How Does Pet Insurance Work and What Are the Costs?

When your furry friend falls ill or takes a bad fall off the couch, nobody wants to choose between a pet’s future and the pocketbook. Enter pet insurance.

Pet insurance helps ease the pet health care cost burden for many families facing big bills for critical illness or emergency care for their beloved dogs or cats. September is National Pet Health Insurance Month, so it’s a good time to learn about the products available and assess your pet’s needs.

Finding the perfect pet insurance can be especially important because visits to the veterinarian can be costly. Bills can easily run into thousands of dollars. That’s where pet health insurance comes in, but is it worth the cost of a policy?

The answer depends on your family’s financial situation, and the physical condition of your pet.

“We want the same health care for our pets as we do for other members of our families,” says Dr. William H. Craig, a San Antonio-based veterinarian who is also president of the nonprofit SpaySA. “Unfortunately, a lot of technological advances come with a price tag. Advanced imaging procedures, ultrasounds, high-tech surgical procedure — the list goes on and on.”

Many of these procedures, Craig says, were not possible five or 10 years ago.

“Pets would have had to suffer with consequences of disease,” he says. “We have so many more options these days. However, these procedures come with a price.”

Pet insurance policies vary greatly by provider

According to the New York-based Insurance Information Institute, the pet insurance industry got its start almost a century ago in Sweden where about half that country’s pets are now insured. In North America, Veterinary Pet Insurance issued the first pet insurance policy in the United States in 1982 to Lassie — the most famous four-legged TV star in the world at the time.

Since then, numerous pet insurers have come on board to offer similar policies, covering everything from routine veterinary visits to accidents to illnesses.

The North American Pet Health Insurance Association estimated in 2017 that 1.8 million pets are insured — a number that has grown 11.5 percent from the previous year. That number may sound high, but that’s just a little more than 1 percent of the cats and dogs in North America.

According to Consumer Reports, pet insurance is one of the fastest growing employer benefits being offered, with nearly one in three Fortune 500 companies now offering it to their employees.

According to NAPHIA, dog owners are far more likely to insure their pets than cat owners. But according to Consumer Reports, at least one insurer offers policies that go beyond just dogs and cats and includes “exotic” pets that include amphibians, chameleons, ferrets, geckos and potbellied pigs, to name just a few.

According to NAPHIA, dog owners are far more likely to insure their pets than cat owners. But according to Consumer Reports, at least one insurer offers policies that go beyond just dogs and cats and includes “exotic” pets that include amphibians, chameleons, ferrets, geckos and potbellied pigs, to name just a few.

Coverage, though, can vary wildly from policy to policy. For instance, some pet insurance plans cover treatment for cancer, while other policies do not. Oftentimes, accidents are extra and pre-existing conditions are not covered.

“The sole purpose of pet insurance or any insurance is to soften an unexpected … bill,” says Dr. Frances Wilkerson, a veterinarian who authored “A Vet’s Guide to Pet Insurance.”

No two policies are alike, and it can be hard to figure out which policy is right for you and your pet. Low-cost policies usually don’t cover major illnesses or accidents. It’s up to you to read each policy to see what is and is not covered.

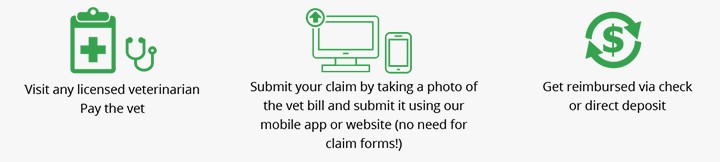

The good news is that there are no networks in pet insurance, as there are in human health insurance. You can go to any veterinarian. Pet health insurance plans are agreements between the carrier and the pet owner.

Policyholders are reimbursed by the insurance company, so the vet is out of the loop. You fill out a form, submit it with your vet’s invoice to the insurance company, and the pet insurance company sends you a check.

What vet treatments are the most expensive?

Wilkerson says costly financial hits in veterinary medicine come in the form of:

- Emergencies (broken bones, accidental poisonings, ingestion of foreign objects).

- Chronic diseases (heart disease, liver disease, cancer, chronic kidney disease).

- Diseases that are contracted quickly (for example, pancreatitis or leptospirosis, a bacterial infection).

“To get an idea of your costs, ask your veterinarian, ‘What is the highest estimated cost I can expect from each of the three scenarios?’ The costs will vary based on geographical location, with big cities being much higher than rural areas,” Wilkerson says.

These, however, are not necessarily the most frequent insurance claims made by pet owners.

Veterinary Pet Insurance, one of the nation’s oldest pet insurers, says bladder infections, dental disease and thyroid conditions top the claims list for cats.

Top claims for dogs were skin allergies, ear infections and upset stomachs.

The typical claim filed under a pet policy in 2017 according to NAPHIA was $263.

How does pet insurance work?

How much does pet insurance cost?

For 2017, NAPHIA says the average annual premium for a dog was $517, and $321 for a cat.

Significant savings can be had by selecting “accident only” policies, and most insurers offer discounts for homes with several pets. However, only 2 percent of policies sold nationally are for accident-only coverage. The typical accident-only policy cost only $168 per year for a dog and $149 per year for a cat.

Dr. Arnold Goldman, a veterinarian at Canton Animal Hospital in Canton, Connecticut, suggests that pet owners ask their veterinarians for recommendations on insurers.

“And your state’s insurance commission can provide you with information about different policies so you can make your own comparisons,” Goldman says.

Goldman believes that pet owners should buy health insurance before any pre-existing conditions occur, “but for major medical only,” he says.

According to the American Pet Products Association, routine vet care typically costs cat owners $196 and dog owners $235.

Thinking ahead is also important because many insurers won’t issue new policies for older pets, who are statistically more likely to have more expensive claims.

Consumer Reports found that pet insurance policies can be worth it if the pet has an unfortunate accident or diagnosis, but really it often just comes down to playing the odds.

“The cost for routine annual care is not worth the bother or extra cost,” Goldman says, “whereas the security of knowing that if a disaster occurs — a sudden illness or accident — the cost of the required care will not have to limit the possibilities or result in the end of a pet’s life. Insurance represents peace of mind.”

Editor’s Note: Michelle Hollow contributed to this updated article.