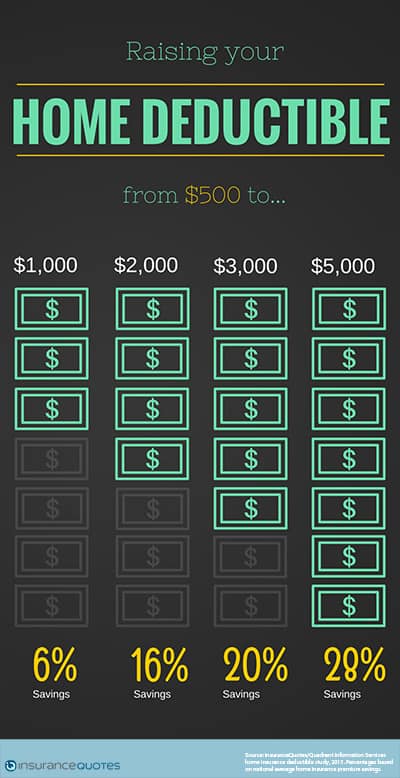

Raising your home insurance deductible can save you 16% on your premium

There are many ways to save money on home insurance, but a new study finds that one of the most significant ways to save may come from adjusting your deductible.

The Quadrant Information Services study, commissioned by insuranceQuotes.com, examined the average economic impact of increasing a home insurance deductible. Your deductible is how much you pay out of pocket for a claim before your insurance coverage kicks in.

Using a hypothetical two-story single-family home covered for $140,000, the study looked at how much an annual U.S. home insurance premium can decrease after increasing the deductible. According to the National Association of Insurance Commissioners (NAIC), the average U.S. home insurance premium is $1,034.

Using a hypothetical two-story single-family home covered for $140,000, the study looked at how much an annual U.S. home insurance premium can decrease after increasing the deductible. According to the National Association of Insurance Commissioners (NAIC), the average U.S. home insurance premium is $1,034.

“The upside here is obvious — if you increase your deductible, you save money on your premium,” says Mike Barry, spokesman for the nonprofit Insurance Information Institute.

However, before you call your agent and raise your deductible, ask yourself: Do I have enough money to pay the deductible out of pocket should I need to make a claim?

“For most Americans, I think (a $3,000 or $5,000 deductible) would be a significant burden,” Barry says.

Why are home insurance deductibles so important?

Generally, the size of a deductible strongly correlates to how often a homeowner will make a claim — and the more frequently a homeowner makes a claim, the more expensive he or she is to insure.

Most home insurance claims aren’t “total loss” catastrophes, but rather smaller claims for things like smoke, water or theft issues, says Matt Naimoli, co-owner of the Massachusetts-based G&N Insurance.

“If someone has a $500 deductible, they’re more likely to file claims for $1,500 or $2,500 worth of damage,” says Jonathan Stein, a California-based consumer law attorney who specializes in insurance. “If someone raises his or her deductible to $2,000, then he or she is less likely to file a claim.”

“If someone has a $500 deductible, they’re more likely to file claims for $1,500 or $2,500 worth of damage,” says Jonathan Stein, a California-based consumer law attorney who specializes in insurance. “If someone raises his or her deductible to $2,000, then he or she is less likely to file a claim.”

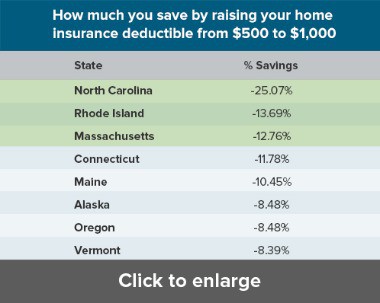

Home insurance deductible savings by state

Increasing a home insurance deductible almost always results in a cheaper premium, but this difference can vary significantly between states.

For instance, North Carolina residents save, on average, 25 percent when increasing a deductible from $500 to $1,000. In fact, North Carolina had the highest percentage savings from deductible increases in all four categories.

Meanwhile, Oklahoma residents see the second-highest savings when increasing home deductibles from $500 to $5,000, but save substantially less for lower amounts.

