The Complete Guide to How Your Car Insurance Deductible Works

Your car insurance bill can eat up a significant share of your monthly budget. When money’s tight, raising your car insurance deductible may help lower your premium considerably — and create extra breathing room for other monthly expenses.

The rate of your deductible directly affects your insurance costs. Raising your deductible amount will lower your premium. By the same token, paying a higher monthly insurance premium does go towards making your deductible lower.

According to a survey by Quadrant Information Services, commissioned by insuranceQuotes, raising your deductible could help you save as much as 28 percent on your premium, depending on where you live.

A lower premium may sound appealing, but determining how much of a deductible you’re willing to pay for car insurance should be an informed, personal decision.

Backed by market research, the following guide can help you pinpoint the best deductible for car insurance to suit your individual needs and get a better understanding of a car insurance deductible’s meaning.

Your Car Insurance Deductible Explained

So what exactly does ‘deductible’ mean in car insurance? A car insurance deductible, by definition, is the amount of money you agree to pay out of pocket if you file an insurance claim for damages to your vehicle. The deductible is a compulsory amount your insurer requires you to pay before your coverage kicks in and pays the balance.

A typical auto insurance policy consists of liability coverage, collision and comprehensive coverage. For the liability portion of your car insurance policy, which covers the costs to repair any damage to another driver’s vehicle, there is no deductible on your car insurance when you’re at fault in an accident. Nearly all states require drivers to carry liability coverage.

There are separate car insurance deductibles on collision and comprehensive coverage. Collision insurance covers the costs to fix your own car after a crash, while comprehensive coverage pays for damages caused by other types of incidents, such as a hail storm, a falling tree or vandalism.

You may be asking: How much is my car insurance deductible? The average car insurance deductible is $500, but typical deductibles run from $250 to $500 to $1,000. The highest car insurance deductibles can go into the $2,000 to $2,500 range.

How Much Will You Save by Raising Your Deductible?

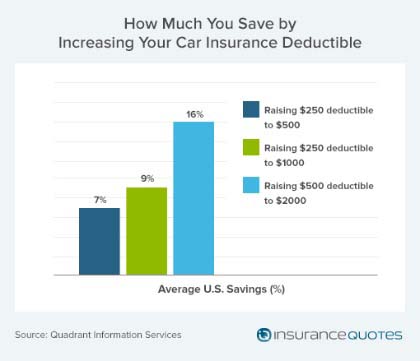

- Raising a deductible from $250 to $500: Bumping up your deductible by just $250 can save you 7 percent, according to the national average.

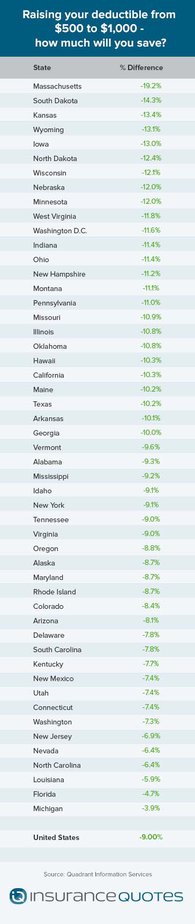

- Raising a deductible from $500 to $1,000: U.S. consumers, on average, can save 9 percent on their premiums by increasing their deductible from $500 to $1,000.

- Raising a deductible from $500 to $2,000: The national average saving on premiums was 15 percent. But the survey found that consumers in South Dakota can save a whopping 28 percent, while consumers in North Carolina saw the smallest savings, only about 6 percent.

So, Should You Raise Your Auto Insurance Deductible or Not?

Is it better to have a higher or lower deductible for car insurance?

When it comes time to choose, there are several factors to weigh — in addition to where you live — in terms of how much your deductible should be for car insurance.

To figure out whether high deductible car insurance is the right option for you, here are a few things to consider:

- Do you have enough cash?

Agreeing to a higher deductible can give you some extra wiggle room in your monthly expenses. But it’s not a helpful strategy if you can’t afford to pay your car insurance deductible.

Make sure you have enough emergency money set aside for auto repairs before you commit to a higher deductible.

- It doesn’t have to be all or nothing

Think about each deductible individually, and consider setting different deductibles for your car insurance comprehensive deductible and your collision deductible.

For example, you may look at reducing your comprehensive deductible since it accounts for a smaller portion of the overall premium. That means you won’t save much money if you increase this deductible.

