Can Raising Your Car Insurance Deductible Save You Money?

Switching companies can save you big on car insurance, but so can a simple move that takes a few minutes: raising your deductible.

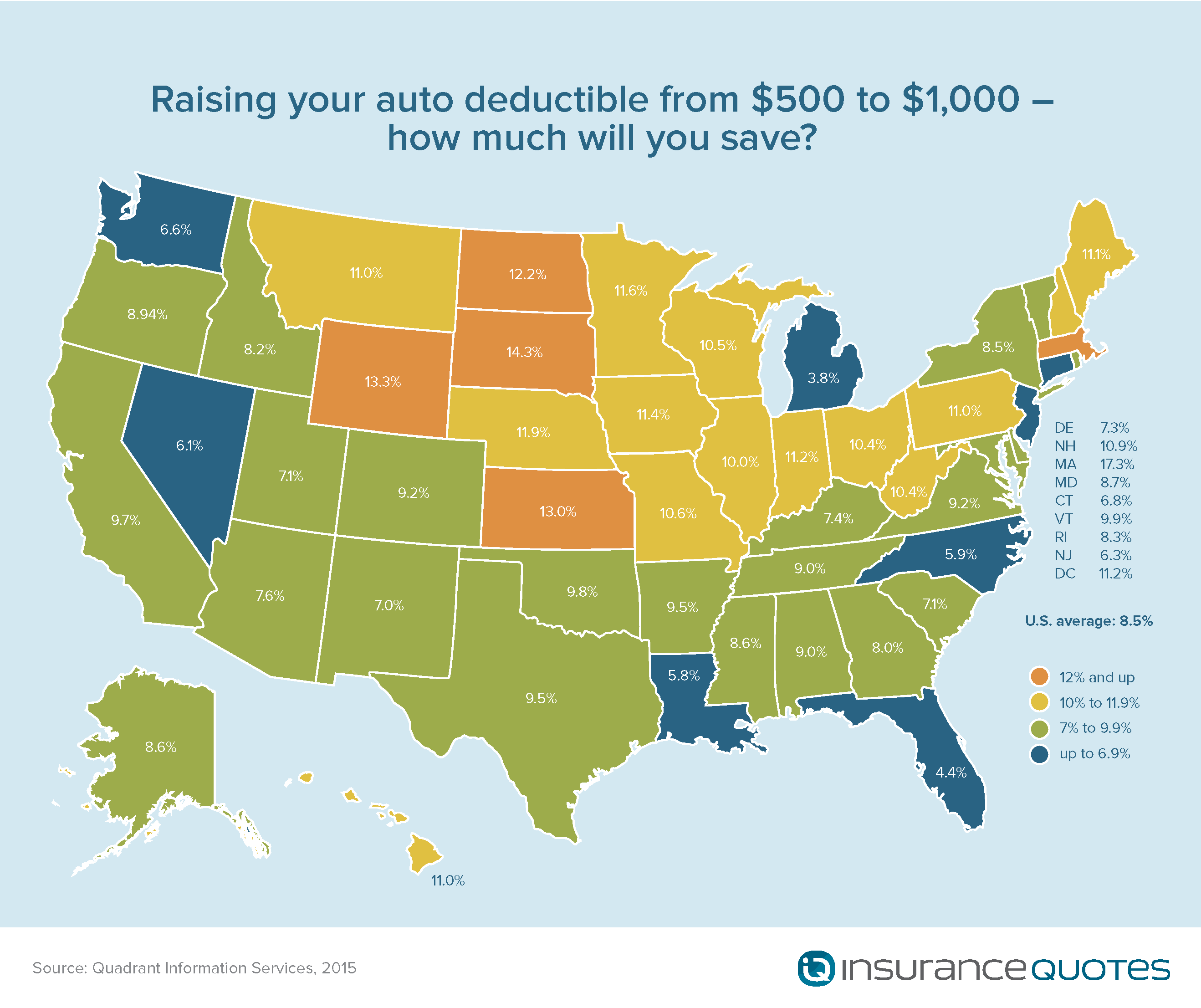

Increasing your auto insurance deductible from $500 to $1,000 slashes premiums by an average of about 8.5 percent across the United States, according to a new study from insuranceQuotes.com, conducted by Quadrant Information Services. And making a bigger change, from $500 to $2,000, can nearly double those savings, to an average of almost 15 percent.

On the flip side, decreasing your deductible from $500 to $250 can cost you, upping your premiums by an average of 7 percent across the nation, the survey shows.

However, the savings vary based on your state: For example, going from a $500 to $1,000 deductible, Michigan residents save the least, while Massachusetts residents save the most. Savings can vary from 4 percent to 28 percent, depending on where you live.

Raising your deductible is “a good way for consumers to save money,” says Bob Passmore, senior director of personal lines policy for the Property Casualty Insurers Association of America.

The reason consumers stand to save so much: There are more small claims than big claims, so you can save big by agreeing to pay for less expensive car repairs out of your own pocket, Passmore says.

“That’s where you can get a lot of bang for your buck,” he says.

A car insurance premium is the full amount charged for your car insurance by your provider, you’ll often have a choice to pay monthly, every 6 months, or yearly – which can affect overall price. A car insurance deductible on the other hand is the amount you’ll pay out of pocket if you were to damage your car and need to make a claim for car repairs. A car deductible usually ranges from $500 to $1,000+, which will affect overall costs.

