Why the Federal Flood Insurance Program Is Under Water and Sinking Fast

To put it simply, the National Flood Insurance Program (NFIP) is in serious trouble. And after the 2017 hurricane season — officially the most expensive on record — the flaws of this ambitious but beleaguered federal program have never been starker.

What’s far less obvious is what needs to be done to fix it.

“I think it’s clear that [the NFIP] was a well-intentioned program that’s now being held together by string and fraying duct tape,” says Jason Wolf, manager of the property insurance litigation group Koch Parafinczuk Wolf Susen in Fort Lauderdale, Florida. “I think it’s good that we seem to be having conversations about the program on a national level, but those conversations have been going on since Katrina. And that was 12 years ago.”

RELATED: What are Trump’s Plans for Federal Flood Insurance?

According to current estimates, the United States suffered more than $200 billion in damages resulting from 17 named storms between June 1 and Nov. 30. But even before that unprecedented onslaught — which saw U.S. coastal devastation from Harvey and Irma, as well as catastrophic wreckage to Puerto Rico by way of hurricane Maria — the NFIP was in dire straights.

An April 2017 report by the American Academy of Actuaries’ Flood Insurance Work Group found that the federal program is $25 billion in debt.

What’s more, this most recent hurricane season could bring the NFIP to its federally mandated $30.4 billion borrowing cap after claims from Harvey and Irma are paid out.

“It’s clear that the financial difficulties facing the NFIP are closely related to what we call mega storms or extreme weather events, and in order for the program to have long term fiscal solidity it needs to address how those events are funded,” says Rade Musulin, vice president of causality at the American Academy of Actuaries and chair of the work group that conducted the study.

“It’s clear that the financial difficulties facing the NFIP are closely related to what we call mega storms or extreme weather events, and in order for the program to have long term fiscal solidity it needs to address how those events are funded,” says Rade Musulin, vice president of causality at the American Academy of Actuaries and chair of the work group that conducted the study.

But Musulin is quick to add that the problems facing the NFIP go beyond funding and economics.

“There are some long term challenges to consider and one of them is rising sea levels. Given that the NFIP has more than a million policies for people living within a mile of the coast, rising sea levels pose a long term challenge to the program, and that needs to be thought about,” Musulin says. “Congress often looks at things like Medicare and Social Security with a long term view, and we think the same type of foresight should occur when considering the future of the NFIP.”

As it stands right now, however, short-term thinking rules the day. Faced with a another extension and a new Feb. 8 funding deadline, there is little time for lawmakers to work on a long-term reauthorization plan for the program moving forward.

Wide political and economic divides exist within the House and Senate concerning the NFIP, and it’s unclear if those can be bridged in just a matter of days. So, expect yet another short-term extension.

“My understanding is that this just isn’t a top priority for Congress right now,” Wolf says. “And this issue isn’t just important for people living

Flood insurance 101

In 1968 Congress passed the National Flood Insurance Act, which enabled homeowners in high-risk flood plains to purchase insurance underwritten by the U.S. government through the NFIP, which is currently administrated by the Federal Emergency Management Agency (FEMA). In the event of water damage from flooding, the insured homeowner has coverage up to statutorily set limits for his or her property.

The program came about after the federal government realized private insurance companies were unable to provide flood insurance to homeowners at a reasonable cost, resulting in increasingly high federal disaster relief expenses. So the federal government started subsidizing flood insurance and the NFIP offered substantially discounted policies.

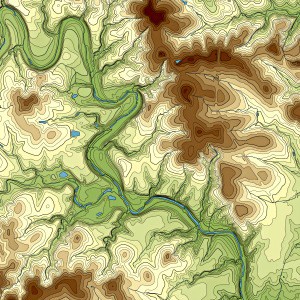

But here a problematic lack of foresight was already emerging. In addition to providing discounted insurance, the NFIP also mapped out Special Flood Hazard Areas (SFHA) demarcating extremely flood-prone regions in the country. This was supposed to discourage homeowners and developers from buying and building property in these zones. But that didn’t happen.

CHECK OUT: How Insurance Misconceptions Can Cost You

“They presumed that if we told people they were at risk for flooding they would move,” said FEMA Deputy Associate Administrator for Insurance and Mitigation Roy Wright in a recent C-SPAN interview. “They also presumed the discounts wouldn’t need to be continued because they presumed that once people knew the risk they would move out. That has not proven true.”

