Study shows millennials skip renters insurance, putting finances at risk

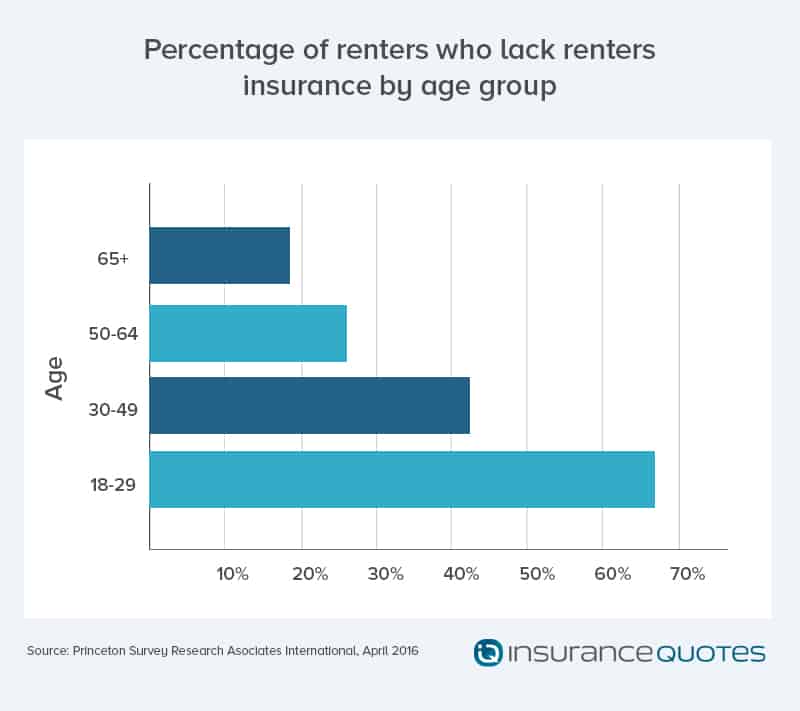

Sixty-six percent of 18- to 29-year-olds rent, compared with just 37 percent of consumers overall. But less than one-third of these young renters have renters insurance, according to an April 2016 survey for insuranceQuotes.com carried out by Princeton Survey Research Associates International.

However, it isn’t lack of money that’s keeping renters 18 to 29 from getting coverage. Consumers in this age group are most likely (59 percent) to say cost isn’t the reason they lack insurance.

Instead, 61 percent of millennial renters cite living in a secure property as an important reason they decided to skip coverage, while 43 percent said they don’t have enough property to insure, and 41 percent said they don’t understand how the product works.

But taking the time to learn about and shop for coverage could pay off for millennials — and all renters, says Linda Sherry, director of national priorities for the consumer advocacy group Consumer Action.

