Making One Auto Insurance Claim Can Increase Your rate by Up to 67%

Many consumers realize that filing an auto insurance claim will likely result in a raised annual premium. What may be shocking to some, however, is just how significant that premium increase may be.

A December 2013 Quadrant study, commissioned by insuranceQuotes.com, examined the average economic impact of filing various claims on your auto insurance policy. Using a hypothetical 45 year-old married female driver who is employed, has an excellent credit score, no lapse in coverage and has filed no prior auto insurance claims, the study looked at how much annual premiums can go up after filing one of three different types of claims:

- Bodily injury.

- Property damage.

- Comprehensive.

The study not only looked at the impact of these three different types of claims but also the impact of the claim’s dollar amount ($500, $750, $1,000 and $2,000 or more) and compared the average premium increases for all 50 states and Washington, D.C. The results were intriguing to insurance analysts and experts.

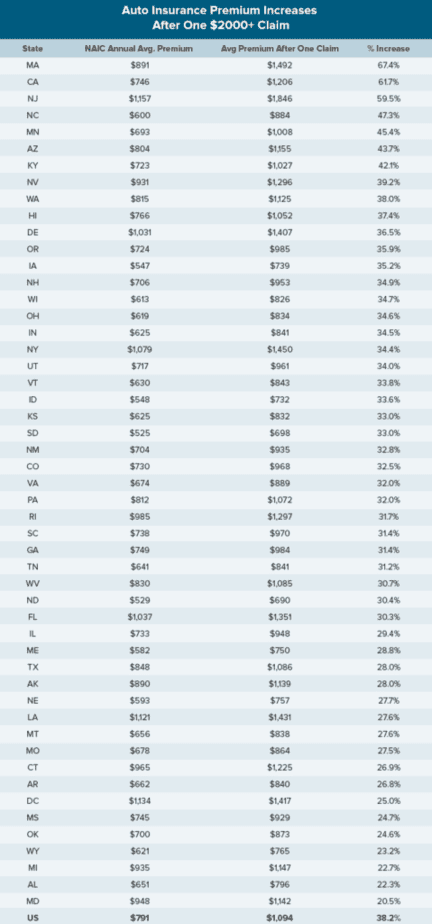

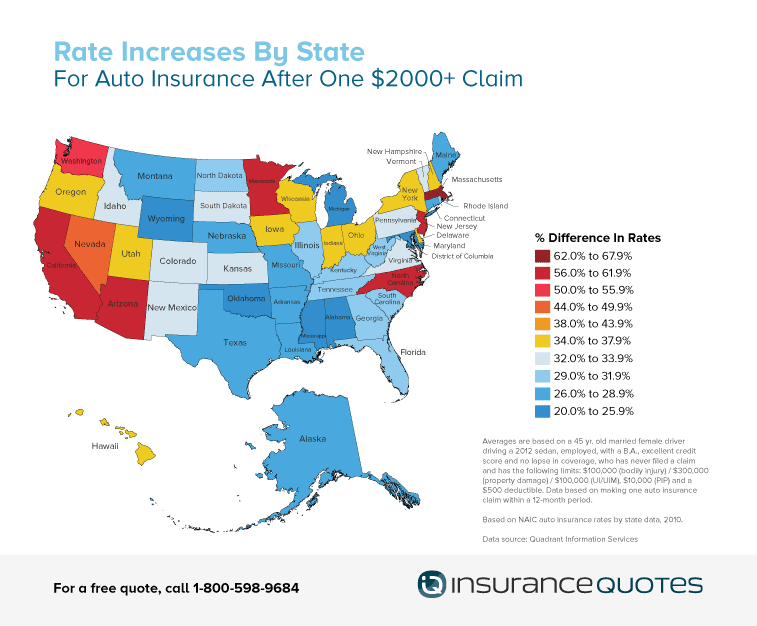

Auto insurance rate increases after a claim by state

The study found that if you make one auto insurance claim, the average increase nationally is 38 percent. According to the National Association of Insurance Commissioners, the average cost of an auto insurance premium in the U.S. is $791, so an increase of 38 percent would result in a $301 increase. It’s important for consumers to note that rate increases only apply to bodily injury and property damage claims where you are at fault. If you are rear-ended by another driver, their insurance or your uninsured motorist coverage will cover your claim and your rates won’t be affected.