Or consider Florida. According to a 2015 study conducted by the National Association of Insurance Commissioners (NAIC), the average cost of home insurance in Florida is $2,084 per year, the highest of all 50 states and Washington D.C.

The insuranceQuotes.com study found that residents of the Sunshine State get the second-highest savings rate for increasing a deductible from $500 to $3,000.

According to industry experts and analysts, the reasons for these state-by-state differences are complex.

Barry says it’s important to point out that many states with the most significant savings are states that also have a very high risk for natural disasters like hurricanes and tornadoes

“If you live in a state with a significant number of natural disasters and you’re willing to absorb more of the risk with a higher deductible, your insurer is going to give you a more substantial break in your premium,” Barry says.

Another possible explanation may be that the frequency of some claims fall below a certain deductible threshold in a given state, says Josh Hite, owner of the Florida-based Brightway Insurance Agency.

For example, let’s say you’re a home insurance company in Florida and 35 percent of your claims are for damages less than $2,999. If all of those customers raised their deductibles by one dollar to $3,000, you’d (theoretically) save yourself from 35 percent of your claims every year.

“In that case you might want to offer a drop in premiums in exchange for those customers taking on more risk,” Hite says.

Should you increase your home insurance deductible?

According to Tennessee-based insurance agent Joseph Graves, the general rule of thumb is that homeowners should set their deductibles between 0.5 and 1 percent of the home’s value.

For example, if your home is worth $150,000 then your deductible should be between $750 and $1,500.

While it may seem tempting to save money by increasing your deductible to as much as $3,000 or $5,000, Graves doesn’t recommend it.

“Do you have access, immediately, to $5,000 in the event of damage to your home?” Graves says.

If you can’t pay your deductible, Graves says the carrier probably won’t renew your policy because there is unrepaired damage to your home.

Then you’ll have to shop for a new policy with a nonrenewal on your record, which will drive up the premium. Oh, and you’ll still have damage that needs to be repaired.

“If you can’t come up with the deductible amount right now, your deductible is too high,” Barry says. “Premium savings only count for so much.”

Other ways to save money on home insurance

Whether or not you increase your deductible, here are other ways to save money on your home insurance.

1. Don’t file minor claims.

1. Don’t file minor claims.

According to a 2014 insuranceQuotes.com study, U.S. families who file a single homeowners insurance claim can expect their annual premium to increase 9 percent.

Homeowners need to think hard before filing an insurance claim, says Eli Lehrer, president of the nonprofit think tank R Street Institute.

Don’t ever file a claim if the cost of the repair doesn’t exceed your deductible. And even if it does, Lehrer says it’s important to consider by how much.

For instance, if you have a $1,000 deductible and you put in a $1,200 claim, you’ll only get a $200 settlement — and you’ll also have a claim on your record, which could increase your premium.

2. Bundle home and auto insurance policies.

According to Graves, insurance discounts are frequently offered to those who buy their home and auto insurance through the same carrier.

“Customers who do this are the most valued by insurance companies,” Graves says.

4. Ask your agent about additional discounts.

According to Lehrer, there are myriad discounts available to homeowners, many of which go unnoticed.

For instance, discounts of between 15 and 20 percent may be applied for the following:

- Setting up an automatic payment through your online checking account.

- Installing a 24/7 security system.

- Updating old wiring in your house.

5. Make sure you aren’t over-insured.

According to Graves, homeowners should look closely at coverage they don’t need.

“Many homeowners’ plans (include) ‘extras’ that might not be needed, like additional structures such as sheds, carports, gazebos or a sun room,” Graves says. “If you don’t have any of these, zero that line out. It doesn’t save much, but it could buy groceries for a week.”

To find out whether your insurance coverage includes these items, read through your policy or consult your agent.

6. Shop around.

According to Graves, homeowners should get at least three home insurance quotes every two or three years, and do so at least a month before your current policy renews.

“Your best bet for saving money is going to be changing carriers every so often,” Graves says.

View the press release here.

Methodology

insuranceQuotes.com commissioned Quadrant Information Services to measure the impact of changing a homeowners insurance deductible in each U.S. state and Washington, D.C. Quadrant examined data from the largest carriers (representing 60 percent to 70 percent of market share) in each territory. The home specifications were kept constant in all regions.