Study: Auto Claims Continue to Drive Up Insurance Costs Despite Year-Over-Year Drop

It’s a widely understood fact of life for anyone who’s filed (or has considered filing) an auto insurance claim: your premium is going to increase. But just how significant an increase can you expect? A new insuranceQuotes survey has the answer — and some of the numbers may be surprising.

For the fifth consecutive year, insuranceQuotes and Quadrant Information Services examined the average economic impact of filing various claims on your auto insurance policy.

Using a hypothetical 45-year-old married female driver who is employed, has an excellent credit score, has no lapse in coverage, and has filed no previous auto insurance claims, the study looked at how much annual premiums can go up, on average, after filing one of three different types of claims:

- Bodily injury

- Property damage

- Comprehensive

The study also looked at the impact of the claim’s dollar amount ($2,000 or more) and compared the average premium increases for all 50 states and Washington, D.C.

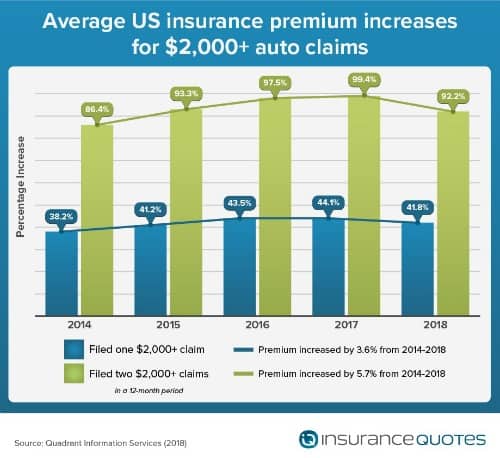

The study’s findings indicate that average premium increases after filing a single claim can be significant, and that while these increases have, on average, gone up steadily in recent years, though they are showing signs of leveling off (and, in some cases, even dropping).

Expect a substantial premium increase after a claim

Continuing with the trend of previous years’ studies, our 2018 analysis found that drivers who make a single auto insurance claim of $2,000 or more will see a substantial increase in their premiums — an average of 42 percent to be exact. And while this is certainly a considerable jump, it’s also less than last year’s average increase of 44 percent.

Filing a second claim in one year is even more costly, with an average annual premium increase of 92 percent (a 7 percent decrease from last year’s 99 percent spike, which was the largest increase over the past five years.)

According to the National Association of Insurance Commissioners (NAIC), the average cost of an auto insurance premium in the United States is $841, which means an increase of 42 percent would result in a $352 annual spike.

RELATED: 5 Things Uber Drivers Should Know About Insurance

According to experts and analysts, the reason for these substantial premium increases, even after a single claim, comes down to the predictable nature of claim data.

“Insurance carriers assess risk based on probability, and the probability of a second claim goes up after you file your first,” says California-based attorney and insurance expert Farid Yaghoubtil. “As a result the insurance carrier’s algorithm used to evaluate your policy will shift. This will, in essence, indicate to the insurance carrier that you’re now an at-risk driver and will effectuate a change in your underlying costs. This has always been the case when dealing with insurance coverage.”

Type of claim tied to increase amount

If you have to file an auto insurance claim, the good news is that an increase will typically only kick in for accidents where you were at fault. If someone hits you, however, that driver’s insurance will cover the claim and typically your rates won’t be affected.

If you have to file an auto insurance claim, the good news is that an increase will typically only kick in for accidents where you were at fault. If someone hits you, however, that driver’s insurance will cover the claim and typically your rates won’t be affected.

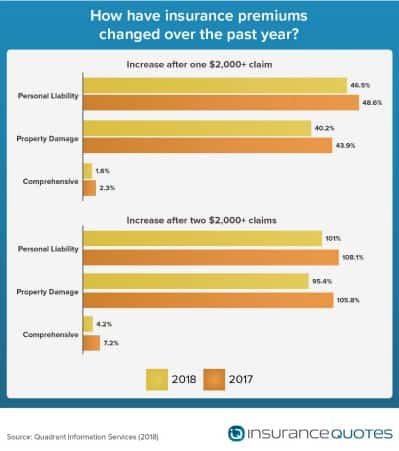

For instance, a single bodily injury claim — which is filed whenever you cause injuries to individuals as the result of an accident—will result in an average premium increase of 46 percent.

Meanwhile, a single comprehensive claim — which pays for damage that results from something other than a collision, such as fire or theft —results in an average premium increase of less than 2 percent.