Shopping for car insurance?

The study found that car insurance rates varied widely by state. For instance, results showed that Massachusetts drivers who file any kind of auto claim of $2,000 or more may see their annual premiums increase by an average of 67 percent. According to a 2010 report by the National Association of Insurance Commissioners (NAIC), Massachusetts drivers paid an average auto insurance premium of $890.83 in 2010, meaning a single auto insurance claim in that state could result in a $597 annual increase.

However in Maryland, where the average premium is $948, one $2,000 auto insurance claim will only raise residents’ annual premium by 20 percent (or about $190, according to NAIC figures).

The following five states showed the greatest average premium increase as a result of filing any type of claim of $2,000 or more:

1. Massachusetts — 67 percent increase

2. California — 62 percent increase

3. New Jersey — 59 percent increase

4. North Carolina — 47 percent increase

5. Minnesota — 45 percent increase

Meanwhile, the following five states, on average, showed the smallest percentage premium increase as a result of filing any type of claim of $2,000 or more:

1. Maryland — 20 percent increase

2. Alabama — 22 percent increase

3. Michigan — 23 percent increase

4. Wyoming — 23 percent increase

5. Oklahoma — 25 percent increase

According to Robert Hartwig, president and chief economist for the nonprofit Insurance Information Institute (III), it’s no surprise that insurance premiums increase after filing a claim. The reason is because insurers know that filing one claim makes you more likely to file another one in the future, thus making you a more risky and expensive customer to insure.

“People shouldn’t view an increased premium as a penalty, but rather as an assessment of your risk moving forward,” Hartwig says. “(After making a claim) you’re now that much more likely to be involved in an accident in the future. But I’m very surprised by the magnitude of these numbers.”

According to California Department of Insurance commissioner Dave Jones, policyholders should consider these average premium increases as just one possible outcome of filing a single auto insurance claim.

Read more:

Many drivers are missing out on car insurance discounts

“Good drivers in California receive a significant premium discount while those whose driving record indicates they present a higher risk typically pay much higher rates,” Jones says. “However, the bottom line is that the overall rate levels in California have been kept in check by our rate regulation process which has saved our consumers billions of dollars.”

Auto insurance rate increases for bodily injury claims

In 49 states and the District of Columbia, drivers are required by law to obtain a minimum amount of liability coverage that insures the policyholder against damage to property and injuries caused to individuals in an accident (New Hampshire, which doesn’t require minimum liability coverage, is the only exception). These are known as bodily injury claims, and they’re often the most expensive.

According to the III, the average auto liability claim for bodily injury in 2012 was $14,653.

“Most people probably think the majority of auto insurance claims go toward repairing vehicles, but in reality they go towards repairing people,” Hartwig says. “And it’s usually a lot more expensive to repair a person than it is to repair a vehicle.”

According to the insuranceQuotes.com study, filing one bodily injury claim of $2,000 or more will result in a national average premium increase of 41.6 percent (or about $330) per year. However, there are several states that buck the national average.

The following five states showed the greatest average premium increase as a result of filing one bodily injury claim of $2,000 or more:

1. Massachusetts — 73 percent increase

2. California — 68 percent increase

3. New Jersey — 63 percent increase

4. North Carolina — 52 percent increase

5. Minnesota — 49 percent increase

The reasons for so much disparity from state to state are varied and nuanced, says Pete Moraga, spokesman for the Insurance Information Network of California. According to Moraga, rate swings between states come from several factors, including the nature and severity of claims filed in a given state, as well as the different ways in which insurance is regulated from state to state.

“State regulations give insurers a certain amount of leeway in how they can apply claims history to premium increases,” Moraga says.

