California Car Insurance Rates by City?

Looking for the best car insurance in California? It probably comes as no surprise that where you live has a bearing on what you pay and the average rates for car insurance. However, a new study that examines car insurance rates in California suggests location may be an even greater pricing factor than most people realize.

The study, commissioned by insuranceQuotes.com, examined the economic impact of ZIP codes on car insurance premiums throughout the state. Using a hypothetical 45-year-old married couple with a clean driving record and who own two cars, the study compared auto insurance premiums by city, county and ZIP code—and the results are somewhat surprising.

According to the National Association of Insurance Commissioners, the average auto insurance premium in California was $746 for one vehicle. So how did California cities compare to the average rate?

The most expensive city is Beverly Hills, where the average auto insurance rate is 44 percent higher than the state average. Meanwhile, Morro Bay holds the distinction of being California’s cheapest city for auto insurance. Morro Bay residents pay 30 percent less than the state average.

Even within individual cities, insurance premiums can vary widely depending on ZIP code. In Los Angeles, an insurance premium for the same couple can vary 33 percent, depending where you live.

California Premiums in Major Cities

Los Angeles residents pay 32 percent higher than the average California auto insurance premium. Residents in San Francisco pay 8 percent more than the state average – however, San Diego residents pay 11 percent less than the state average.

Residents of California’s capital city, Sacramento, pay 15 percent more than the state average for their auto insurance.

According to Rachel Jensen, associate counsel at the American Insurance Association, price differences between certain cities may be surprising to some consumers, but there’s a reason these disparities exist.

“Geographic location (is) used because it helps insurers accurately predict the potential for claims from physical damage, theft and vandalism,” Jensen says.

When an insurer sets your premium, they also take population density as well as the frequency and severity of claims in any given city into account, says Bob Passmore, director of personal lines policy for the Property Casualty Insurers Association of America.

For instance, the population of Los Angeles is 3.8 million, whereas the population of Morro Bay is just over 10,000. These figures are going to produce very different sets of claims data.

“Simply put, if you live in a city where there are more people, there’s also going to be more traffic. And when there’s more traffic there are more accidents,” Passmore says.

In California, car insurance per month costs on average from $180 to $220 per month depending on a few factors such as your driving history, etc. For minimum coverage you can expect to pay around $750 per year.

California car insurance rates are typically more expensive because of a few factors such as high crime urban areas and multiple densely populated cities which are factors that affect a state’s average car insurance cost.

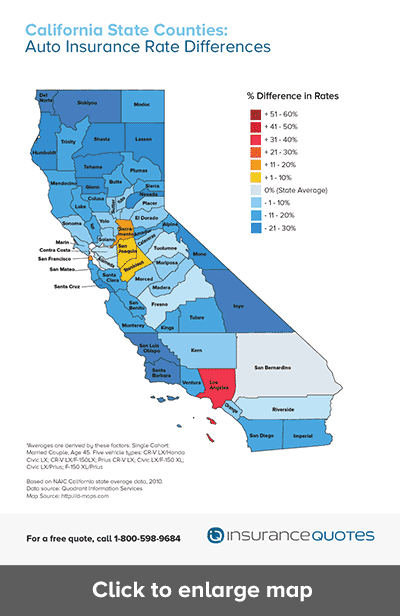

California Car Insurance Premiums by County

When it comes to insurance premiums by county, people living in cities in the central third of the state can expect to pay the most. Here are the three most expensive counties to buy auto insurance in California:

1. Los Angeles: 18 percent higher than the state average.

2. Sacramento: 9 percent higher.

3. San Francisco: 8 percent higher.

And here are the three least expensive counties to buy car insurance in California, starting with cheapest:

1. San Luis Obispo: 25 percent lower than the state average.

2. Inyo: 23 percent lower.

3. Santa Barbara: 22 percent lower.

“I think this falls within the range I’d expect,” says Tully Lehman, spokesman for the Insurance Information Network of California. “The counties that topped the list are generally more urban counties with more vehicles on the road. On the other hand, the low-lying three are generally more rural, where you can drive and not see another car on the road for miles and miles.”

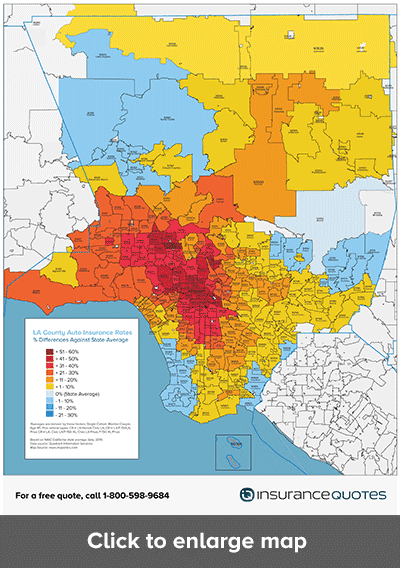

California Auto Insurance Premiums by ZIP Code

Note: The ZIP codes used in this study are USPS designated ZIP codes.

Perhaps the most intriguing finding of this study is the way insurance premiums can swing widely between ZIP codes within the same city. For instance, Los Angeles boasts a 34 percent difference between its most expensive ZIP code, 90038 (West Hollywood) and its least expensive, 90045 (Westchester).

