Does Bad Credit Affect My Car Insurance Costs?

It’s fairly common knowledge that credit scores play a significant role in everything from buying a house to applying for a retail credit card. What may come as a shock, however, is that your credit can also significantly impact what you pay for auto insurance, and a new study shows that poor credit can double or even triple your rate.

The study, commissioned by Insurance Quotes, examined the average economic impact that credit has on auto insurance. Using a hypothetical 45-year-old, married female driver with a bachelor’s degree and no prior claims or lapses in coverage, the study looked at how much annual premiums can change based on this unique rating factor.

The study found that if you have fair credit, you’ll pay 28 percent more for car insurance than a driver with excellent credit (up from 24 percent in 2013). And if you have poor credit, your premium doubles, increasing your rate by 104 percent (up from 91 percent in 2013).

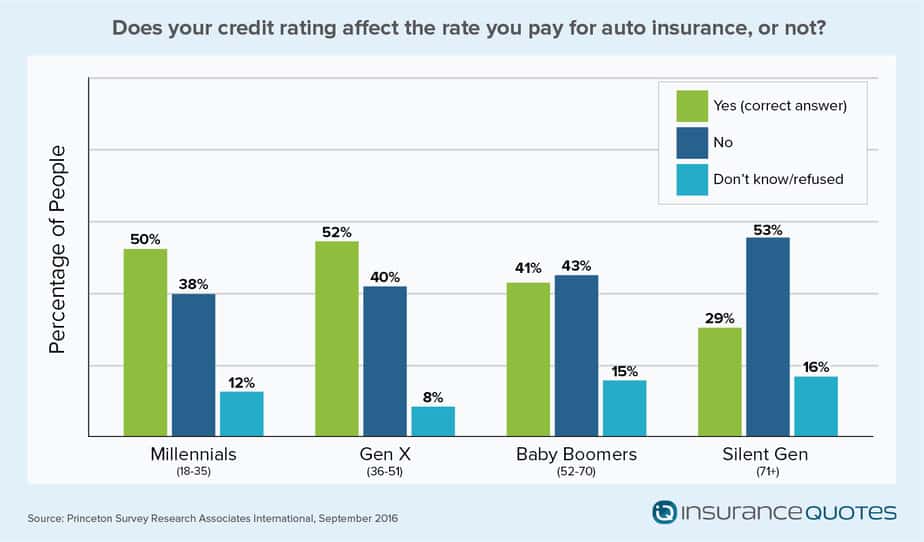

What’s more, many consumers aren’t even aware that their credit history is a factor when they’re searching for affordable auto insurance. According to a 2016 survey commissioned by insuranceQuotes, 42 percent of respondents said credit rating had no impact on the cost of car insurance.

“I can’t say these findings surprise me because I’ve been studying this for so long and I know the extent to which it changes things drastically for consumers,” says Doug Heller, an independent consumer advocate and insurance expert with the Consumer Federation of America. “But I think it will rattle any driver who’s frustrated with the high cost of auto insurance, because people believe that if they drive safely they will get a break on their premium. And yet personal financial challenges can double the cost of insurance, no matter how good their driving is.”

What is a credit-based insurance score?

Using credit to help determine premiums isn’t necessarily a new practice. Since the early 1990s, 97 percent of U.S. insurance companies have been using something called a credit-based insurance score (CBIS) as a rating factor in every state except California, Hawaii and Massachusetts, where the practice is banned.

Unlike the more commonly understood consumer credit score used for products like mortgages and credit cards, a CBIS is different. Ranging from 100 to 999, this score is used exclusively by insurance companies and is derived from a variety of factors in your consumer credit report. Actuaries claim that the higher your CBIS the less likely you are to file a claim. Therefore, the higher your CBIS the lower your car insurance rate.

“Statistically speaking, people with lower credit scores tend to turn in more claims whereas people with higher scores will, many times, pay the cost out of pocket,” says Ohio-based insurance agent Sarah Haun. “That is not always the case, but it has been proven enough times that almost all insurance carriers have adopted this method of credit scoring over the past 15 years or so.”

According to Lamont Boyd, insurance underwriting expert at Fair Isaac Corporation (FICO), your credit-based insurance score is created using approximately 20 to 30 different aspects of financial data collected by the major credit bureaus. They may include:

- Outstanding debt

- Length of credit history

- Late payments

- Collections

- Bankruptcies

- New applications for credit

About 40 percent of a consumer’s credit-based insurance score is driven primarily by whether or not credit obligations are paid on time. The second most impactful factor comes down to how much credit card and loan debt a consumer has compared to how much he or she is allowed to borrow (i.e. your debt-to-credit ratio). This accounts for about 30 percent of the scoring model, and the closer you are to being maxed on your credit cards the more negatively it will impact your score.

Boyd says “people who choose to effectively manage their finances are also less likely to have future insurance losses. We don’t really know why, but we can prove statistically and empirically that this is the case.”

