How Traffic Violations Will Affect Your Insurance Rates

Most U.S. drivers know that being charged with a traffic moving violation, like speeding, will likely result in your car insurance premium going up. What may prove shocking, however, is just how significant that rate increase can be.

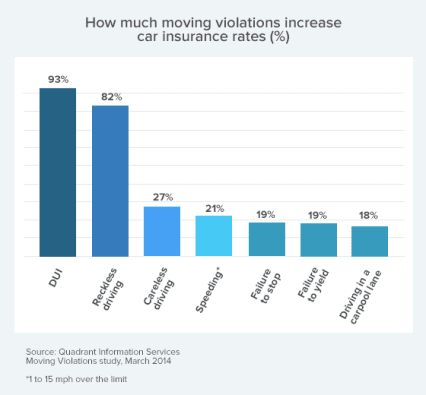

A recent study, commissioned by insuranceQuotes.com, found that car insurance premiums can climb by as much 93 percent after a single moving violation. The study compared the average national premium increase for one moving violation in seven categories:

- Careless driving

- Driving in a carpool lane

- DUI

- Reckless driving

- Failure to stop

- Failure to yield to pedestrians

- Speeding

The study found that the increases varied significantly between different types of auto traffic violations. For instance, one conviction for driving under the influence (DUI) will result in a national average premium increase of 93 percent; however, driving in a carpool lane without the required number of occupants in the car results in an 18 percent average premium spike.

According to Mike Barry, spokesman for the nonprofit Insurance Information Institute, the study illuminates the ways in which insurers use various driving infractions as a way to assess different levels of risk for individual drivers.

Dangerous activities, such as driving under the influence and reckless driving, frequently result in premium increases above 50 percent, while other activities such as failure to yield to pedestrians result in increases of 15 percent or less.

“Insurers base their rates on experience, so the violations that cause premiums to jump the most are the ones that, over the years, insurers have found are strong indicators that the driver is likely to have an accident in the future,” Barry says.

Auto Premium Increases by Moving Violation Type

These are the average national auto insurance premium increases for seven traffic moving violations from greatest to least:

- DUI — 93 percent.

- Reckless driving — 82 percent.

- Careless driving — 27 percent.

- Speeding 1 to 15 mph over the limit — 21 percent.

- Speeding 16 to 30 mph over the limit – 28 percent.

- Speeding 31+ mph over the limit – 30 percent.

- Failure to stop — 19 percent.

- Failure to yield to pedestrians — 19 percent.

- Driving in a carpool lane — 18 percent.

Tully Lehman, spokesman for the Insurance Information Network of California, says it makes sense that certain traffic moving violations will result in greater premium increases than others.

For instance, speeding 5 mph over the posted limit is very different from racing a friend at 100 mph, which could result in a reckless driving charge. And insurers have very specific algorithms (prior insurance data and equations used to predict future driving behavior) that show certain types of moving violations are more indicative of future risk.

“The likelihood of (a driver) being in an at-fault accident is higher after a reckless driving violation compared to someone who gets pulled over for driving in a carpool lane,” says Dan Weedin, a Seattle-based insurance and risk management consultant.

This sentiment was echoed by the Kentucky Department of Insurance.

“Companies assess different weights to various violation types,” says Ronda Sloan, spokeswoman for the Kentucky Department of Insurance. “This would result in higher premium increases for some types with smaller increases for others. Companies may tier violations based on the likelihood that a certain behavior causes, or is the predictor, of an accident.”

The Difference Between Reckless and Careless Driving

While every state has its own specific definition, Barry says reckless driving is typically considered a blatant disregard of traffic laws and driving safety that intentionally makes things riskier for others on the road. Careless driving, however, is usually defined as an unintentional act that causes a risk to others

For instance, reckless driving includes things like drag racing and road rage, while careless driving could include offenses such as switching lanes without signaling, following another car too closely, or driving while texting or talking on a cellphone.

“Reckless driving is a far more serious offense than careless driving,” Barry says. This view is reflected in the study’s numbers; one reckless driving offense can increase your premium by 81 percent, which is three times more than a careless driving charge (27 percent).

Violation Forgiveness and Driving Classes

Some car insurers are more forgiving of minor traffic tickets, like speeding or driving in the carpool lane, than others. According to Jeff Sibel, a spokesman for Progressive, if you have a previously clean record and haven’t filed any insurance claims, a single moving violation for minor offenses like failure to stop or driving in the carpool lane may not result in higher premiums.

Also, many states offer driving classes to help drivers remove one or two moving violations from their records. For instance, Ohio drivers can take up to three driving classes over the course of a lifetime. After successfully completing the course, drivers are awarded a two-point credit that improves their driving records. So if you get a speeding ticket that added two points to your driving record, completing an approved driving class would wipe away those points.

Some car insurers may overlook a traffic ticket if you also have a homeowners insurance policy with them, says Michael Cicero, a traffic attorney in Ohio.

“I come across insurance agents and brokers all the time who tell me that people who bundle multiple types of insurance together usually do better with ticket forgiveness than customers who only have auto coverage,” Cicero says.

Shopping for a New Car Insurance Policy

Shopping for new insurance quotes after receiving a traffic moving violation is usually a good idea. iQ can help you get the best auto rates in your area. Talk to one of our live advisers today or simply fill out a form and we will get you started.

“Some insurers penalize mistakes less harshly than others, so you may be able to find a new policy that’s cheaper than the one you have, even with a moving violation on your record,” Barry says. “Just be sure to honestly reveal your driving record on the application. Withholding pertinent information like a recent major traffic ticket can result in the insurer denying a claim. Then you’re really paying for your mistakes.”

Study methodology: The study assessed data from all garageable ZIP codes in every U.S. state and 60% to 70% of the carrier market share in each state. Averages are based on a 45-year-old married female with a previously clean driving record who commits one traffic driving violation in a 12-month period, drives a 2012 sedan, is employed, has a bachelor’s degree, excellent credit score and had no lapse in coverage with the following limits: $100,000 (bodily injury per person) / $300,000 (bodily injury per accident) / $100,000 (property damage per accident), $10,000 (personal injury protection or medical payments) and a $500 deductible for comprehensive and collision.