4 Surprising Factors Driving Up Your Car Insurance Rates

Everyone wants to pay as little as possible for car insurance. The challenge is doing that while ensuring you have reliable and sufficient coverage. So, where do you start? A good place is to understand what goes into determing your auto premium.

Much of what you pay each month for auto insurance is determined by factors that are out of your control, everything from whether you’re a man or woman to how old you are.

Some things you have more control over, such as your driving record, of course. If you have a history of accident-free driving you’re paying far less than you would if you have accident claims in your past.

Factors determining your auto premiums

Here’s a look at some of the more important things that determine your rate. You should always shop for car insurance from multiple insurance companies in order to get the best prices and coverage for your needs.

Here’s a look at some of the more important things that determine your rate. You should always shop for car insurance from multiple insurance companies in order to get the best prices and coverage for your needs.

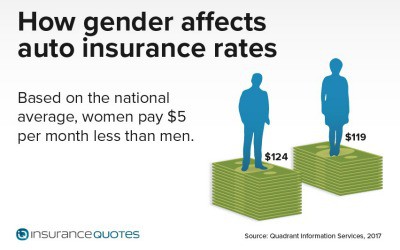

Gender: Whether you’re a man or woman can play a big difference in how much you pay in auto insurance each month. We found that men pay an average of $124 a month for auto insurance, while women pay an average of $119 a month.

That $5 different might not seem like much, but over a year, that comes out to an average of $60 more than male drivers pay.

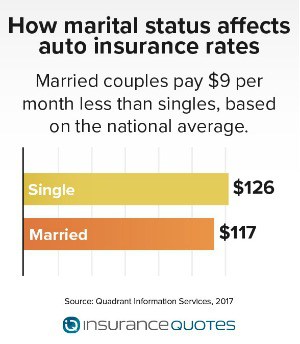

Marital status: You might not think that whether you’re married or single should matter to insurers. But we found that single drivers tend to pay about $9 more a month for car insurance.

Why? Insurers think that married drivers tend to be more responsible, and thereby get into fewer traffic accidents.

Single drivers pay an average of $126 a month for auto insurance, while married drivers pay an average of $117.

That $9 a month comes out to $108 more on average that single drivers pay each year.

Your credit: You already know that your three-digit FICO credit score plays a big role in determining whether you qualify for a mortgage or auto loan and what interest rate you’ll get.

But did you know a version of your credit score could impact how much you pay for auto insurance? Many insurers use a credit-based insurance score to determine how much of a risk you are as a driver.

Drivers with lower insurance scores do tend to file more claims, making them riskier to insure.

CHECK OUT: How Your Commute Drives Up Insurance Costs

Eric Klein, senior attorney with Boca Raton, Florida-based Klein Law Group, says that this often takes consumers by surprise.

It’s important for consumers to realize that anything that hurts their credit might cause their auto rates to increase.

“If you have a $25 medical bill that you refuse to pay because of the way you were treated by the doctor’s staff, your account will go to collections and the negative information will be reported to the credit-scoring company, resulting in a higher insurance premium,” Klein says.

John Espenschied, agency principal with Insurance Brokers Group in St. Charles, Missouri, agrees that credit problems can cause drives’ scores to rise even if these motorists have never filed a claim.

“It’s becoming more common for insurance companies to rescore your policy annually based on your creditworthiness,” Espenschied says.

“Yes, credit is a major factor in determining insurance premiums for new and renewed insurance policies.”

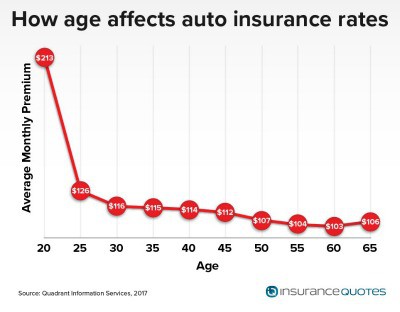

Age: Your age is one of the most important factors in how much you pay for auto insurance. insuranceQuotes found that younger drivers tend to pay significantly more. This isn’t a surprise; younger drivers are less experienced and tend to get into more accidents. This makes them a higher risk, and insurers charge them more because of this.

According to insuranceQuotes, a 20-year-old will pay on average $213 a year for auto insurance. That average drops significantly when drivers hit their 25th birthdays, with insuranceQuotes reporting that drivers at this age pay an average of $126 a month.

The rates really drop, though, when drivers turn 30, falling to an average of $116 a month, and then remaining in that general range until drives hit 50.

RELATED: Guide to Gifting a Car

At that age, drivers pay an average of $107 a month. At age 60, drivers pay an average of $103 a month, with the average rising a bit to $106 when motorists hit their 65th birthdays.

“Data show male teenagers are more likely to have accidents than female teenagers. That is why young males usually incur higher rates,” says Natasha Rachel Smith, a personal finance expert. “Age, however, has the biggest impact on your rate since young drivers with no experience have statistically shown to be immature behind the wheel, so they are risky drivers to insure.”

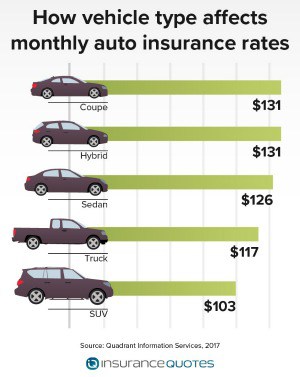

Vehicle type: The car you drive will also influence your insurance rates. According to insuranceQuote’s research, those who drive coupes and hybrids pay an average of $131 a month, while those driving sedans pay an average of $126 and those driving trucks pay an average of $117.

SUV drivers pay less, an average of $103 a month.

“Size, repair cost and safety ratings are all factors that determine your insurance rate,” Smith says. “Smaller vehicles tend to be more dangerous in an accident than larger cars. Large cars with good safety ratings have lower premiums than small cars.

“High safety ratings mean there is a lower chance of medical bills in case of an accident, which results in lower premium rates.”

In general, a newer car will cost less to insure than an older one that lacks certain safety features.

“Newer cars offer a huge variety of safety features, lane departure, back up cameras, blind-spot monitoring,” says Travis Biggert, chief sales officer with Tulsa, Oklahoma-based insurance company HUB International Mid-America. “Most carriers offer discounts for these extra features.”

Methodology

Data from Quadrant Information Services was used to measure the impacts of age, gender, marital status and vehicle type on car insurance premiums in each U.S. state and the District of Columbia. Averages are based on driving 12,000 miles per year, having a clean driving record, and good credit. Policy limits include $100,000 for injury liability, $300,000 for all injuries, a $500 deductible on collision and comprehensive coverage and uninsured motorist coverage