Renters confused about insurance coverage

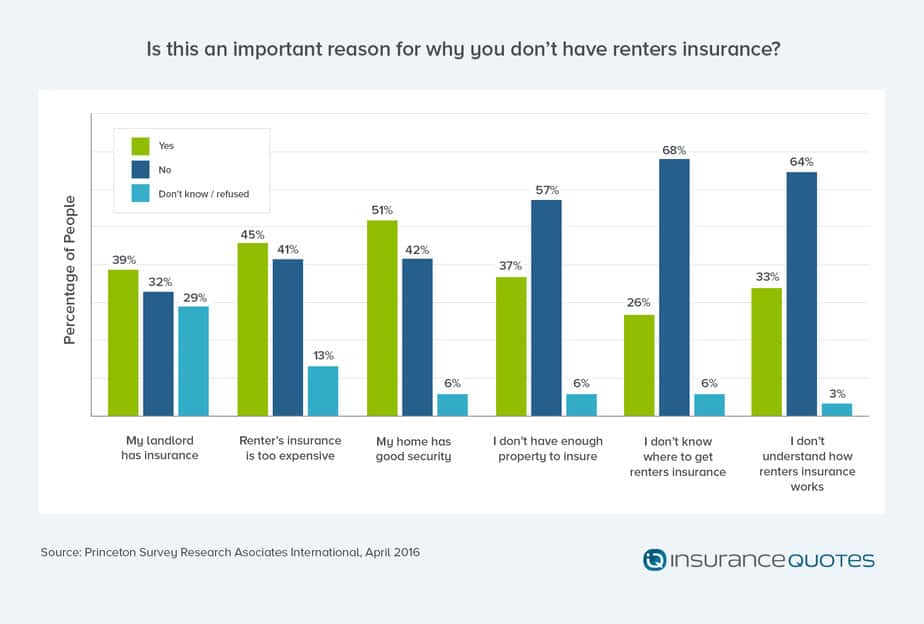

So, why do renters skip renters insurance? A growing number of renters cite a lack of understanding about the product as a big reason they haven’t bought coverage, according to the survey.

About one-third of all renters (33 percent) who go without insurance say it’s because they don’t understand the product, up from 27 percent who said the same in the 2015 survey. And over a quarter of renters (26 percent) say they don’t have a policy because they don’t know where to buy one, up from 20 percent last year.

Renters insurance has three main components:

1. Personal property coverage: Most renters know that insurance covers personal property but wrongly think their stuff isn’t at risk or worth covering. Renters insurance covers the contents of your home, including your clothes, bike, furniture, dishes, TV and other electronics, says Jack Hungelmann, an insurance agent in Minnesota and author of “Insurance for Dummies.” If you’re among the 37 percent of renters who say they don’t have enough property to insure, according to the survey, think again. Even if you have only secondhand furniture and mismatched dishes, you might be surprised at how much it would cost to replace all your possessions at one time, Hungelmann says. For example, the contents of an apartment filled with minimal, low-cost possessions could cost more than $8,000 to replace, according to this personal property calculator from Confluency Solutions, a company that provides services for insurance agents.

As a rough guide to the dollar amount of coverage to buy, add up the cost to replace all the major items in your home: appliances you own, computers, other electronics and furniture, and then double that amount, Hungelmann recommends.

And good security in your building doesn’t mean it’s wise to skip coverage, says Chris Hackett, director of personal lines policy for Property Casualty Insurers Association of America. “Typically, there’s a lot of foot traffic in and out of an apartment building, and you can’t be familiar with everyone who’s coming or going,” he says.

Finally, 60 percent of renters mistakenly believe property stolen from outside your home isn’t covered, according to the survey. New York renter Liran Amrany would have been out of luck if he didn’t have a renters insurance policy. He was covered when, in November 2014, a thief broke into his rental car in San Francisco, swiping his laptop, iPod, sunglasses and other items. His renters insurance paid for the $3,000 loss, minus a $1,000 deductible.

2. Liability coverage: Many renters have no idea that renters insurance offers liability coverage, the survey shows. In fact, only 40 percent of renters know renters insurance covers you in a lawsuit by someone injured in your home, while only 21 percent know it covers you if your dog bites someone outside your home.

The liability component might be the biggest reason to get renters insurance because it can protect you from huge financial losses, Hungelmann says. He had a client who, at age 19, threw a baseball that hit another man in the eye during a game. The injured man later lost his eyesight and sued for $100,000. Fortunately, Hungelmann’s client had renters insurance that paid those costs, Hungelmann says.

3. A place to stay after a disaster: Another feature included in most renters insurance policies is called additional living expenses (ALE) coverage. If you can’t stay in your apartment after a fire, burst pipe or other disaster, ALE coverage will pay for temporary lodging, Hackett says. For example, when Tracee Larson’s Portland apartment caught fire due to a neighbor’s smoldering cigarette in October, her renters insurance paid for her to stay in a hotel for a month until she could move into a temporary apartment, she says. The temporary place costs more than her apartment, so insurance covers the difference in rent, she says.