Today, the NFIP insures about 5.5 million homes nationwide, and a certain percentage of them are known as repetitive loss properties — homes that are continually damaged by flooding and then repaired or rebuilt using federally subsidized insurance policies. This particular problem is cyclical and experts say it plays a significant role in the NFIP’s current financial woes.

“The risks of living in a flood-prone region are not being accurately felt in the free market of people looking to buy or build homes in these areas,” says Matthew Pinsker, a professor at Virginia Commonwealth University’s Department of Homeland Security and Emergency Preparedness. “The risk of living by the ocean is being subsidized by the taxpayers, and there’s almost no financial disincentive to taking on that risk.”

What’s more, says Pinsker, the NFIP is simply paying out more than it’s taking in.

In 2012 The New York Times took a deep look at this particular problem by examining insurance losses from floods on Dauphin Island, a small piece of land located four miles off the Alabama coast. According to the Times article, property owners have paid just $9.3 million in premiums to the NFIP since 1988, but have received $72.2 million in payments for their damaged homes during that same time frame.

“It’s not surprising that the NFIP is experiencing large deficits,” Musulin says. “With Harvey and Irma we see again that there are very significant events putting further strain on the program and yet building continues in high risk areas. All of this is converging on why Congress needs to substantially review the program.”

False sense of security after a flood

To be sure, the problems facing the NFIP are not merely the concerns of rich Americans looking to build vacation homes on risky beaches or rebuild damaged properties next to flood-prone inlets.

Consider, for instance, Hurricane Harvey, which left behind close to $180 billion in damage after hitting the Houston metro area in late August. The flooding from that storm was unprecedented and catastrophic for thousands of homeowners, many of whom didn’t have flood insurance because they had no idea they lived in a flood-prone area.

“A lot of those victims in Houston had no idea that their city and the outlying suburbs were built on one giant flood plane,” Wolf says.

Under the Flood Disaster Protection Act of 1973 and the National Flood Insurance Reform Act of 1994, mortgage lenders are mandated to require the purchase of flood insurance by property owners who obtain mortgage loans from federally regulated, supervised, or insured financial institutions for structures located within —or to be located within — a Special Flood Hazard Area. The problem is that flood zone mapping can be wildly inaccurate, as was highlighted by a recent study from Rice University and Texas A&M University at Galveston and published in the journal Natural Hazards Review earlier this year.

The study analyzed flood claims from several Houston suburbs between 1999 and 2009. It found that “FEMA’s 100-year flood plain maps — the tool U.S. officials use to determine both flood risk and insurance premiums — failed to capture 75 percent of flood damages from five serious floods, none of which reached the threshold of a 100-year event.”

Aside from their remarkable inaccuracy in predicting future flood losses, these maps are also problematic for another reason.

“These maps create a false impression that there’s a black and white line, where on one side of the street you have a flood risk and on the other side you don’t. Rather, it’s thousands of shades of gray, and that’s a public education issue,” Musulin says. “The NFIP will sell policies outside high risk zones, but most people don’t buy them because they don’t think they need to. And that needs to be addressed with more public education.”

In order to determine the flood zone risk for a particular region, current and prospective homeowners can visit the NFIP’s website at for access to national flood-hazard maps that detail various levels of risk.

No easy solution for flood insurance funding

There have been attempts at solving the NFIP’s woes in the past, but they’ve been less than effective in combatting its deepest problems.

For instance, the Biggert-Waters Flood Insurance Reform Act of 2012 was originally drafted to address many of the NFIP’s most fiscally untenable elements. Under the proposed bipartisan legislation properties built before the NFIP would no longer be grandfathered into the program, repetitive loss properties would be denied coverage, and premiums were going to increase in order to more accurately reflect actuarial risk.

But after numerous special interest groups — including the National Association of Homebuilders — and angry coastal constituents complained about the potential for skyrocketing premiums, politicians scaled back many of the bill’s most substantive reforms and ended up passing a much less ambitious (and less effective) law.

At the end of the day, Pinsker says, “there’s no easy solution.”

“People who currently own waterfront or flood-prone property bought that property with the promise that this federal program would be there if they needed it. And if you suddenly take that promise away, it could make that property virtually worthless overnight,” Pinsker says. “A change is going to be painful and costly for some, but it’s obvious that things simply can’t continue the way they are.”