Study: Insuring Teen Drivers Getting Cheaper but Family Premiums Can Easily Double

When it comes to adding a teen to your auto insurance policy there’s some slightly good news and some really bad news.

For the fifth consecutive year, insuranceQuotes commissioned a detailed study to look at the economic impact teen drivers have on their family’s auto insurance rates. Each of those years the cost has decreased (that’s the good news), but that continued decline is tiny. Parents, on average, should expect to pay an additional $671 annually with a teen on their auto policy, with the cost rising to as much as $1,862 in some states (that’s the bad news).

Of course, all of this depends on where you live. Parents in Hawaii won’t see much of a spike, while those living in Rhode Island probably should be sitting down when talking to their agent.

Why the huge increase?

Generally, the cost of insurance is based on a simple equation: the riskier you are behind the wheel the more you’re going to pay. And when it comes to putting a teen driver to an existing car insurance policy, you’re going to pay a lot even after the slight savings over the past five years.

“There is a very strong link between age and accident rates,” says Mike Barry, vice president of media relations for the non-profit Insurance Information Institute. “Young drivers file more claims than almost any other age group, particularly single young men. That means an insurer is taking on considerably more risk to insure these drivers, which is why this study shows such substantial increases in premiums.”

According to the National Highway Traffic Safety Administration (NHTSA), 1,886 drivers between the ages of 15 and 20 died in motor vehicle crashes in 2015 (the most recent data available), which was up 9 percent from 1,723 in 2014. What’s more, an additional 195,000 teen drivers were injured in 2015.

Furthermore, according to the U.S. Department of Transportation, the fatal crash rate per mile driven for drivers between the ages of 16 and 19 is almost three times higher than all other age groups. Additionally, teenagers accounted for 9 percent of all drivers involved in fatal crashes in 2015, and comprised 12 percent of all drivers involved in police-reported crashes.

RELATED: How Does a Ticket Affect Your Auto Insurance?

Finally, according to the Centers for Diseases Control and Prevention (CDC), motor vehicle crashes remain the leading cause of death among 13-19 year-old males and females.

According to experts and analysts, these data points illustrate why teens are so expensive to insure — and why adding a teen driver to your existing auto policy can sometimes double your premium.

Will the rates to insure teen drivers continue to drop?

According to the new Quadrant study, U.S. families who add a young driver to their existing auto insurance policy will see an average annual premium increase of 78 percent, which translates to $671. It’s a costly consideration, but from an insurer’s perspective it’s also somewhat unavoidable, as a teen’s riskiness behind the wheel comes down to overall inexperience, says Insurance Institute for Highway Safety (IIHS) spokesman Russ Rader.

“The fact that teens have crash rates that are three times higher than those over the age of 20 is because of their immaturity,” Rader says. “That immaturity leads to risky behaviors like speeding and other dangerous habits. In addition to that, because they’re so inexperienced teens often don’t recognize or know how to respond to hazards.”

Rader says teen crashes and driving-related fatalities “has always been a public health problem,” but also notes that statistics are improving — slowly but surely.

For instance, there were nearly 10,000 teen driver deaths in 1975, according to the IIHS. That figure has continued to drop substantially every year. And while more than 2,700 teens died in motor vehicle crashes in 2015, that’s 69 percent fewer than the high water mark 40 years prior.

Even recent trends are promising. According to NHTSA, fatal crashes amongst drivers between 15 and 20 are down 43 percent from the 7,493 involved in fatal crashes in 2006.