How to buy and use renters insurance

If you’re ready to get renters insurance, here are some tips for shopping for and using renters insurance.

- Take time to shop. Consumers have multiple options for buying renters insurance, including through an agent, an insurer’s 800 number or online, Hackett says. Visit a local agent who can explain your options. If you go through an agent or broker, Sherry recommends asking them to gather quotes from several insurers.

- Boost liability limits. Many policies come with $100,000 of liability coverage, and most renters don’t think to increase that, Hungelmann says. At minimum, you should have liability coverage equal to your assets, State Farm recommends. But you can get $500,000 in coverage for about $20 extra per year — a bargain that could really save you later, he says.

- Consider flood insurance. About 35 percent of renters mistakenly believe renters insurance doesn’t cover personal property damaged in a natural disaster, the survey shows. However, there is one caveat: Depending on where you live, you might need additional flood insurance, Sherry says. Like homeowners insurance, renters insurance typically doesn’t cover floods, according to Trusted Choice, an association of independent insurance agents. However, it would cover water damage from a plumbing problem like a burst pipe. You can purchase a separate flood policy from the National Flood Insurance Program.

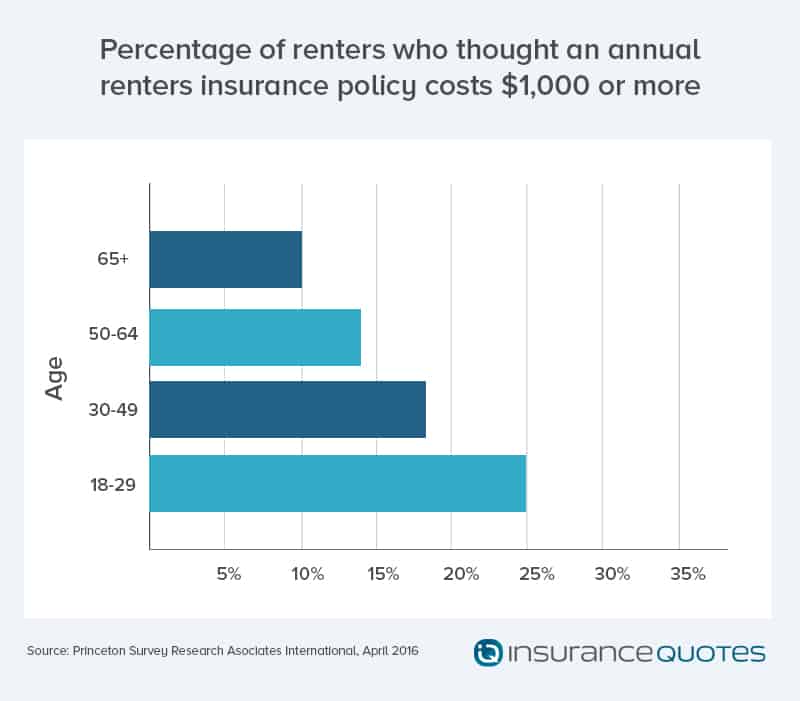

And you might be relieved to learn renters insurance probably won’t bust your budget. Many renters mistakenly think coverage is very expensive, and 25 percent of those ages 18 to 29 think it costs $1,000 annually. In fact, coverage costs an average of $188 a year, according to the National Association of Insurance Commissioners.

“Renters insurance provides a lot of valuable protection and peace of mind for a reasonable amount of money,” Hackett says.

Methodology

The PSRAI April 2016 Omnibus Week 1 obtained telephone interviews with a nationally representative sample of 1,000 adults living in the continental United States. Telephone interviews were conducted by landline (500) and cell phone (500, including 318 without a landline phone). The survey was conducted by Princeton Survey Research Associates International (PSRAI). Interviews were done in English and Spanish by Princeton Data Source from April 7-10, 2016. Statistical results are weighted to correct known demographic discrepancies. The margin of sampling error for the complete set of weighted data is ± 3.6 percentage points.