How a credit-based insurance score impacts your auto premiums

According to Heller, insurance companies keep a tight lid on the specific ways they use credit-based insurance scores to write new policies. What’s more, unlike a traditional consumer credit score used by lenders, consumers have no way of accessing their CBIS, primarily because different insurers use different scoring models to set premiums.

Regardless of the specific formulas used by insurers, our study shows that credit has a significant impact on what you pay for auto insurance. What’s more, we reviewed three tiers of credit: excellent, fair and poor. How these tiers impact your insurance premium varies widely from state to state.

The following five states showed the greatest average premium increase if you have fair credit instead of excellent credit.

- Alabama — 56 percent increase

- Michigan — 55 percent

- Delaware — 52 percent

- Arizona — 50 percent

- Nevada — 48 percent

Excluding Hawaii, Massachusetts and California, the following five states, on average, showed the smallest percentage increase.

- North Carolina — 16 percent increase

- Virginia — 18 percent

- New York — 20 percent

- Alaska — 22 percent

- Washington, D.C. — 23 percent

The premium increase you see when you have poor credit instead of excellent credit is even more dramatic. Here are the top five states with the biggest increases, all of which more than triple what drivers pay for car insurance.

- Arizona — 226 percent increase

- New Jersey — 216 percent

- Nevada — 213 percent

- Nebraska — 206 percent

- Oklahoma — 201 percent

Excluding Hawaii, Massachusetts and California, the following five states, on average, showed the smallest percentage premium increase between excellent and poor credit scores.

- North Carolina — 51 percent increase

- Virginia — 75 percent increase

- Wyoming — 76 percent

- New York — 77 percent

- Connecticut — 86 percent

“Different insurance companies use credit in different ways, and they also use credit scores differently depending on the state in which they’re writing the policy,” Heller says. “But even in states with the smallest difference you’re still looking at a substantial increase.”

Critics of credit-based insurance scoring

Haun, who has worked in the industry for more almost two decades, says credit-based insurance scoring has always been a contentious topic.

“It has caused questions and controversy ever since it began [because] people don’t understand why their credit has anything to do with their insurance rates,” he says. “But many times people with low credit scores tend to turn in more claims, tend to turn in more low cost claims, tend to not take much pride in ownership, and don’t stay long with one carrier.”

But Heller, a longtime and vocal opponent of using credit to determine insurance premiums, says this correlation has no theoretical basis.

Insurance pricing, Heller says, is supposed to rely on “factors that have a meaningful relation to risk,” such as how much and how far you drive each year, whether you’ve recently had an accident or DUI conviction, or the length of time you’ve been driving.

“But with credit scores there’s no theory about why your financial health means you’re a safe or risky driver,” he says. “When you have access to millions of points of data you could find data that shows higher insurance losses based on certain religions or races or hair colors. But of course no one does that. Credit scoring is just a legal way to discriminate against certain drivers.”

What’s more, Heller adds that U.S. drivers are widely opposed to using credit as a rating factor. According to a June 2016 survey conducted by the Consumer Federation of America, 60 percent of Americans think it’s “unfair to use credit scoring to determine auto insurance premiums.”

“Regular folks know that whether you’ve had to confront big medical bills or you’ve lost a job or you’ve gone through a divorce, it doesn’t make you an unsafe driver, and it shouldn’t cause a spike in your auto insurance premium,” Heller says.

Finally, Heller says credit-based insurance scoring has a disproportionately negative impact on low-income drivers.

“Consider the cycle. If you’re already struggling financially you’re now also going to be charged two or three times more for car insurance. When you can’t afford it you wind being uninsured. And then you lose your ability to drive, which makes it harder to get to work, which makes it harder to stabilize your finances,” he explains. “This is bad for everybody.”

Raise your credit to lower your auto insurance premiums

That being said, Boyd says there are steps you can take to improve your credit-based insurance score, and they go hand-in-hand with improving your overall consumer credit score. Most importantly, pay all of your credit obligations on time, don’t open new credit accounts unless it’s absolutely necessary, and keep your credit card balances as low as possible.

Additionally, Haun says drivers should keep track of their consumer credit score and make sure their insurance policy reflects any positive changes over the years.

“Insurers will always run your score at the time of an initial quote. After that, it depends on the carrier,” Haun says. “Some carriers will run a new score every couple of years and some will never run a new score. But you can usually request that they run it. Just know that your rate will be adjusted regardless of whether it’s better or worse. So if you’re not sure your score has improved, find out prior to asking your insurance carrier to go through this process.”

Methodology

Quadrant Information Services and insuranceQuotes calculated the average economic impact of credit on auto insurance rates using data from the largest carriers (representing 60-70 percent of market share) in each U.S. state and the District of Columbia. The three tiers of credit analyzed were excellent, fair and poor. Average rates are based on a 45-year-old married, employed female with a clean driving record. The hypothetical driver has a bachelor’s degree, no lapses in coverage and the following limits: $100,000/$300,000 (bodily injury), $100,000 (property damage), $100,000/$300,000 (UI/UIM), $10,000 (PIP) and a $500 deductible. The hypothetical driver owns a 2012 Toyota Camry and drives 12,000 miles annually.