Here are the three most expensive L.A. ZIP codes:

1. 90038 (West Hollywood): 51 percent higher than the state average.

2. 90006 (Pico Heights): 47 percent higher.

3. 90015 (Downtown L.A): 47 percent higher.

And here are the three cheapest L.A. ZIP codes, starting with the cheapest:

1. 90045 (Westchester): 7 percent higher than the state average.

2. 90066 (Culver City / Mar Vista): 10 percent higher.

3. 90040 (Commerce): 10 percent higher.

The swings aren’t as significant in some of California’s other large metro areas. In San Diego, residents of the most expensive ZIP code, 92105 (Kensington) only pay 20 percent more than least expensive ZIP code, 92131 (Scripps Ranch).

And in San Francisco, residents of the most expensive ZIP code, 94124 (Bayview Heights) pay just 14 percent more than the least expensive ZIP code, 94123 (the Marina).

“It really comes down to the size of the city you’re talking about,” Jensen says. “In larger cities you’re going to have a larger swing between ZIP codes. In smaller cities, that variation is probably going to be less significant.” It’s always a good idea to get multiple auto insurance quotes when shopping locally for a policy

Minimum California Car Insurance Coverage

California requires drivers to carry at least the following auto insurance coverages:

Liability

- Bodily injury liability coverage: $15,000 per person and $30,000 per accident minimum

- Property damage liability coverage: $5,000 minimum

Uninsured

- Uninsured motorist bodily injury coverage¹: $15,000 per person and $30,000 per accident minimum

- Uninsured motorist property damage coverage¹: $3,500 minimum

While these are the minimum coverages California requires you to have, your coverage will depend on you and your current situation.

California Car Insurance Laws for New Residents

Anyone moving to California should understand the state’s laws regarding road laws and car insurance. Reading the California Driver Handbook is a good resource for learning the various state laws and requirements that may differ from other states. Here are some good things to know if you are moving to California.

- California is not considered a no-fault state. In no-fault states, insurance companies cover the cost of medical and property expenses of the insured driver they cover, no matter who caused the accident or collision. In at-fault states like California, the insurance company covering the driver who is at fault for the accident is required to compensate the other driver for liability expenses.

- Drivers must carry proof of insurance in their vehicle at all times, and must show proof of insurance when requested by law enforcement, after an accident, and when renewing the car’s registration at the DMV.

- Insurance companies in California are legally required to report private passenger car insurance information to the DMV.

- Existing law imposes a use tax on a vehicle purchased outside of California and brought into California within 12 months of purchase.

Why Auto Insurance in California Is So Unique

In 1988 California voters passed Proposition 103, a ballot measure that limited the factors insurance companies could use when determining auto rates, which included a ban on using credit scores. Since then, Lehman says insurance companies in the Golden State must base insurance premiums on three primary factors:

- Driving safety record.

- Average miles driven per year.

- Years of driving experience.

After these factors are weighted, insurers can use additional factors to determine rates, including the type of vehicle driven, marital status and ZIP code. So while a driver’s ZIP code isn’t one of the primary rating factors, it still plays a role in determining premiums.

“Prop 103 forced insurance companies to look primarily at how we drive, not where we live. And if that hadn’t happened, you’d be seeing much larger differentials from zip to zip,” says Doug Heller, an independent consumer advocate with the Consumer Federation of America. “It didn’t deny insurance companies from using ZIP codes altogether, but it diminished their impact, which is ultimately good for the consumer.”

4 Tips to Reduce Your Car Insurance Rates in California

No matter which California ZIP code you call home, here are 4 tips to save money on car insurance:

1. Shop around

According to Lehman, most consumers don’t think about their auto insurance often enough, and this winds up costing them more money in the end.

“Shopping for car insurance should be something you do (at least) every two years,” Lehman says. “That doesn’t mean you have to switch companies every time, but there’s always a chance that a better deal is out there.”

2. Ask about discounts

Many drivers may be entitled to discounts on their auto insurance coverage – but insurers typically won’t grant them automatically so policyholders need to ask if they qualify for price breaks.

See also: Many drivers are missing out on car insurance discounts

It’s always good to check in with your insurer about discounts if you’re renewing your policy, or if you go through a significant life change, like getting married. You may also get a discount for:

- Getting good grades in school.

- Installing anti-theft devices.

- Taking a defensive driving course.

- Driving less than a mileage threshold that your insurer sets (typically up to 12,000 miles per year).

3. Drop your collision coverage

Lehman also says that many drivers are carrying too much coverage.

“Collision coverage is what pays for your car if it’s damaged in an accident, but it may be unnecessary,” Lehman says. “If your car is only worth $2,000, and you have a $1,000 deductible for collision, it probably doesn’t make sense to pay extra for that type of coverage.”

It’s going to vary from vehicle to vehicle, but Lehman says dropping collision will probably result in saving about $300 a year.

4. Consider California’s low cost auto insurance program (CLCA)

Boasting annual premiums that start between $226 and $338, the CLCA was implemented in 2000 as a way to provide low-cost liability insurance to California residents who might otherwise not be able to afford it. In order to qualify, drivers must have a good driving record, be at least 19 years old, have been licensed for at least three years, own a vehicle valued at $20,000 or less and meet the income eligibility requirements (which, for a family of four, is earning less than $23,550 a year).

Data source: Quadrant Information Services