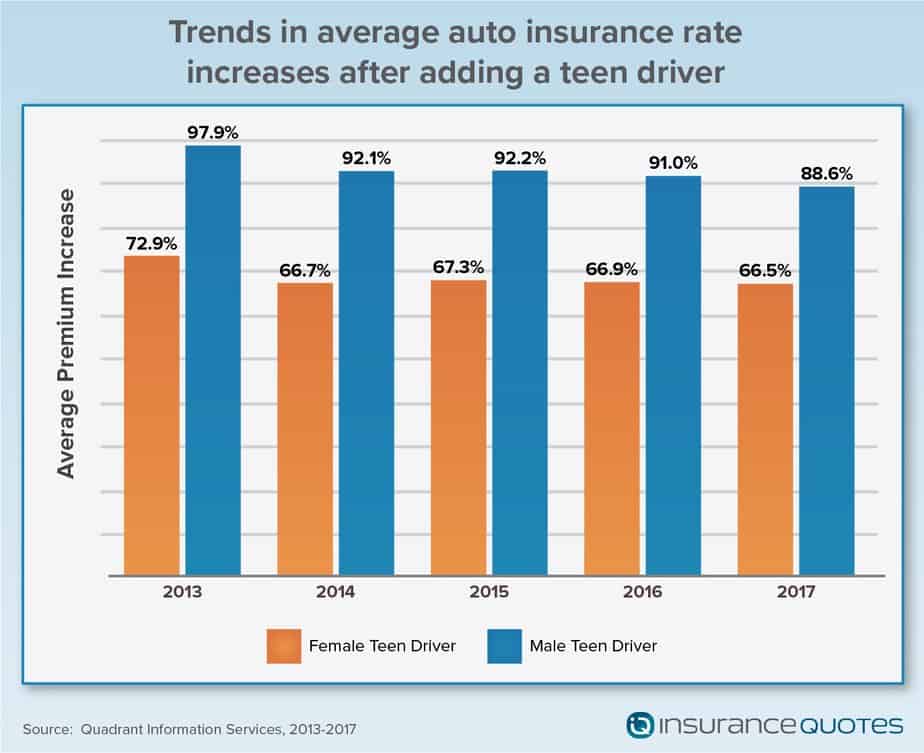

As a result, the cost of insuring a teen driver has slowly declined as well. According the insuranceQuotes study, this year’s average premium increase is down 1 percent from last year’s 79 percent spike — which was down from an 80 percent premium increase in 2015 and an 84 percent increase in 2013.

Experts say there are several factors at play here, including the improved safety of modern vehicles, the fact that fewer teens are behind the wheel than ever before (you can partially thank ridesharing services for that), and the continued positive impact of graduated driver’s licensing programs (GDL) across the country.

For instance, a recent IIHS analysis of teen crash deaths shows that fatality rates have plummeted since 1996, the year that states first began enacting GDL systems. The greatest decline occurred among 16-year-olds, with fatal crashes dropping by 68 percent between 1996 and 2010. Fatal crashes fell 59 percent for 17-year-olds, 52 percent for 18-year-olds, and 47 percent for 19-year-olds.

CHECK OUT: Dangerous States to Be on the Road

What’s more, the percentage of teens on the road has been on a steady decline. According to a recent study from the University of Michigan’s Transportation Research Institute, just 24.5 percent of 16-year-olds had a license in 2014, a decrease of 47 percent since 1983.

“It’s not so much that teens are suddenly safer drivers, but they’re benefiting from safer cars and laws that restrict when, and under what conditions, they can drive,” says Rader.

Cost of teen insurance by age, gender

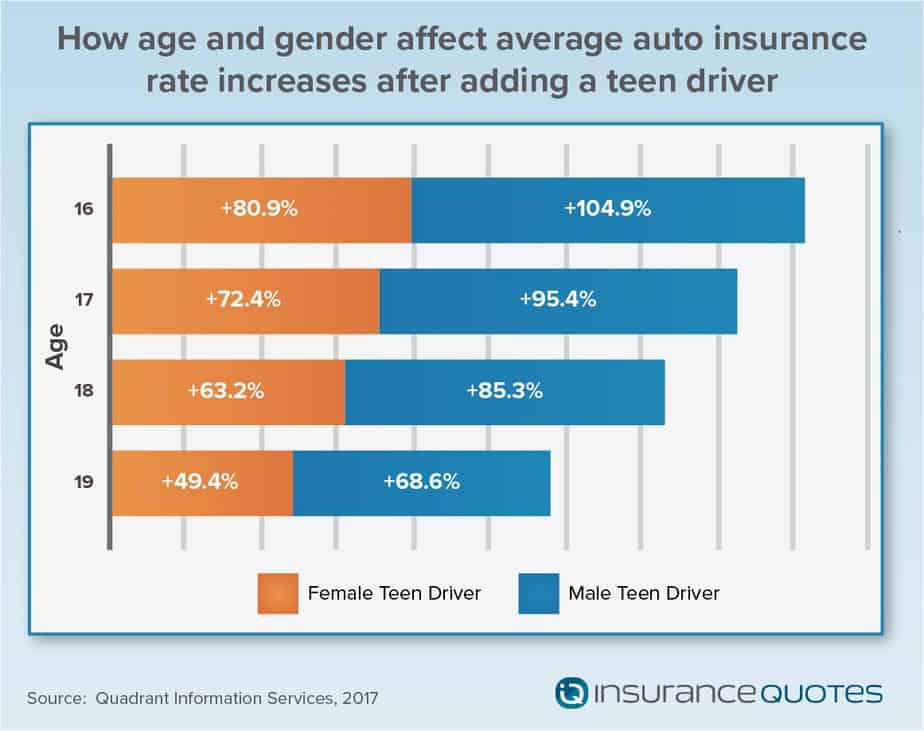

If you’re thinking of adding a teen to your existing policy, know that the economic impact will vary depending on the teen’s age and gender.

