Why Ohio Auto Insurance Rates Vary Widely Depending on Where You Live

When it comes to the cost of auto insurance in Ohio, the state is comparatively inexpensive. The National Association of Insurance Commissioners, in fact, ranks the Buckeye State as the nation’s 40th most expensive state for car insurance, on average.

Nonetheless, a new study finds that auto insurance premiums for Ohio drivers can vary significantly depending on the city or county they call home.

A recent Quadrant Information Services study, commissioned by insuranceQuotes, examined the average cost of auto insurance premiums in more than 800 Ohio cities. Using a hypothetical 40-year-old female driver with a clean driving record and no prior claims, the study also examined the average cost of auto insurance in all 88 counties statewide, and some of the results were quite significant.

For instance, drivers in Youngstown (the most expensive auto insurance city in the state) pay 22.3 percent more than the state average.

And drivers in Hamilton, Lucas, Mahoning, Lawrence and Franklin counties pay about 11 percent more than the state average.

Meanwhile, drivers in Seneca, Wyandot, Mercer, Van Wert and Hancock (the five cheapest counties) pay about 14 percent less than the state average for car insurance.

Ohio insurance experts and analysts say these differences may be alarming to the average driver, but add that they logically reflect the realities of insurance pricing and the regional variables that play a role.

“There are all sorts of variables that contribute to the cost of insurance from city to city or county to county,” says Ohio-based insurance broker Steven Franklin.

“Things like population density, driving patterns and the competiveness of local markets all play a role. It shouldn’t be surprising to Ohio drivers that some pay more and some pay less.”

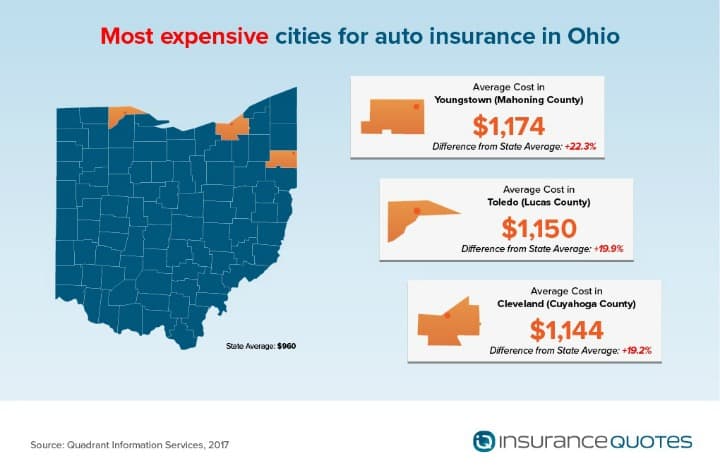

Auto insurance premiums by city

According to the insuranceQuotes study, the average annual cost of car insurance in Ohio is $960. But when it comes to examining the average cost of car insurance on a smaller scale, it’s apparent that not all cities are created equal.

According to the study, the following five cities, on average, have the most expensive annual auto insurance rates in Ohio:

- Youngstown — $1,174; 22.3 percent above average

- Toledo — $1,150; 19.9 percent above average

- Cleveland — $1,144; 19.2 percent above average

- Campbell — $1,125; 17.3 percent above average

- Columbus — $1,094; 14.0 percent above average

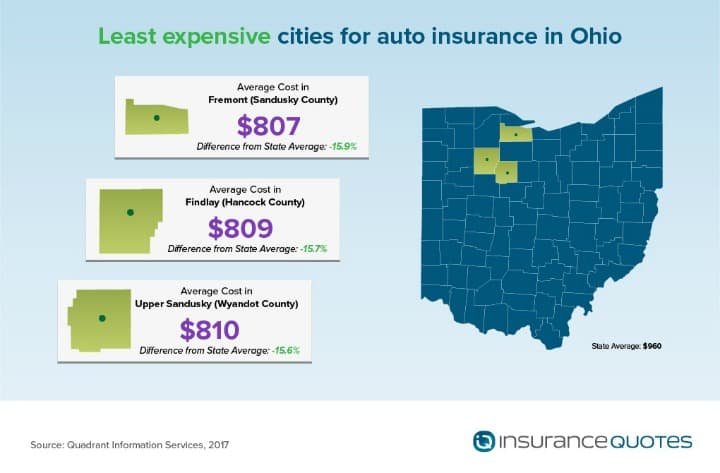

Meanwhile, the following five cities, on average, have the least expensive auto insurance rates in the state:

- Fremont — $807; 15.9 percent below average

- Findlay — $809; 15.7 percent below average

- Upper Sandusky — $810; 15.6 percent below average

- Coldwater — $810; 15.6 percent below average

- Saint Mary’s — $812; 15.4 percent below average

This breakdown of auto insurance costs doesn’t surprise insurance and data analyst and personal finance expert Dan Green. Youngstown, Toledo, Cleveland and Columbus, he points out, are all in the top 10 of Ohio’s most populated cities — and highly populated regions often come with more accidents and more insurance claims.

Conversely, Findlay’s population is just north of 40,000, Fremont is about 16,000, and Upper Sandusky, Coldwater, and Saint Mary’s all have populations of fewer than 9,000 people, which is probably a significant contributing factor to why insurance in these cities is comparatively cheap.

“Traffic patterns and accident data are going to look very different in highly populated or urban areas than they will in more sparse, rural regions,” Franklin says.

“I think that’s what you’re seeing reflected here in the numbers.”

Green also points out that the length of a driver’s commute is also a significant factor in pricing auto insurance, and the average commute for Cleveland drivers is 12 percent longer than anywhere else in the state.

