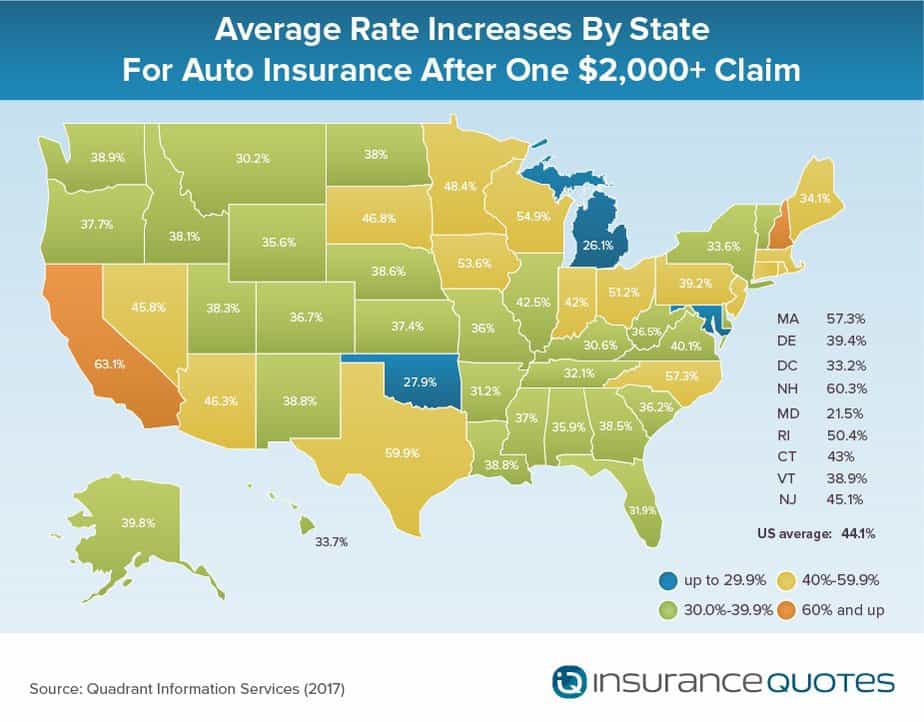

According to the insuranceQuotes study, premium increases vary widely by state.

For instance, filing a single auto claim of $2,000 or more in California will result in an average premium increase of 63.1 percent (the most significant increase in this study, but down from 78.4 percent last year).

According to the NAIC, California drivers pay an average annual premium of $783. That means a single auto insurance claim in that state could result in paying an additional $494 per year for auto insurance.

Meanwhile, other states were far below the national average.

For instance, Maryland drivers who file a single auto claim of $2,000 or more will only see a 21.5 percent spike in annual premiums. According to NAIC figures, that’s an annual increase of about $220.

The following five states showed the greatest average premium increase as a result of filing any type of claim of $2,000 or more:

- California — 63.1 percent increase

- New Hampshire — 60.3 percent increase

- Texas — 59.9 percent increase

- Massachusetts — 57.3 percent increase

- North Carolina — 57.3 percent increase

Meanwhile, the following five states, on average, showed the smallest percentage premium increase as a result of filing any type of claim of $2,000 or more:

- Maryland — 21.5 percent increase

- Michigan — 26.1 percent increase

- Oklahoma — 27.9 percent increase

- Montana — 30.2 percent increase

- Kentucky — 30.6 percent increase

Barry says the primary reason why certain states show more significant premium increases than others is because of different insurance regulations in different states.

For instance, California voters passed Proposition 103 in 1988, which significantly limited the factors insurance companies could use when determining auto rates, including a ban on using credit scores. Therefore, California insurance companies must base insurance premiums on three primary factors: driving safety record, average miles driven per year, and years of driving experience.

“When that’s all you can go on to set rates, drivers who cause an accident are going to get hit particularly hard,” says Barry.

Meanwhile, states such as Maryland can use a whole host of nondriving-related factors when setting premiums, including gender, age, marital status, occupation and a driver’s credit score.

The bad news is that drivers in California get hit hardest after filing a single claim, but this comes with a greater benefit to the larger population of drivers in that state, says Doug Heller, an independent consumer advocate with the Consumer Federation of America who specializes in insurance.

“At it’s best, insurance pricing is supposed to incentivize safety, and premiums should be adjusted to reflect that,” says Heller. “If you cause a lot of accidents but don’t really see an impact on your premiums, it’s one less reason people need to worry about driving safely.”

Bodily injury claims cause biggest spike

According to the insuranceQuotes study, different types of claims have different impacts on your insurance premium, and bodily injury (liability) claims are by far the most expensive.

Bodily injury claims are filed whenever a driver causes injuries to individuals as the result of an accident. And because they are often so costly, every state except New Hampshire requires drivers to obtain a minimum amount of coverage for these circumstances.

According to the NAIC, the average bodily injury claim cost $17,024 in 2015 while the average property damage claim was just $3,493.

Barry says the higher cost of bodily injury claims is because doctors and hospitals typically generate larger bills than auto body repair shops.

“In other words, it’s more expansive to fix bodies than automobiles,” says Barry.

According to the study, filing one bodily injury claim of $2,000 or more will result in a national average premium increase of 48.6 percent per year. However, there are several states that buck the national average.

The following five states showed the greatest average premium increase as a result of filing one bodily injury claim of $2,000 or more:

- California — 73.2 percent

- New Hampshire — 65.9 percent

- North Carolina — 65.9 percent

- Texas — 64.8 percent

- Massachusetts — 62.3 percent

Meanwhile, the following five states, on average, showed the smallest percentage premium increase:

- Maryland — 22.6 percent

- Michigan — 28.3 percent

- Oklahoma — 30.1 percent

- Montana — 32.8 percent

- Kentucky — 33.3 percent

“Bodily injury claims are typically the most costly of the three, because anytime you involve bodily injury it’s more likely to involve expensive medical costs and possibly litigation—which is also expensive,” says Nancy Kincaid, spokeswoman for the California Department of Insurance. “A bodily injury claim will result in not only losing one’s good driver discount but also in a significant surcharge.”

Comprehensive claims and insurance

Of the three different claims featured in the insuranceQuotes study, comprehensive claims resulted in the least significant premium increases, and the reason is two-fold.

According to the NAIC, the average cost of a comprehensive claim in 2015 was $1,671. Not only is a comprehensive claim cheaper than any other, it is also not directly associated with driving behavior.

“It makes sense that comprehensive claims barely move the needle because they’re the result of something beyond the driver’s control, like hitting a dear or having a tree fall on your vehicle,” says Heller. “So it really doesn’t tell an insurer anything about the future likelihood of filing another claim.”

The numbers somewhat bear this out. According to the insuranceQuotes.com study, the national average premium increase after filing one comprehensive claim of $2,000 or more is about 2 percent. However, a few states did come in above average.

The following five states showed the greatest average premium increase as a result of filing one comprehensive claim of $2,000 or more:

- Nebraska — 10.6 percent

- Louisiana — 9.7 percent

- Minnesota — 7.1 percent

- Wisconsin — 6.9 percent

- Iowa — 6.8 percent

Meanwhile, 19 states showed a premium increase of less than 2 percent, and eight of those showed no increase at all.

Auto insurance rates can decrease

The good news is that premium increases don’t stick around forever. Barry says drivers can expect rates to remain high for about three to five years. After that they will begin to lower to pre-claim levels (provided you don’t file another claim during that time).

“If you don’t like that, shop around,” says Barry. “Different insurers treat prior claims differently, so you could end up with a better deal elsewhere.”