Again, says Yaghoubtil, it all comes down to statistical probabilities, because insurers know that if you file a claim after an accident for which you were at fault, you are statistically more likely to file another claim in the future.

“There’s a big difference between filing a claim because, say, you hit someone while driving recklessly versus filing a claim after a vandal caused damage to your car while it was parked overnight,” Yaghoubtil says. “Again, it stands to reason that the degree to which your premium increases is based on how the insurers assesses your level of future risk.”

Where you live affects what you pay

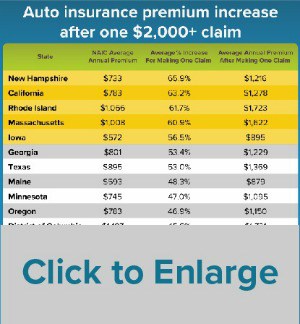

According to the insuranceQuotes study, premium increases vary widely by state.

For instance, filing a single auto claim of $2,000 or more in New Hampshire will result in an average premium increase of 66 percent (the most significant increase in this year’s study and an increase from the state’s average 2017 increase of 60 percent.)

According to the NAIC, New Hampshire drivers pay an average annual premium of $733. That means a single auto insurance claim in that state could result in paying an additional $483 per year for auto insurance.

Meanwhile, other states were far below the national average.

For instance, Kentucky drivers who file a single auto claim of $2,000 or more will only see a 19 percent spike in annual premiums, on average. According to NAIC figures, that’s an annual increase of about $150.

The following five states showed the greatest average premium increase as a result of filing any type of claim of $2,000 or more:

- New Hampshire — 65.9 percent increase

- California — 63.2 percent increase

- Rhode Island — 61.7 percent increase

- Massachusetts — 60.9 percent increase

- Iowa — 56.5 percent increase

Meanwhile, the following five states, on average, showed the smallest percentage premium increase as a result of filing any type of claim of $2,000 or more:

- Kentucky — 19.4 percent increase

- Tennessee — 20.1 percent increase

- Michigan — 22.2 percent increase

- Oklahoma — 23.4 percent increase

- West Virginia — 27.8 percent increase

According to Doug Heller, an independent consumer advocate who specializes in insurance, there is one overarching reason why certain states show more significant premium increases than others — regulation.

Heller points out that both Massachusetts and California, for example, have “the most prohibitive insurance regulations in the country” when it comes to using socioeconomic factors like credit scores and occupations to set a driver’s auto insurance premiums.

CHECK OUT: Adding a Teen Driver Can Double Your Insurance Premiums

For instance, California voters passed Proposition 103 in 1988, which significantly limited the factors insurance companies could use when determining auto rates, including a ban on using credit scores. Since then, Heller says insurance companies in the Golden State must base insurance premiums on three primary factors:

- Driving safety record.

- Average miles driven per year.

- Years of driving experience.

“Essentially, I would expect to see pretty dramatic rate increases in states like California and Massachusetts for people who cause accidents because rates in these states are very closely aligned with driving safety,” Heller says. “At the end of the day, this is all about how insurance companies prioritize information about their customers.”

Meanwhile, states like Kentucky, Tennessee, and Michigan can use a whole host of nondriving-related factors when setting premiums, including gender, age, marital status, occupation, and a driver’s credit score.

The bad news is that drivers in states like California and Massachusetts get hit hardest after filing a single claim, but this comes with a greater benefit to the larger population of drivers in that state, says Heller.

“At its best, insurance pricing is supposed to incentivize safety, and premiums should be adjusted to reflect that,” Heller says. “If you cause a lot of accidents but don’t really see an impact on your premiums, it’s one less reason people need to worry about driving safely.”

Bodily injury claim the costliest

According to the insuranceQuotes study, different types of claims have different impacts on your insurance premium, and bodily injury (liability) claims are by far the most expensive.

Bodily injury claims are filed whenever a driver causes injuries to individuals as the result of an accident. And because they are often so costly, every state except New Hampshire requires drivers to obtain a minimum amount of coverage for these circumstances.

Consider that according to the NAIC, the average bodily injury claim cost $16,110 in 2016, while the average property damage claim was just $3,683.

Yaghoubtil says the higher cost of bodily injury claims is because doctors and hospitals typically generate larger bills than auto body repair shops.

“Generally speaking, insurance carriers will have the highest degree of exposure for bodily injury claims,” Yaghoubtil says. “These claims carry the highest payout for insurance companies. As a result the value of the premium will change according to the degree of the exposure.”

