Study: Poor Credit Can Double Auto Insurance Rates

This may or may not come as a shock, but insurance companies are very interested in your credit score, and the strength (or weakness) of that score can drastically affect what you pay for auto insurance.

“It’s really hard to say exactly how much your credit score is going to affect your premiums, because every insurance company uses the score differently,” says Bob Hunter, former Texas Insurance Commissioner and current director of insurance at the D.C.-based Consumer Federation of America, a consumer advocacy organization. “But I do know that the data I’ve seen shows that a poor credit score can easily result in paying at least 50 percent more for auto insurance. That’s a lot of money.”

CHECK OUT: How Your Daily Commute Affects Your Insurance Premiums

In order to quantify this variable, insuranceQuotes commissioned a study to examine the average economic impact your credit-based insurance score has on auto insurance. Using a hypothetical 45-year-old, married female driver with a bachelor’s degree and no prior claims or lapses in coverage, the study looked at how much annual premiums can change based on this unique rating factor.

The study found that if you have an average, or median, credit-based insurance score, you’ll pay 28 percent more for car insurance than a driver with an excellent score. And if you have a poor credit-based insurance score, your premium doubles, increasing your rate by 103 percent.

It’s an important — and often confusing — aspect of determining premiums, and many consumers aren’t even aware that credit history is being used this way. Nonetheless, analysts and experts say it’s critical that consumers know how credit-based insurance scoring works and what they can so to improve their own score.

What is a credit-based insurance score?

No one has a single, all-encompassing credit score. You’ve got dozens, actually, and each one is used differently depending on the financial circumstance.

For instance, you’ve got credit scores that measure your creditworthiness when applying for a new credit card. You’ve got other credit scores used to determine whether or not you should be approved for a mortgage. And yes, you’ve even got credit scores that insurance companies use to help determine what you will pay for home or auto insurance.

For more than a decade now, the vast majority of U.S. insurance companies (about 97 percent) have been using something known as a credit-based insurance score in determining individual premiums. Only California and Massachusetts ban the use of insurance credit scoring for rating purposes. Hawaii does not permit its use for auto insurance and Maryland bans it for homeowners insurance.

“Credit-based insurance scores are used by almost every insurance company in the nation because it’s a very good segmentation tool,” says Lamont Boyd, insurance underwriting expert at the credit-based insurance scoring firm FICO. “It’s such a powerful tool because it is very, very predictive of future losses. In other words, lower scoring individuals typically have more insurance losses than those in the higher ranges, which means they are more expensive to insure.”

According to Boyd, credit-based insurance scoring dates back to the early 1990s, when FICO conducted numerous studies with insurers across the country to determine whether or not a statistical correlation existed between certain aspects of one’s credit score and the likelihood that he or she will file an auto insurance claim in the future.

“What we found is that there is a correlation,” says Boyd. “The data proves over and over again that people who choose to effectively manage their finances are also less likely to have future insurance losses. We don’t really know why, but we can prove statistically and empirically that this is the case.”

To that end, one’s credit-based insurance score is created using approximately 20 to 30 different aspects of financial data collected by the major credit bureaus. They may include:

- Outstanding debt

- Length of credit history

- Late payments

- Collections and bankruptcies

- New applications for credit

“About 40 percent of every consumer’s bottom line score will be driven primarily by whether or not you paid your credit obligations on time,” says Boyd. “The second most impactful factor, accounting for about 30 percent of the scoring model, is based on how much you owe compared to your credit limits.”

Boyd explains that when an insurance company wants to use credit as one of its factors in underwriting a new policy, they purchase an insurance score from one of the major credit-reporting agencies. That reporting agency then runs the consumer’s credit report through FICO’s scoring model and sends the score back to the insurer, along with the reasons why the score came out the way it did.

According to Mike Barry, spokesman for the nonprofit Insurance Information Institute, credit-based insurance scores range between 100 and 999. The higher the number, the better the score.

“In essence, the higher the score, the less likely you are to file a future insurance claim, which means you are less of a risk to the insurance company,” says Barry. “A good score is typically above 760 and a bad score is generally considered anything below 600.”

How does your credit-based score affect premiums?

When it comes to the way credit scores are used by lenders, the equation is the same across the board. So, for instance, a credit score of 720 is going to be equally favorable whether you’re applying for a new credit card, a car loan, or a mortgage.

When it comes to credit-based insurance scores, however, there is no uniformity—and that’s where things get complicated.

“Let’s say you have a credit-based insurance score of 720. Well that’s going to mean one thing to insurance company X and another thing entirely to insurance company Y,” says Boyd. “That’s because each insurance company weights these scores differently when coming up with premiums.”

If this sounds a bit abstract it’s because insurance companies don’t like to let the public know precisely how they use credit-based insurance scores to write new policies. It’s a tightly guarded and highly confidential piece of the overall underwriting puzzle.

“Consumers can certainly ask their agents to explain how heavily this score is weighted, and the agent may be able to give some guidance on which insurers weigh this more heavily than others,” says Barry. “But you’re going to have difficulty quantifying this. Insurance companies feel as though they are at a competitive disadvantage if they share with the public the extent to which they use these scores in writing new policies.” You should compare car insurance companies to make sure you are getting the best price for your insurance premium.