According to the insuranceQuotes study, it’s more costly to add a young male driver than a female driver to an existing policy. Barry says that’s because insurers know young men are statistically riskier drivers than young women.

The study found that adding a male teen to a married couple’s policy results in a national average premium increase of 89 percent (down from 91 percent in 2016).

However, the average increase for adding a female teen is 66 percent.

Age also plays a significant role in determining premium increases. For instance, the average premium increase is highest for a 16-year-old male driver (105 percent) and diminishes each year through age 19, when premiums increase by 67 percent, on average.

Auto premium differences from state to state

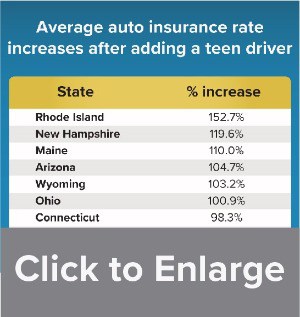

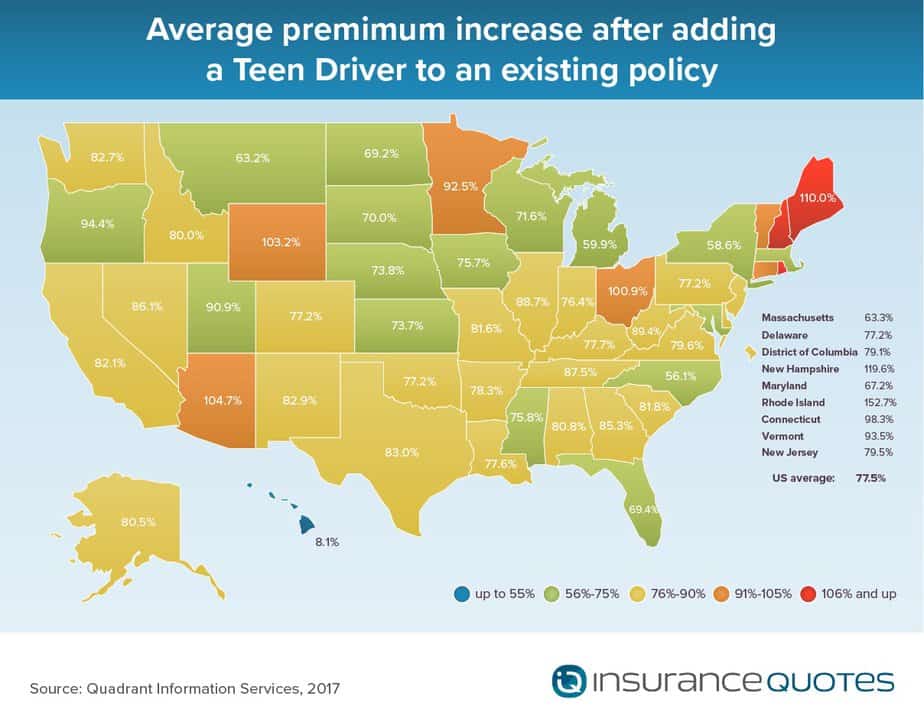

Once again the insuranceQuotes study found that not all states are created equal when it comes to the cost of insuring a teenage driver. For instance, adding a teen to a married adult’s auto policy in Rhode Island will result in an average annual premium increase of 153 percent.

In Hawaii, however, the average increase is just 8 percent.

Here are the five most expensive states, on average, for adding a teen driver to an existing auto policy:

- Rhode Island — 153 percent increase

- New Hampshire — 120 percent increase

- Maine — 110 percent increase

- Arizona — 105 percent increase

- Wyoming — 103 percent increase

Meanwhile, here are the five least expensive states, on average, for adding a teen driver to an existing auto policy:

- Hawaii — 8 percent increase

- North Carolina — 56 percent increase

- New York — 59 percent increase

- Michigan — 60 percent increase

- Montana — 63 percent increase

As always, the reasons behind these differences are somewhat complicated and difficult to pin down, but it starts with the fact that each state regulates insurance differently, and those regulatory differences account for some of the variations in the study’s findings.