Depending on what the state allows, Moraga says some insurers will charge more, and others will charge less for previous claims history. What’s more, some insurers will sell policies that include perks like accident forgiveness, which keeps premiums down even if you’ve filed a previous claim

Dan Weedin, a Seattle-based insurance and risk management consultant, says he isn’t surprised to see that bodily injury claims result in the largest overall premium increase compared to property damage and comprehensive.

“Liability claims are more concerning to insurers and will always cost more,” Weedin says. “And the bigger the threat to the insurer, the higher the premium and the consequences.

Auto insurance rate increases for property damage claims

When you’re involved in an accident that results in damage to your vehicle, someone else’s or other types of property, like mailboxes or buildings, you’re likely to file a property damage claim. In general, these are far less expensive than bodily injury claims.

According to the III, the average auto claim for property damage in 2012 was $3,073.

According to the insuranceQuotes.com study, filing one property damage claim of $2,000 or more will result in a national average premium increase of 41.11 percent (or about $325) per year. However, as with bodily injury claims, several states fall above and below this average.

The following five states showed the greatest average premium increase as a result of filing one property damage claim of $2,000 or more

1. Massachusetts — 73 percent increase

2. New Jersey — 71 percent increase

3. California — 63 percent increase

4. Minnesota — 50 percent increase

5. Arizona — 49 percent increase

Meanwhile, the following five states, on average, showed the smallest percentage premium increase as a result of filing one property damage claim of $2,000 or more

1. Connecticut — 22 percent increase

2. Michigan — 24 percent increase

3. Alabama — 24 percent increase

4. Wyoming — 25 percent increase

5. Maryland — 25 percent increase

And while the average bodily injury claim is nearly five times more expensive than a property damage claim, the premium increases are similar because the factors used to determine those increases are the same.

“It’s all about the way a previous claim makes you riskier to insure moving forward,” Hartwig says. “The cost of the claim isn’t what’s most important, but rather the statistical likelihood of filing another claim in the future. And that’s more or less the same for bodily injury and property damage.”

Considering the possible rate increase, Hartwig says policyholders need to do the math when faced with a potential property damage claim.

“Because these can be much smaller claims, the decision to file a property damage claim is going to depend a lot on your deductible,” Hartwig says. “For instance, if you have a $500 deductible and you caused $500 worth of damage, it probably doesn’t make sense to file a claim.”

Auto insurance rate increases for comprehensive claims

Comprehensive coverage pays for vehicle damage that comes from something other than a collision, such as fire, hail or theft. According to the III, the average cost of a comprehensive claim in 2012 was $1,585.

Since comprehensive claims are the result of situations beyond the policyholder’s control, premiums are affected far less drastically than for bodily injury or property damage claims (if they’re affected at all).

“Comprehensive claims are a different animal altogether, because they’re not the result of anything the driver did,” Hartwig says. “If a tree falls on your car while it’s parked overnight, that’s not related to how you drive.”

As a result, the national average premium increase for these types of claims is fairly negligible. According to the insuranceQuotes.com study, filing one comprehensive claim of $2,000 or more will result in a national average premium increase of just 1.74 percent (or about $14) per year. However, a few states fall above this average.

The following five states showed the greatest average premium increase as a result of filing one comprehensive claim of $2,000 or more:

1. Nebraska — 10 percent increase

2. Iowa — 9 percent increase

3. South Dakota — 8 percent increase

4. Louisiana — 7 percent increase

5. Connecticut — 6 percent increase

Meanwhile, 20 states showed a premium increase of less than 1 percent, and 11 of those showed no increase at all.

When will your premium go back down?

The good news is that increased premiums don’t last forever. Rate increases typically last three years, as long as you don’t make another claim during this period.

“In most cases, traffic convictions and at-fault accidents are used as part of your driving record for three years,” says Nancy Kincaid, spokeswoman for the California Department of Insurance. “That being said, in many states, including California, major convictions like driving under the influence can stay on your record for as long as 10 years, along with their corresponding premium charges.”

Hartwig says that even if you’ve filed a claim and are looking at a higher premium for auto insurance, it’s always a good idea to shop around for a less expensive policy.

Data source: Quadrant Information Services