If you increase your car insurance deductible, you can expect the amount you pay for your premium to go down – saving you money. If you are a safe driver, you may opt to have a higher deductible in order to save money on your auto insurance costs with a lower monthly, semi-annual, or annual decreased premium payment. The best choice will all depend on your personal needs and budgetary availability to cover costs.

How Do You Increase Your Auto Insurance Deductible?

To decide whether raising your deductible might be a smart move, you first need to understand how auto insurance deductibles work.

A deductible is the amount you pay out of pocket if you have a car insurance claim. So, if you hit a tree and cause $3,000 worth of damage to your car, and you have a $500 deductible on your collision insurance, you’ll have to cough up that amount while your insurer foots the remaining $2,500 of the repair bill.

Car insurance is made up of three major parts: liability coverage, which is required in virtually all states; collision coverage, which is optional and pays for damage to your car from crashes with other cars or objects; and comprehensive coverage, which is also optional and covers just about everything else — such as a collision with a moose, hail damage or car theft, Passmore says.

Liability insurance typically does not carry a deductible, but both collision and comprehensive insurance do, and you can set a different deductible for each one, Passmore says. (The insuranceQuotes study used the same deductible for both collision and comprehensive.) Because a collision is the type of mishap most likely to happen, you stand to save more by increasing your collision deductible than by upping your comprehensive deductible, Passmore says.

Can You Save Money by Raising your Auto Insurance Deductible?

While bumping up your auto insurance deductible can lead to lucrative savings in some states, premiums in other states may barely budge.

That may be due to differences in the frequency and dollar amount of claims in different areas, Passmore says. For example, states with more densely packed urban areas might have more collision claims than rural states.

Check out these insuranceQuotes.com study findings to see if your state is a great place to save by changing your deductible or if your savings might not be so hot:

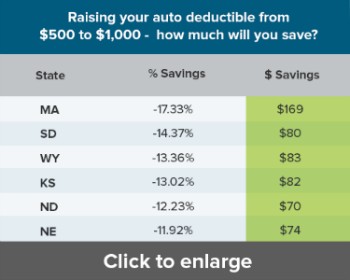

- Increase a deductible from $500 to $1,000: In Massachusetts, the switch will save 17 percent, while in Michigan, it will save you about 4 percent, on average. That’s a dollar savings of $169 in Massachusetts or $40 per year in Michigan, based on state-by-state average auto insurance premium amounts from the National Association of Insurance Commissioners.

- Increase a deductible from $500 to $2,000: This big change is rewarded with fat savings only in certain states. South Dakota drivers lop almost a third off their premiums, while North Carolina residents save about 6 percent. That’s $156 annually in South Dakota, but just $37 a year in North Carolina.

Even if you live in a place where the savings are slim, it still can pay to raise your deductible, says J. Robert Hunter, director of insurance for the Consumer Federation of America.

That’s because paying less in premiums typically works out in the consumer’s favor down the road. In fact, over the long term, consumers get back in claims payments an average of only about 65 cents on every dollar they pay for insurance, he says.

“You want to minimize the number of dollars you give an insurance company,” Hunter says.

Tips for raising your auto insurance deductible

If you think boosting your deductible might be a great way to save, check out these four tips first.

- Get multiple free auto insurance quotes. The amount you can save depends on where you live, how much you increase your deductibles and your base premium amount. So do your homework, and request quotes from your insurance agent or company so you know the exact amount of potential savings.

- Consider your risk. Saving money on premiums is nice, but remember that filing a claim can cost more, says Carole Walker, executive director of the Rocky Mountain Insurance Information Association. Do you have a clean driving record, or are you accident-prone? If you generally have few or no claims, lowering your premium by raising your collision deductible may be a smart move, Passmore says. Also, where do you live? If you’re in a state like Colorado with frequent hail, or one like Florida where hurricanes hit, you’re more likely to file a comprehensive claim, Walker says. If you live in a high-crime neighborhood, that increases your risk of auto theft, which also would fall under the comprehensive part of your policy, she says. In those cases, you might want to keep your comprehensive deductible low even if you raise your collision deductible, she says.

- Calculate what you can afford. If you decide to increase your deductible, make sure you know where the money will come from if you do have a claim, Passmore says. It’s smart to budget the dollar amount of your deductible as part of your emergency savings fund, he says. Remember, if you end up paying part of an auto repair with a credit card, high interest could eat away any savings you gained by raising your deductible.

- Make a long-term savings plan. You can really save big down the road if you strategize now, Hunter says. In fact, it might be a good idea to bank the money you save on premiums.

“Say, I’m saving $120 a year,” Passmore says. “I’m going to tuck that away.”

That’s what Hunter started doing decades ago, and he’s banked more than $18,000 in premium savings, which has allowed him to keep raising his deductibles higher and higher, saving even more money. He also pays for fender benders out of that fund, avoiding the hassle of dealing with a claims adjuster and keeping his premiums from going up as a result of claims. Eventually, you may be able to raise your deductible to $2,000, then $5,000 or more. “Your premiums can go down quite a bit,” Hunter says.

Study methodology: insuranceQuotes.com and Quadrant Information Services calculated rates using the data from the largest carriers in each state. The averages are based on a married and employed 45-year-old female who drives 12,000 miles per year with policy limits of $100,000 for injury liability for one person and $300,000 for all injuries. Collision and comprehensive coverage policies were rated with the following deductibles: $250, $500, $1000 and $2000. The hypothetical driver has a clean driving record and good credit.