According to the insuranceQuotes study, filing one bodily injury claim of $2,000 or more will result in a national average premium increase of 46 percent per year (down from 49 percent in 2017.) And filing two bodily injury claims results in an average premium spike of 101 percent.

However, there are several states that buck the national average.

The following five states showed the greatest average premium increase as a result of filing one bodily injury claim of $2,000 or more:

- California — 75 percent

- New Hampshire — 72 percent

- Rhode Island — 68 percent

- Massachusetts — 66 percent

- Iowa — 61 percent

Meanwhile, the following five states, on average, showed the smallest percentage premium increase:

- Kentucky — 21 percent

- Tennessee — 22 percent

- Michigan — 24 percent

- Oklahoma — 25 percent

- West Virginia — 30 percent

“Bodily injury claims are typically the most costly of the three, because anytime you involve bodily injury it’s more likely to involve expensive medical costs and possibly litigation — which is also expensive,” says Nancy Kincaid, spokeswoman for the California Department of Insurance. “A bodily injury claim will result in not only losing one’s good driver discount but also in a significant surcharge.”

Property damage claim causes rate spike

When you’re involved in an accident that results in damage to your vehicle, someone else’s or other types of property — like mailboxes or buildings — you’re likely to file a property damage claim. In general, these are far less expensive than bodily injury claims, but result in some hefty premium spikes nonetheless.

According to the NAIC, the average auto claim for property damage in 2016 was $3,683.

According to the insuranceQuotes study, filing one property damage claim of $2,000 or more will result in a national average premium increase of 40 percent. However, as with bodily injury claims, several states fall above and below this average.

The following five states showed the greatest average premium increase as a result of filing one property damage claim of $2,000 or more:

- New Hampshire — 70 percent increase

- Massachusetts — 66 percent increase

- Rhode Island — 63 percent increase

- Iowa — 61 percent increase

- Georgia — 58 percent increase

Meanwhile, the following five states, on average, showed the smallest percentage premium increase as a result of filing one property damage claim of $2,000 or more:

- Kentucky — 21 percent increase

- Tennessee — 22 percent increase

- Michigan — 24 percent increase

- Oklahoma — 25 percent increase

- West Virginia — 30 percent increase

And while the average bodily injury claim is several times more expensive than a property damage claim, the premium increases are similar, say analysts, because the factors used to determine those increases are the same.

In other words, it’s not necessarily the cost of the claim that matters, but what that particular claim type says about a driver’s likelihood of filing a future claim.

Comprehensive claims least impactful for rates

Of the three different claims featured in the insuranceQuotes study, comprehensive claims resulted in the least significant premium increases.

Of the three different claims featured in the insuranceQuotes study, comprehensive claims resulted in the least significant premium increases.

A comprehensive claim pays for damage that results from something other than a collision, such as fire or theft. According to the NAIC, the average cost of a comprehensive claims in 2016 was $1,748 — but the smaller cost of paying for a comprehensive claim isn’t the primary reason why it barely affects premiums.

“It makes sense that comprehensive claims barely move the needle because they’re the result of something beyond the driver’s control,” Heller says. “So it really doesn’t tell an insurer anything about the future likelihood of filing another claim.”

The numbers bear this out. According to the insuranceQuotes study, the national average premium increase after filing one comprehensive claim of $2,000 or more is just 1.6 percent (and just 4 percent for a second claim).

However, a few states did come in above average.

The following five states showed the greatest average premium increase as a result of filing one comprehensive claim of $2,000 or more:

- Oregon — 11 percent increase

- Nebraska — 11 percent increase

- Iowa — 9 percent increase

- Wisconsin — 9 percent increase

- Louisiana — 8 percent increase

Meanwhile, 24 states showed a premium increase of less than 1 percent, and 18 of those showed no increase at all.

Premium spikes only temporary

The upside to all of this is that premium increases eventually simmer back down to pre-claim levels.

Yaghoubtil says drivers can expect rates to remain high for between three to five years, depending on the severity of the claim. In the years following your claim you can expect the premium to gradually lower closer and closer to pre-claim levels (provided you don’t file another claim during that time).

“And it’s never a bad idea to shop around for a new policy after you’ve filed a claim,” Yaghoubtil says. “There’s no guarantee that you’ll pay less because other companies will know you’ve recently filed a claim. But you never know. You might get a better deal. It’s worth a shot.”