Americans Don’t Know How to Shop for Auto Insurance and It’s Costing Them Money

A surprising number of Americans never take a few minutes to shop for a better deal on auto insurance, which means they might be speeding past a chance to save big, a new survey shows.

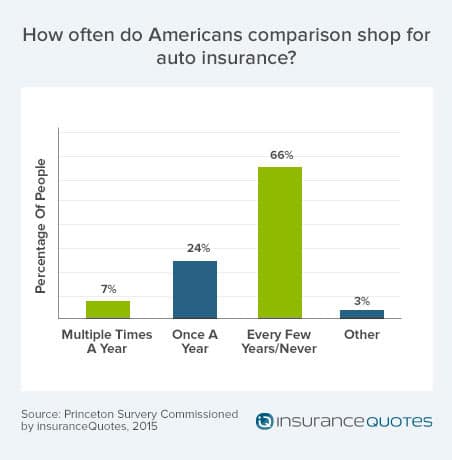

In fact, 66 percent of policyholders never or rarely check to see if they could get their coverage more cheaply, according to a June 2015 survey conducted by Princeton Survey Research Associates International and commissioned by insuranceQuotes.com.

Just like with other products, it’s smart to regularly compare prices on car insurance, says Rob Hoyt, a professor of risk management and insurance at the Terry College of Business at the University of Georgia.

“The savings can be sizable, so it’s worth an afternoon of your time,” says Jeremy Bowler, a property and casualty insurance expert and senior vice president of research and consulting in the financial services division of Market Strategies International, a market research company.

But many Americans tend to idle with one insurer. The survey also found that:

The average American has been with the same auto insurance company for 12 years, and some consumers (14 percent) have stayed with one insurer for two to three decades — or longer.

- Millennials (ages 18 to 29) and seniors (65 and up) are the age groups least likely to shop around for car insurance.

- Many Americans are unaware they can shop anytime. About 46 of Americans — and 6 in 10 millennials — wrongly think they have to wait until renewal time to switch insurers.

“A lot of customers tend to be pretty sticky,” Bowler says.

Why Don’t Americans Shop Around for Auto Insurance?

Auto insurance rates can vary a lot depending on the insurance company — partly because different insurers have different risk preferences, Hoyt says. Some insurers might offer comparatively great rates for single drivers with one car, while others might offer better deals for big families who need full coverage for a house and several vehicles, Hoyt says. “It’s difficult for one insurer to be all things to all people,” he says.

So, why don’t more Americans shop around for car insurance — especially when their life circumstances change? It’s partly because many consumers use auto pay, so the premium simply gets deducted from their bank account each month, Bowler says. When a consumer gets a renewal notice in the mail, it gives the new rate but doesn’t spell out that the amount is going up by, say, $50 a month, Bowler says. “Many people don’t think much about it,” he says.

Also, many policyholders view gathering car insurance quotes as about as much fun as going to the dentist for a teeth cleaning, Bowler says.

In fact, the survey found that 62 percent of Americans think shopping for auto insurance is time-consuming, while 44 percent call it frustrating and 40 percent say it’s complicated.

“It’s not very glamorous to shop for car insurance,” Bowler says.

Shopping Is Key to Getting the Best Deal on Car Insurance

However, most Americans know there are benefits to checking prices on coverage. In fact, nearly two-thirds of Americans think shopping around for auto insurance is worthwhile, the survey found. And 29 percent even think it’s “interesting.” If you want to look for a better deal, here are four car insurance shopping tips:

Remind yourself to shop regularly. How do you remember to swap the air filters in your home, change the oil in your car and take your pets to the vet for vaccinations? Use the same technique — whether it’s setting an alert on your smartphone or writing in red marker on your wall calendar — to schedule regular auto insurance shopping, Bowler recommends.

Shop through various channels. First, check with an independent agent, who should be able to shop eight to 10 insurers for you, Bowler says. Also check with a company or two that doesn’t use independent agents, so you can get a wider variety of quotes, Hoyt says. And finally, get quotes online from insurance company websites or a quote aggregator, such as insuranceQuotes.com, Bowler says. Get at least three to five quotes, he recommends.

And when comparing quotes, make sure you’re looking at the same levels and types of coverage. “Make sure you’re comparing apples to apples,” Hoyt says.

Choose a good company. Don’t pick an insurer based only on price, says Etti Baranoff, associate professor of insurance and finance at Virginia Commonwealth University. First, visit your state department of insurance website to look at the complaint ratio for each company you’re considering. Some companies try to wriggle out of paying claims — which can cost you money down the road, Baranoff says. “If a company has a high complaint ratio, I wouldn’t touch it,” she says.

Ensure you won’t have a gap in coverage. It’s important to get a new policy before canceling your old one. The survey found half of Americans incorrectly believe a lapse in coverage won’t affect their rate. But insurers look at continuity of coverage when deciding how risky you are — and deciding how much you’ll pay, Hoyt says.

So, should you stay or should you go? Weigh switching for a better deal against building a relationship with an insurer you know and trust, Hoyt says. There can be financial benefits to sticking with one insurer, he says. For example, some companies offer discounts based on how long you’ve been with the company without having an accident, he points out.

“Being the person who moves every time they can save $5 probably isn’t the best strategy in the long run,” Hoyt says.

But, insurers have taken note of the fact that customers who have been loyal for a long time are less likely to switch just because their rates get hiked, Bowler says.

“At the end of the day, you want to get the most bang for your buck,” he says.