- Are you at risk?

If you’re car accident prone, you might be better off with a lower deductible so you won’t have to pay as much out of pocket for filing repeated claims.

Even though your deductible doesn’t reset annually, you would still need to pay a deductible every time you make a claim.

- Look out for “vanishing deductibles”

Some insurers will reduce your deductible for each year you don’t have an accident. What you might not see is that these “savings” are inflating the cost of your premium.

- Stash away the savings

Figure out how long it will take for your annual insurance savings to equal the amount of your deductible. If it only takes a few months or a year, you can set aside enough to pay your premium, and then start banking the rest.

How to Avoid Paying a Car Insurance Deductible

Paying a deductible can mean having to cough up a hefty chunk of change. If you’re worried that you can’t afford to come up with enough cash to pay your deductible, you have a few options.

- Negotiate with your mechanic

If you’re short on cash to pay your car insurance deductible, requesting a payment plan from your repair shop could help you cover your costs in installments. You may even be able to get your deductible waived by the auto shop.

- Purchase a collision deductible waiver

A collision deductible waiver, or CDW, is an additional coverage you can add to your collision policy that waives your deductible if you get into an accident caused by an uninsured driver.

- Find out if you can get free glass repairs

Some insurers waive the deductible for repairs to a windshield or broken window for policyholders with comprehensive coverage. Florida, Kentucky and South Carolina are known as zero deductible states because their laws require insurers to provide these repairs for free.

- Ask for car insurance without a deductible

Choosing what is known as non-deductible car insurance, means selecting coverage that does not require you to pay any money up front on an approved claim. If you usually don’t have much money set aside, it may be a good idea to pursue this option so you don’t find yourself coming up short if you need to make a claim.

But remember: The upside of having zero car insurance deductible is that you won’t have to pay any money out of pocket if you file a claim to pay for damages to your car. So if your claim covers you for $3,000 in damages, your insurer will refund you the full amount, instead of taking out a deductible.

Since lower deductibles mean higher insurance costs, the drawback of having no deductible is that you’ll pay more for your monthly premium.

- Find out if you’re not at fault

As long as the driver who hit you is covered, you shouldn’t have to pay a car insurance deductible if you’re not at fault. The other driver’s insurance will cover the costs to repair your car, and the driver will pay whatever deductible the insurer requires.

When Exactly Do You have To Pay Your Car Insurance Deductible?

When you’re trying to figure out how much your deductible should be for car insurance, ask your insurer about what their process is for collecting deductibles, and how long it might take for you to receive a payout. Here’s what you can usually expect in a few different scenarios.

- After you file a claim

First, your insurer must approve the claim in order for you to receive a payout. After the claim is approved, your insurer will require that you pay your deductible. Once the amount of your damages reaches your deductible, the insurer will issue a payout for any repair costs over and above that amount

- If you don’t know who’s at fault

When you get into an accident with another vehicle, the insurance companies involved will conduct an investigation into which driver was at fault to determine who pays the car insurance deductible. If you’ve already paid your premium up front, your insurer will give you a reimbursement if you were not at fault

- How to pay your car insurance deductible

Your insurer may apply your car insurance deductible to the amount it pays out. That means the insurer will deduct however much you owe from your payout. If your car is a total loss, your insurer will give you the cash value for your vehicle, minus the deductible amount.

- When your car insurance deductible is due

Ideally, the time when you pay your car insurance deductible is after your insurer approves your claim. Many insurers do not require that you pay up front. It’s worth noting that if they do, most major insurers accept credit card payments, and that includes payments for deductibles

- Car insurance deductible vs. out of pocket

Before you file an insurance claim, consider whether it’s worth paying out of pocket instead. If your car received minor damages in a fender bender, your car insurance claim may be less than your deductible amount. What’s more, adding a claim to your claims history could ultimately drive up your auto insurance rates.

Methodology

InsuranceQuotes.com and Quadrant Information Services calculated rates using the data from the largest carriers in each state. The averages are based on a married and employed 45-year-old female who drives 12,000 miles per year with policy limits of $100,000 for injury liability for one person and $300,000 for all injuries. Collision and comprehensive coverage policies were rated with the following deductibles: $250, $500, $1000, and $2000. The hypothetical driver has a clean driving record and good credit.

The amount you can save by changing your deductible can vary widely.

The amount you can save by changing your deductible can vary widely.