For instance, Hawaii (which the National Association of Insurance Commissioners ranks as the 30th most expensive state for auto insurance) is the only state that doesn’t allow insurance providers to consider age, gender or length of driving experience when determining premiums, which means teens really don’t pay much more than adults for auto insurance.

This may also account for lower increases in states like New York, Michigan and North Carolina, where insurance is regulated more strictly and rating factors are more stringent, which means it’s more difficult for individual insurers to raise and lower premiums.

“Generally, I don’t think the differences between states are that great,” says Eli Lehrer, insurance expert and president of the nonprofit R Street Institute. “Some of them probably result from regulatory differences, particularly in the case of the extreme outlier of Hawaii. Michigan and New York are also known for lots of bureaucratic regulations, which probably impacts the rates.”

Other factors, says Lehrer, may include variable traffic densities, demographics and “driving cultures” from state to state.

5 tips to help your teen driver stay safe

No matter what it’s going to cost you to insure your teen driver, safety behind the wheel should always be the primary focus. Here are some expert tips on how to make sure your young driver is as safe as possible behind the wheel:

1. Consider electronic monitoring devices.

Many insurance companies now offer the installation of devices that monitor driving and flag risky behavior, such as speeding, aggressive driving, and the non-use of seatbelts. Some devices can even pinpoint a vehicle’s location and let parents dial directly into the car if an alert sounds. What’s more, a recent IIHS study indicates that teens in vehicles with monitoring devices take fewer risks while driving than unsupervised teens.

“Teen drivers are always safest when a parent is in the car with them,” Rader says. “And these types of monitoring devices can virtually keep you in the car all the time.”

2. Ask your agent about pay-as-you-drive programs

Otherwise known as usage-based insurance (UBI), pay-as-you-drive programs are now offered by some of the county’s largest insurance providers, including Progressive, Allstate, State Farm, Travelers, the Hartford, Safeco and GMAC.

The concept is rather simple. UBI programs are voluntary and drivers can earn discounts based on how well, how far and how often they drive. This is accomplished through the use of telematics devices, which record data regarding driver behavior and then transmit that to insurers to help set the discount.

“Usage-based programs are a good way to not only monitor your teen’s driving but to also financially incentive good driving behavior,” Barry says.

3. Find a safe vehicle for your teen

Rader says there are three words parents should keep in mind when looking for a safe car for their teen: Big, boring and slow.

Not only are larger vehicles safer on the whole, Rader points out that premiums for collision and comprehensive coverage will be lower if your teen drives a safe car that has little value and costs less to repair. For comprehensive information about insurance losses by make and model visit the IIHS website.

“Vehicles with lower-than-average injury and collision losses will typically cost consumers less to insure,” Rader says. “And they’re often larger, heavier vehicles that are safer for teens to drive. It’s a win-win.”

4. Educate them about the dangers and hold them accountable.

Zero tolerance for alcohol is a good start. Also consider not allowing your teen to drive at night or with other teens in the car until your teen has had sufficient experience and you believe he or she will drive responsibly.

Susan Tordella, parenting expert and author, suggests having your teen sign a contract of safe driving that you are prepared to enforce.

“Be willing to take away the car privileges for any infraction of agreed upon rules,” Tordella says. “For example, speeding tickets mean a loss of driving privileges for a certain period of time.”

5. Actively teach your teen how to drive.

Susan Kuczmarski, author of “The Sacred Flight of the Teenager: A Parent’s Guide to Stepping Back and Letting Go,” suggests asking your teen to talk out loud as you drive, narrating what a good driver should be seeing and doing to drive safely.

“Listen as your teen describes your driving and check for any omitted steps,” Kuczmarski says. “When a teen can describe your good driving habits as you drive, you’ll know that he is ready to get behind the wheel.”

Methodology

insuranceQuotes commissioned Quadrant Information Services to calculate the economic impact of adding a driver between the ages of 16 and 19 to a family’s existing auto insurance policy. Averages are based on a married and employed 45-year-old male and 45-year-old female who each drive 12,000 miles per year and have clean driving records and good credit. Policy limits include $100,000 for injury liability, $300,000 for all injuries, a $500 deductible on collision and comprehensive coverage, and uninsured motorist coverage.