Furthermore, Green finds it interesting that Youngstown is located in Trumbull County, which has the highest unemployment rate in Ohio, which could also be a contributing factor in the average cost of auto insurance there.

“A driver’s employment status is going to impact his or her auto rates,” Green says. “Those without a full time job are considered statistically riskier drivers, on average, which means they are going to pay more for an auto policy.

“When you have a high concentration of unemployment that could bump the numbers up.”

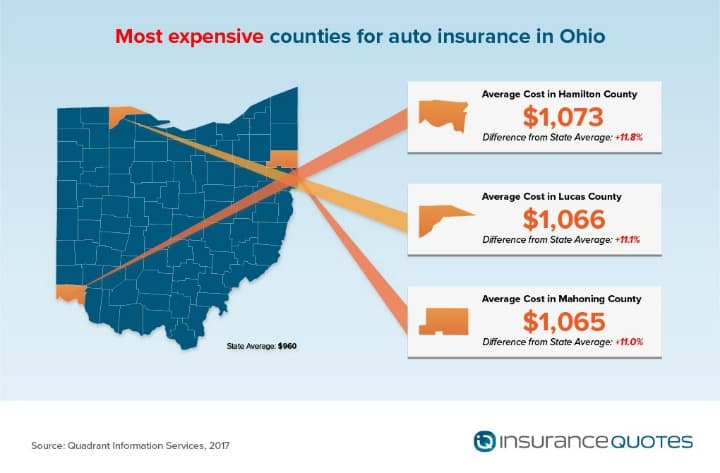

Auto insurance premiums by county

Stepping back and looking at the cost of auto insurance by county, a similarly varied landscape emerges. According to the study, the following five counties, on average, have the most expensive annual auto insurance rates in Ohio:

- Hamilton — $1,073; 11.8 percent above average

- Lucas — $1,066; 11.1 percent above average

- Mahoning — $1,065; 11.0 percent above average

- Lawrence — $1,064; 10.9 percent above average

- Franklin — $1,058; 10.3 percent above average

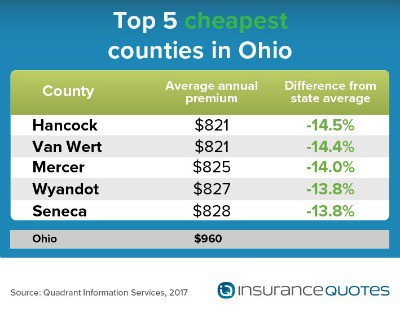

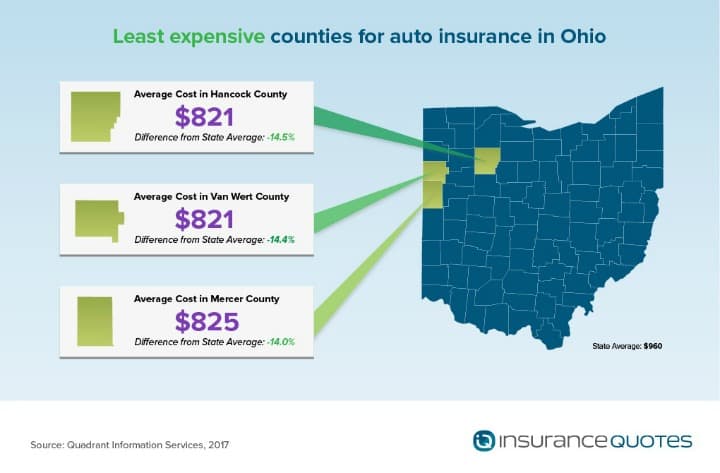

Meanwhile, the following five counties, on average, have the least expensive auto insurance rates in the state:

- Hancock — $821; 14.5 percent below average

- Van Wert — $821; 14.4 percent below average

- Mercer — $825; 14.0 percent below average

- Wyandot — $827; 13.8 percent below average

- Seneca — $828; 13.8 percent below average

Again, geography and driving patterns seem to play a critical role in the distribution. Counties with the least expensive insurance rates tend to be in the state’s most rural, sparsely populated regions, while those counties with the highest rates tend to be the most densely populated in the state.

For instance, Franklin County is the largest in the state, with a population of 1.2 million people. Hamilton is the third most populated county, Lucas is the sixth, and Mahoning is the 10th.

For instance, Franklin County is the largest in the state, with a population of 1.2 million people. Hamilton is the third most populated county, Lucas is the sixth, and Mahoning is the 10th.

Meanwhile, the entire population of Wyandot County is just 22,118. And the entire population of Van Wert is just over 28,000.

More people means more cars, more traffic congestion, and a greater risk for accidents, says Franklin — and the data supports this.

For instance, according to the Ohio State Highway Patrol, Franklin County experienced 524 investigated motor vehicle crashes in 2016, which included 87 fatal crashes.

That same year, Wyandot County only experienced 80 investigated crashes — just two of which were fatal.

“Insurance is all about predicting risk and pricing policies accordingly,” Franklin says. “So when you consider the density of some of these most expensive counties it’s no surprise that drivers there are paying a little bit more than those who live in less densely populated regions of the state.”

In the end, the distribution of auto rates in Ohio seem to be more or less on par with what experts and analysts would expect.

“You’re going to find this types of variability in every state in the U.S.,” Franklin says. “And that’s because no state is entirely homogenous when it comes to the factors influencing auto insurance rates.”

Methodology

insuranceQuotes commissioned Quadrant Information Services to examine the average cost of auto insurance premiums in more than 800 Ohio cities. Using a hypothetical 40-year-old driver with a clean driving record and no prior claims, the study also examined the average cost of auto insurance in all 88 counties statewide.