It’s also important to understand that unlike a traditional credit score, consumers do not have access to their credit-based insurance score, and that’s because there is no one single scoring model used by all insurers (or credit agencies).

“I wish consumers could see their score, and it’s actually something I’ve been working on for years,” says Boyd. “The problem is that there are several different scoring models currently in use to calculate credit-based insurance scores, including models developed by third-party vendors and individual insurance companies. There are just too many variables and inconsistencies.”

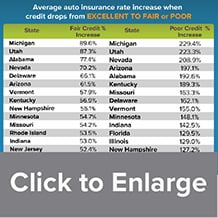

Regardless of the specific formulas used by insurers, our study shows that credit has a significant impact on what you pay for auto insurance. What’s more, we reviewed three tiers of credit: excellent, average and poor. How these tiers impact your insurance premium varies widely from state to state.

The following five states showed the greatest average premium increase if you have average credit as opposed to excellent credit.

- Michigan — 68 percent increase

- Utah — 64 percent

- Alabama — 57 percent

- Nevada — 49 percent

- Delaware — 49 percent

Excluding Hawaii, Massachusetts and California, the following five states, on average, showed the smallest percentage increase.

- North Carolina — 13 percent increase

- Virginia — 18 percent

- New York — 22 percent

- Arkansas — 22 percent

- Connecticut — 24 percent

The premium increase you see when your score drops from excellent to poor is even more dramatic. Here are the top five states with the biggest increases, all of which more than triple what drivers pay for car insurance.

- Michigan — 229 percent increase

- Utah — 223 percent

- Nevada — 209 percent

- Arizona — 197 percent

- Alabama — 193 percent

Excluding Hawaii, Massachusetts and California, the following five states, on average, showed the smallest percentage premium increase between excellent and poor credit scores.

- North Carolina — 75 percent increase

- Virginia — 76 percent increase

- Wyoming — 79 percent

- New York — 85 percent

- Alaska — 89 percent

“Different insurance companies use credit in different ways, and they also use credit scores differently depending on the state in which they’re writing the policy,” says Hunter. “But even in states with the smallest difference you’re still looking at a substantial increase.”

How often do insurers look at your score?

Like all things pertaining to credit-based insurance scores, the answer to this question is going to vary from carrier to carrier, and state to state.

“Different carriers are going to look at this score at different times,” says Mark McElroy, executive vice president of insurance business for TransUnion, one of the three major U.S. credit bureaus. “What I can tell you is that the majority of insurance companies are going to use your credit-based insurance score only when you apply for a new policy.”

RELATED: 4 Surprising Factors That Drive Up Auto Insurance Rates

According to McElroy, “very few” insurance companies use credit-based insurance scores every time a policy is up for renewal, which means that changes to your credit score are probably not going to affect your premiums very much—if at all—once you are already signed up for a policy.

What’s more, certain states have laws designed to protect consumers from being adversely affected by credit-based insurance scores once they already have a policy. In Maryland, for instance, insurers can only use credit-based insurance scores when writing a new policy. After that, they can only use the score if it’s going to result in a better premium.

“If you already have insurance, your premium is most likely going to be affected by factors other than your credit-based insurance score,” says McElroy. “For instance, changes to your vehicle, changes to where the vehicle is kept, and any accidents or moving violations you incur are the things insurance companies are most interested in mid-policy.”

Opponents to credit-based insurance scoring

Credit-based insurance scoring has not come along without its critics, most of whom claim that using someone’s credit history to determine risk is unfair and irrelevant.

“The problem here is that there may be a correlation, but there’s no thesis,” says Hunter, a long-time vocal opponent of credit-based insurance scoring. “California did research a few years back that found higher accident rates amongst drivers with dark hair. Should we use hair color as a way to determine premiums? Of course not. It’s ridiculous, because there may be a correlation but there’s no thesis.”

What’s more, Hunter says that credit-based insurance scoring negatively impacts low-income homeowners and drivers disproportionately more than higher earning consumers.

“There are large segments of poor people out there who are unable to afford required minimum liability insurance, and a lot of them are just choosing to drive without insurance,” says Hunter. “Credit scoring is one of the reasons this problem exists.”

Boyd disagrees, claiming multiple studies have shown credit-based insurance scoring “is beneficial to everybody.”

“The insurance companies benefit because they have one more tool to help determine risk. And consumers benefit because they are getting more accurate premium pricing,” says Boyd. “I would say that about 70 percent of consumers applying for auto insurance are getting better prices today because credit-based insurance scores are used as one of the factors in underwriting.”

How to improve your credit-based insurance score

According to McElroy, consumers can help improve their credit-based insurance scores the same way they can help improve their overall credit score. A few tips include:

- Stay current on paying all of your credit obligations on time.

- Don’t open any new accounts unless you absolutely need to.

- Keep credit card balances as low as possible. And if you do have a credit card balance, make sure it is no more than 30 percent of your maximum borrowing limit.

“If you look at the steps you can take to help improve your overall financial rating, those same steps are going to have a positive impact on your insurance rating as well,” says McElroy. “The good news is if you can improve your credit report, you can improve your credit-based insurance score.”

Methodology:

Quadrant Information Services and insuranceQuotes.com examined the average economic impact of credit-based insurance scores on auto insurance using a hypothetical 45-year-old, married female driver with a bachelor’s degree and no prior claims or lapses in coverage.